Following the recent directive given by President Muhammadu Buhari, ordering the Central Bank of Nigeria not to provide Forex for food importation in the country, several stakeholders have called on the Government to rescind its decision.

The stakeholders hold the view that the implementation of the directive will have an adverse effect on the economy of Nigeria.

Some of the stakeholders that called for leniency on the ban are the Nigeria Employers Consultative Association (NECA), Lagos Chamber of Commerce and Industry (LCCI) and the Centre for Social Justice (CSJ). According to a report, these groups asserted that the directive came at the wrong time. LCCI also demanded clarification on the number of food items restricted from the use of forex.

[READ MORE: NECA issues warning, says AfCFTA may cost Nigerian firms to fold up]

Economic effect: NECA in its reaction, commended the initiative but reiterated that the country could not adopt such a policy since Nigeria currently relies on importation to make up for the shortfall in local production.

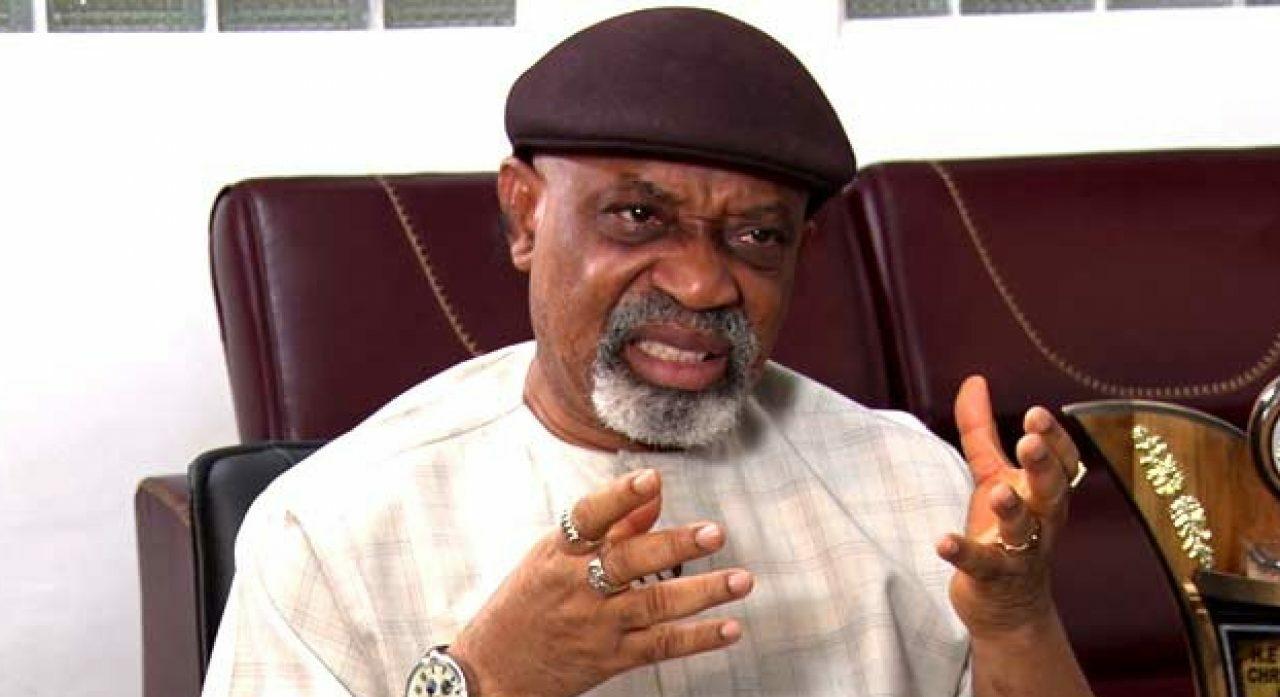

Timothy Olawale, the Director-General of NECA insisted that the Federal Government should give businesses a period of five years to adjust. He also said the implications of this move on the economy could be dire.

“We commend the President and indeed Federal Government for its numerous efforts at ensuring food sufficiency in Nigeria and protection of local farmers.

Though the recent thrust towards the withdrawal of forex for imported foods is laudable and welcome, the timing, however, calls for concern.”

Centre for Social Justice (CSJ) also responded through its Lead Director, Eze Onyekpere, saying the ban was illegal.

The group regarded the directive as false, stating that no evidence can show any efforts by the Government to enable food sufficiency in the country.

[READ ALSO: CBN says no more interest payment on bank deposits exceeding N2 billion]

Seeking Clarification: The Director-General of LCCI, Muda Yusuf sought more clarification on the items categorised as food in the context of the ban. Yusuf was hoping the Central Bank of Nigeria would make the adequate clarification, going forward.

“First, there is a need to get more details and clarifications on what exactly constitutes food items in the context of the presidential directive.

“It is hoped that these details would be made available in subsequent releases by the CBN. This is essential for proper analysis of the possible impact on investment, welfare of citizens and the economy.

Yusuf also said that the constant spate of import bans on milk and rice will ground the economy to a halt if not curtailed.

[READ FURTHER: NSE to dialogue with CBN over banks’ recapitalisation plans]

Ban on importation of milk is appropriate but that of rice is a miscalculation and a sign of ill wish.