There is a strong indication that the Federal Government of Nigeria may still find it difficult to implement the adjusted 2020 budget that was recently sent to the National Assembly for vetting. As you may well know, the adjusted budget was pegged at an oil price of $30 per barrel and crude oil production estimate of 1.7 million barrels per day.

Nigeria’s 2020 Appropriation Act was initially based on crude oil production volume of 2.18 million barrels per day, with a $57 benchmark per barrel. As of April 15, 2020, the price of Brent Crude was $27.69 per barrel.

Output cuts not enough: Last week OPEC and its allies agreed to deeper output cuts in a bid to save declining oil prices. Following the deal, Nigeria’s Minister for Petroleum, Timipre Silvia, announced that the country will now be producing 1.412 million barrels per day, as against 1.829 million barrels per day. With this volume, if crude oil is sold at an average price of $25 bpd in April, then the country would be earning N13.41 billion per day as against the N17.29 billion that was earned prior to the cut.

A new problem: Unfortunately, there is a troubling new twist to this arrangement. As Nairametrics reported, the International Energy Agency (IEA) has projected that global oil demand in April will be 29 million b/d lower than a year ago; down to a level last seen 25 years back (1995). This shows that no amount of output cut by producers can fully offset the near-term falls facing the market. Already, this month has been described as ‘Black April’, especially for a country like Nigeria which has recently been facing serious troubles as far as revenue generation is concerned.

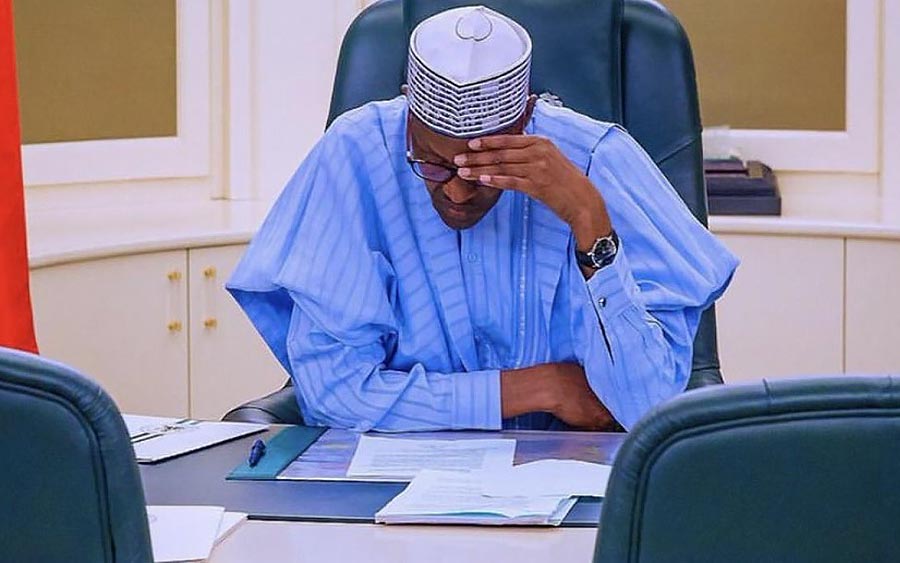

More work for the Presidency: If the IEA’s projection manifests, it means that the economic team of President Muhammadu Buhari will have more to do in order to quickly address the revenue shortfall of the budget. That is not all.

The government would still find it difficult to close the revenue gap with tax, as the commercial hub centre of the economy, Lagos, has been lockdown for about three weeks to control the spread of COVID-19. If the lockdown is prolonged extended beyond four months, 2020 would be a Black year for Nigeria.

But there is hope: The IEA report noted that there is hope for a rebound in the second quarter of 2020. Some part of the report said:

“Demand is expected to be 23.1 million b/d below year-ago levels. The recovery in 2H20 will be gradual; in December demand will still be down 2.7 million /d y-o-y.

“If production does fall sharply, some oil goes into strategic stocks, and demand begins to recover, the second half of 2020 will see demand exceed supply. This will enable the market to start reducing the massive stock overhang that is building up in the first half of the year. Indeed, our current demand and supply estimates imply a stock draw of 4.7 million b/d in the second half.”

In the meantime, the global capital expenditure by exploration and production companies has been forecast to drop by about 32% to $335 billion in 2020. This will mark the lowest level since 13 years. Unfortunately, this will come with some negative implications as you can see in the quote below:

“This reduction of financial resources also undermines the ability of the oil industry to develop some of the technologies needed for clean energy transitions around the world.”