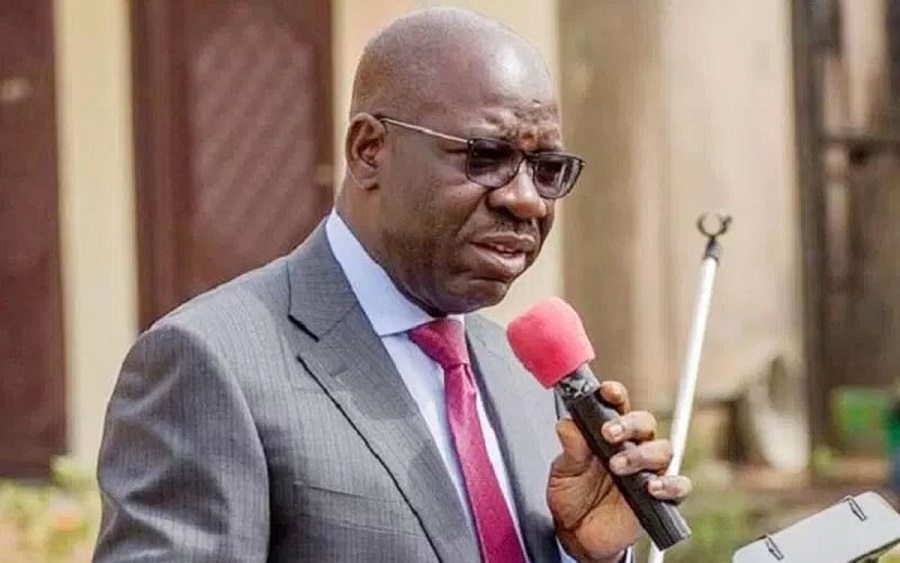

The Edo State Governor, Godwin Obaseki has disclosed that over 13,000 Micro, Small and Medium Enterprises (MSMEs) benefitted from the MSME Fund distributed by 12 Microfinance banks in the state.

Represented by the State Commissioner for Wealth Creation, Cooperative and Employment, Felix Akhabue, at a one–day sensitisation workshop organised by the National Association of Microfinance Banks, Edo State chapter, Obaseki made known that the funding for the MSMEs had gulped N2 billion and had been completely settled with the Central Bank of Nigeria (CBN).

[READ MORE: BoI to extend grant to 110,000 MSMEs in Borno and others]

The Governor emphasized how the funds have helped in improving the income of the citizens while hinting at the fact that a larger percentage of the beneficiaries are female.

“In line with CBN guidelines for the fund, over 60% beneficiaries are female and this has greatly improved the household income of Edo citizens. Besides, beneficiaries are from the 18 local government areas of the state and cut across all the sectors of the state economy.”

He added that if the loans were recovered, more citizens would benefit and thus better their businesses. He also stated that the success of any loan scheme depended on the rate of repayment.

Why this matters: Lack of adequate funding has been the major challenge Nigerian SMEs have raised concerns about. The SMEs stakeholders have overtime lamented the absence of adequate credit facility for startups and business expansions.

SMEs contribute to the economy by creating value through the production of goods and services, thus enhancing the Gross Domestic Product (GDP). They also generate employment by creating much-needed jobs in the economy as well as expanding the export sector largely through linkages with large firms that produce for the foreign sector.

[READ ALSO: These easy to overlook challenges are killing SMEs in Nigeria]

Obaseki has once again used this funding to reiterate his promise about making Edo state an economic hub through the creation of Small and Medium Scale businesses, agricultural activities, expansion in Information and Communication Technology, provision of the right environment for industries to thrive, as well as promotion of the ease of doing business in the state.