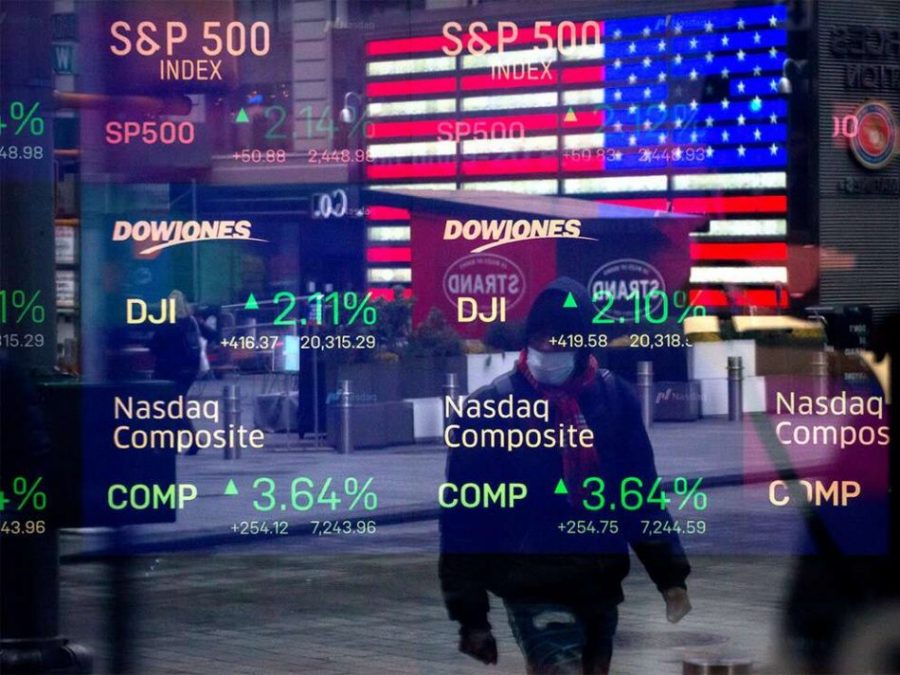

After a multi-day losing run last week, US equities surged on Monday, regaining lost territory. Following the surge, Dow Jones futures, S&P 500 futures, and Nasdaq 100 futures were all higher late Monday.

The Nasdaq composite climbed 0.8% on Monday, while the S&P 500 gained 1.4%. The Dow Jones Industrial Average rose 586 points, or 1.8%. After the stock market close, Monday, Dow Jones futures, along with S&P 500 futures and Nasdaq 100 futures, were up at least 0.1%. Keep in mind that trading in Dow Jones futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Apple (AAPL) gained 1.4% on Monday, while Microsoft (MSFT) gained 1.2%. Alphabet (GOOGL), KKR (KKR), Microsoft, PayPal (PYPL), and Pool (POOL) are among the best stocks to purchase and keep an eye on.

Interest rates are expected to rise in 2023, according to the Fed’s estimates, while some central bank officials believe a rate hike might happen next year. In an interview with CNBC on Friday, St. Louis Fed President, James Bullard stated that he expects rates should be hiked by the end of 2022.

Greater interest rates, especially if they are accompanied by a better economy, are seen as bad for equities since they would entail higher borrowing costs for businesses. For the time being, rates remain low, and this will not alter from day to day.

“It’s clear that the economy is improving at a rapid rate, and the medium-term outlook is very good. But the data and conditions have not progressed enough for the FOMC to shift its monetary policy stance of strong support for the economic recovery,” said New York Fed President, John Williams during a speech at the Midsize Bank Coalition of America.

Yields on longer-dated Treasuries rebounded in the U.S. session Monday, even as short-end rates remained firmly anchored. That undid some of the curve-flattening that swept across markets after Fed officials last week accelerated their expected pace of policy tightening.