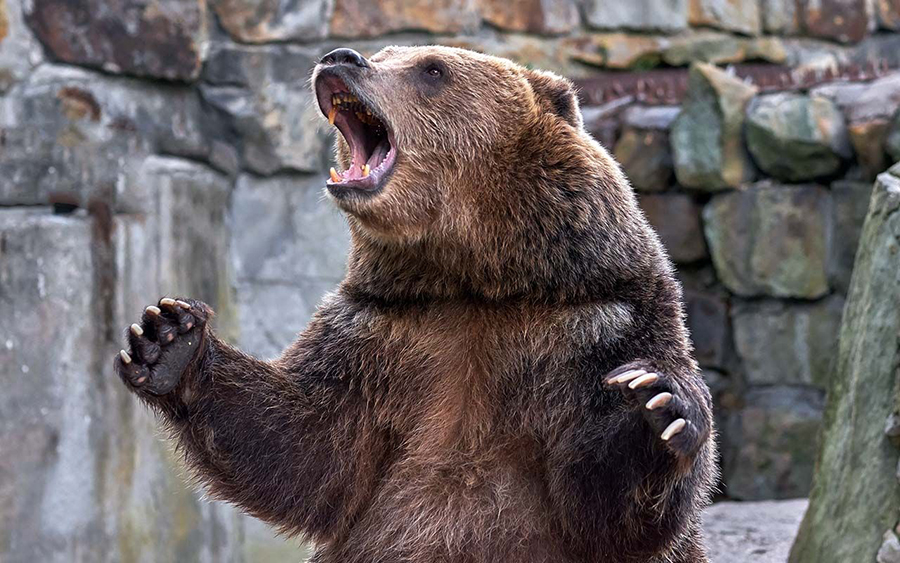

Nigerian bourse continued its second trading session for the week on a bearish note.

The All Share Index gained 0.33% to close at 25,497.32 points as against a 0.09% drop recorded on Monday.

Nigerian Stock Market capitalization presently stands at N13.302 trillion Its Year-to-Date (YTD) returns currently stands at -5.01%. Investors’ losses stood at N42.84 Billion.

Nigerian Stock Exchange trading turnover printed negative as volume dipped by 5.07% as against the 39.24% plunge recorded in the previous session. CUSTODIAN, FBNH, and ZENITHBANK were the most active to boost market turnover.

Market breadth closed negative as CAP led 10 Gainers as against 19 Losers topped by ARBICO at the end of today’s session an unimproved performance when compared with the previous outlook.

Top gainers

- CAP up 2.65% to close at N17.45

- NB up 2.50% to close at N41

- FBNH up 2.02% to close at N5.05

- NAHCO up 1.91% to close at N2.13

- MTNN up 0.76% to close at N119.5

Top losers

- ARBICO down 9.65% to close at N1.03

- GUARANTY down 6.18% to close at N24.3

- ZENITHBANKdown 2.31% to close at N16.9

- UBN down 3.92% to close at N4.9

- GUINNESS down 2.78% to close at N14

Outlook

Nigerian bourse continued its downward trend at Tuesday’s trading sessions, after the U.S dollar’s upward move in value powered down Nigeria’s major export (crude oil), which saw its pricing losing as much as 4% and traded below $40.

In addition, the upsurge in COVID-19 caseloads in key international markets continued to rattle local investors’ nerves.

It should also be noted that significant losses in Nigeria’s tier-1 banks (GTBank, Zenith Bank) neutralized gains recorded by MTN.

Nairametrics envisages cautious buying as market indicators show a degree of increased sell-offs in the coming days.