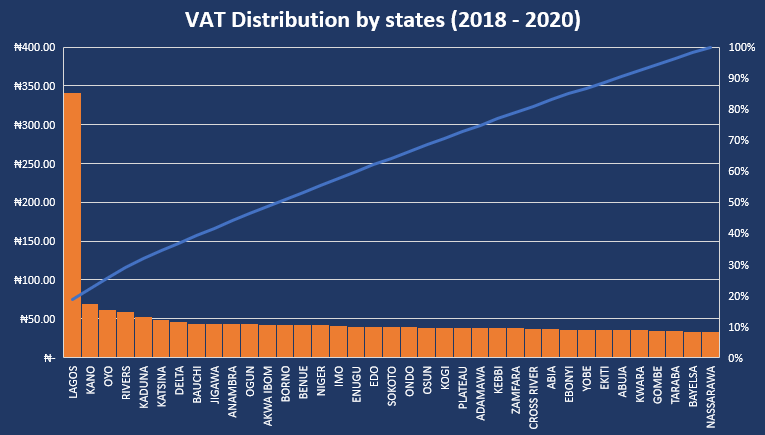

The 36 states of the federation including the Federal CapitalTerritory shared a sum of N1.84 trillion in 3 years as part of the federal VAT collections. This is according to data extracted from various FAAC reports, released by the National Bureau of Statistics (NBS) and compiled by Nairametrics Research.

Lagos, Kano, and Oyo States were the highest recipients during the period under review, jointly accounting for 25.6% of the total gross VAT allocations to the entire states. According to data from the NBS, the Federal Inland Revenue Service (FIRS) on behalf of the federal government generated a sum of N3.82 trillion as VAT between 2018 and 2020.

Nigeria’s VAT revenue has continued to record significant increases in recent times since the federal government increased the rate from 5% to 7.5% in January 2020, growing from an annual gross of N659.15 billion in 2011 to about N1.53 trillion in 2020. In the first half of 2021, VAT revenue has already hit N1.01 trillion, indicating that a huge annual collection for the year 2021 may well be underway, especially at a time when oil revenues have been less than impressive.

Lagos State dwarfs others

Lagos State being the commercial hub of the country, with an estimated population of 14.86 million people in 2021 according to World Population Review, received a sum of N342.2 billion between January 2018 and December 2020.

This represents 18.6% of the total amount shared by the 36 states and the FCT. This is no surprise considering the economic value the state presents to the nation at large, housing most of the taxable businesses and multinationals in the country.

Notably, Lagos State accounts for over 55% of the VAT collections in the country, yet received 18.6% of the shared amount, whilst accounting for even less (8.9%) when compared to the total N3.82 trillion generated as VAT revenue in Nigeria. It is worth noting that VAT distribution to local governments is excluded from the analysis.

However, this appears small relative to the amount generated from the state. Little wonder Lagos alongside Rivers State seeks to take over VAT collections from the federal government.

It will be interesting to consider the sharing formula of the VAT revenue, which would give an idea of why some southern states would want to collect their VAT themselves, but we will come to that in a bit. Meanwhile, Kano and Oyo State followed in VAT collections with N68.95 billion and N61.32 billion, representing 3.7% and 3.3% of the total, respectively.

Others on the list include Rivers (N59.22 billion), Kaduna (N52.96 billion), Katsina (N48.73 billion), Delta (N45.95 billion), and Bauchi (N44.03 billion).

Southern states fight for VAT collection

Value-added tax is a very important component of the federal revenue, considering the decline in crude oil revenue due to the cut in production quota by OPEC, and the decline in crude oil prices and demand in the recent past. The increase in VAT rate, however, appears to be a saving grace in boosting Nigeria’s non-oil revenue.

Meanwhile, southern states have started to raise eyebrows with some states openly agitating against the current formula being used to administer VAT revenue to the states, a situation that appears to favour the northern part of the country more, as opined by the governor of Rivers State, Nyesom Wike.

Wike highlighted that Rivers State generated about N15 billion as VAT in June 2021 but received only N4.7 billion, Lagos State generated over N46 billion as VAT in June, but got just over N9 billion, whereas Kano State generated N2.8 billion and also got N2.8 billion as allocation.

Meanwhile, 87% of the total VAT revenue comes from only five states while the other 32 state accounts for only 13% of the funds. Lagos State accounts for 55% of Nigeria’s VAT, followed by Abuja with 20%, Rivers with 6%, Kano with 5% while Kaduna accounts for 1% of the fund.

Despite the aforementioned, Kano State received the second-highest share of the VAT allocations to states. This is largely due to the sharing formula used by the federal government in distributing the revenues.

Under the current sharing formula, the federal government gets 15% of VAT revenue. 50% goes to the states and the final 35% to local governments. Furthermore, each state keeps 20% of the VAT derived from their states. 30% of the VAT is allocated based on the population of the states, and 50% is then shared equally. This is a major factor that would see Kano a highly populated state, receive more than Rivers State and the FCT.

A brief analysis of the breakdown of Nigeria’s VAT collection shows that 50% of the collections are made from non-import local taxes, 27% from foreign non-import taxes, while import VAT generated by the Nigeria Customs Service accounts for 23% of the VAT, which falls directly under the purview of the federal government.

States to suffer if allowed to collect their VAT

A number of states in the country will likely feel the immediate brunt of the FAAC allocations if states are allowed to collect their value-added taxes. This is because the VAT revenue forms a significant part of the net federal allocations to states and most of the states rely largely on these funds.

According to IGR data from the National Bureau of Statistics (NBS), only three states in the entire country make more revenue internally compared to FAAC allocation, with Lagos State IGR accounting for 78.3% of its entire revenue for the year 2020.

The remaining two states were Abuja and Ogun. Their IGR accounted for 57.85% and 57.39% of the revenue available to them in the year respectively. On the flip side, states like Jigawa, Bayelsa, Yobe, Adamawa, Taraba amongst others rely almost solely on the federal allocation to fund their expenses. Hence, they would likely be at the losing end, at least in the short term, if states are allowed to collect the VAT they generate.

Whilst, Lagos and Rivers States have pushed to collect their VAT themselves, northern states have kicked against this movement, as it is obviously going to affect their total revenues at the end of the day. The Northern States Governors Forum stated that VAT laws in states will lead to the collapse of inter-state trade.

This was disclosed by the Chairman of the forum and governor of Plateau State, Simon Lalong, earlier in the week. The Forum also stated that they will only respect the outcome of the Supreme Court’s ruling on the VAT impasse.

Why this matters

Southern states are pushing to increase their internally revenue by collecting their states’ generated VAT. However if the federal government should let go of this stream of revenue, it will affect the federal revenue, especially with the continual annual budget deficit. States, who also rely on these proceeds, and do have the economic power to generate significant VAT internally, will also suffer from this.

Please when you finish writing “Lagos, Kano, and Oyo States were the highest recipients during the period under review, jointly accounting for 25.6% of the total gross VAT allocations to the entire states”, ALSO give us figures and percentages of what those states CONTRIBUTED so we can ascertain if they are being justly treated.

Yes i agree with you