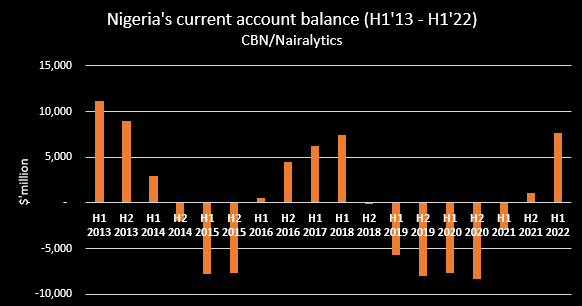

Nigeria’s current account balance rose to a 9-year high of $7.7 billion in the first half of 2022, five times higher than the $1.13 billion recorded in the second half of last year.

It is also significantly higher when compared to the negative balance of $2.98 billion recorded in the corresponding period of 2021.

This is according to data tracked by Nairalytics from the Central Bank of Nigeria. Nigeria’s current account also known as the balance of payment, is a statement that records all the monetary transactions made between residents of a country and the rest of the world during any given period.

- A balance of payment (BOP) statement of a country indicates whether the country has a surplus or a deficit of funds, i.e. when a country’s export is more than its import, its BOP is said to be in surplus. On the other hand, the BOP deficit indicates that its imports are more than its exports.

- Nigeria endured a current account deficit between H2 2018 and the first half of 2021, largely due to a decline in export earnings, an increase in imports, and a drop in diaspora remittances. However, since the second half of 2021, the balance has maintained a surplus and hit a 9-year high in the period under review.

- A positive current account balance is a major positive for Nigeria’s foreign currency crisis and could mark a turning point in the drive to stabilize the exchange rate.

Highlights

Nigeria recorded a crude oil export of $27.8 billion in H1 2022, a 37.7% increase when compared to $20.16 billion recorded in the second half of 2021 and an 85.1% increase from $14.99 billion recorded in the corresponding period.

- In the same vein, gas export earnings in the period under review increased by 40.7% year-on-year to stand at $3.81 billion.

- Meanwhile, net imports moderated marginally by 0.8% to stand at $26.3 billion between January and June 2022 from $26.51 billion recorded in H2 2021. Although when compared to the corresponding period of 2021, it increased by 11.5%.

Nigeria’s earnings for electricity export also improved by 70.4% year-on-year to stand at $3963 billion from $2.31 billion recorded in H1 2021.

Factors driving the growth

The significant improvement in Nigeria’s current account balance may be attributed to the favorable position in its international trade balance in the period due to the uptick in the crude oil export earnings largely driven by the rally in the crude oil market reported earlier in the year.

- Recall that crude oil prices rose to a record level high in the first and second quarters of 2022, following Russia’s attack on Ukraine in February.

- Russia is a significant oil producer and exporter in the global market and still continues to deal with sanctions from other western economies which reduced the supply of oil in the market, triggering a bullish sentiment in the market.

- Nigeria, also gained from this oil rally despite a decline in production as crude oil earnings elevated its trade balance and by extension its current account. A major bane in the Nigerian economy in the recent past has been the lack of FX and depreciation of the exchange rate.

Naira has depreciated significantly at the parallel market year-to-date, hinging on increased demand for dollars and lack of supply, leading to a market disparity of over N300 between the official and black markets.

However, with the improvement in Nigeria’s current account balance occasioned by improved oil earnings, and an increase in remittance inflows, the apex bank could begin to find liquidity to continue to defend the local currency against volatility.