Globally, central banks (CBs) are described as the supreme monetary authority and heartbeat of the economy, saddled with the responsibility of regulating financial and macroeconomic stability. The first central bank in the world is the Swedish National banks (Sveriges Riksbank), which was established in 1668.

Since inception, central banks have taken up the central task of formulating monetary policies and reforming banking sectors to boost financial conditions and reduce vulnerability.

Basically, the CBs adopt monetary policy instruments such as money supply and interest, targeted at price stability (inflation) and the reduction of unemployment in any economy. Unlike the U.S Federal Reserve which was established in 1913, the Central Bank of Nigeria (CBN) was established by the CBN Act of 1958 and swung into full operation on the 1st of July, 1959.

CBN’s Governors and five-year tenure – Specifically, the regulatory objectives of the CBN include maintaining external reserves of the country, promoting monetary stability, sound financial environment, and acting as a banker of last resort and financial adviser to the Federal Government.

Since the establishment of CBN, a total of eleven (11) Governors have been at the helm of affairs of the institution. Note that each of the CBN Governors introduced their unique policy reforms and measures. However, apart from Alhaji Abdulkadir Ahmed, most of the other CBN Governors spent only 5 years (or less) single tenure in office.

The first CBN Governor was Roy Pentelow Fenton (1958 – 1963). Other CBN Governors that came after him include:

- Alhaji Aliyu Mai-Bornu (1963 – 1967)

- Dr. Clement Nyong Isong (1972 – 1975)

- Mallam Adamu Ciroma (1975 – 1977)

- Mr. O. Ola. Vincent (1977 – 1982)

- Alhaji Abdulkadir Ahmed (1982 – 1993)

- Dr. Paul Agbai Ogwuma (1993-1999)

- Chief (Dr.) Joseph Oladele Sanusi (1999 – 2004)

- Prof. Chukwuma C. Soludo, (2004 – 2009)

- Mallam Sanusi Lamido Sanusi, (2009 – 2014)

- Mr. Godwin Emefiele, (2014 – To Date)

From Soludo to Emefiele, how the economy has performed – The news about the reappointment of the current CBN Governor, Godwin Emefiele, has taken Nigerians by surprise, amidst earlier reports of his possible replacement with another potential candidate. While some Nigerians regarded the news as a good move from the Presidency, others are sceptical of Emefiele’s reappointment because they’re not quite impressed with his first tenure in office.

Note that this will be the first time in many decades that a CBN Governor will be returned to serve another five years.

As earlier stated, most CBN Governors in the past typically spent a single tenure of 5 years or less. This is why many people did not see Emefiele returning for a second term.

To join the debate, a cursory look at the performance of the most recent CBN Governors became extremely important.

Prof. Chukwuma C. Soludo (May 2004 – May 2009) – The most strategic reform under Soludo’s era as the CBN Governor was the banking sector reform in 2004. Upon assumption of office, Soludo pushed for the recapitalisation of commercial banks from a minimum capital base of N2bn to N25bn.

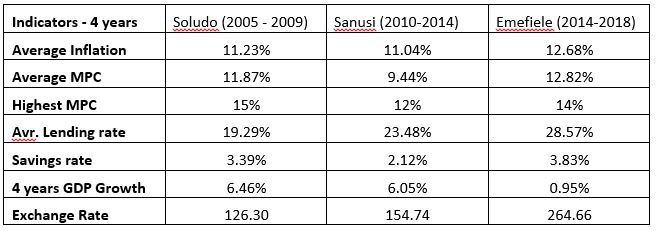

Analysis of the data obtained from the CBN shows that the Nigerian economy grew an average of 6.46% in 4 years under the era of Soludo. This shows that the Nigerian economy recorded accelerated growth under the Soludo’s era. Specifically, 4 years average inflation stood at 11.23%, while the exchange rate of the naira was an average of N126.30 per dollar for nearly 4 years.

Furthermore, the 4 years average of monetary policy rate (MPR) under Soludo was 11.87%, with an average lending rate of 19.29%.

However, the Soludo’s tenure ended with a reported Northern Oligarchy putting pressure on the then President Umaru Musa Yar’Adua to install someone from the North as CBN Governor. Sources confirmed then that the North complained of being deprived of CBN‘s exalted position. Consequently, Sanusi Lamido replaced Soludo.

HRH Sanusi Lamido Sanusi (2009 – 2014) – The former Governor inherited Soludo’s banking sector reforms and further rejigged the existing banking structure and entire financial system in the country. Some highlights of Lamido’s era are listed below:

- The economy grew by a 4 year average of 6.05%

- Inflation was on a 4 years average of 11.04%

- Exchange in 4 years was an average of 154.74/$

- 4 years average inflation stood at 9.44%

- Highest MPC was 12%

- Average 4 years MPC was 12%

- Average 4 years lending rate was 9.44%

- Savings rate 4 years average was 2.12

However, former President Goodluck Jonathan controversially sacked Sanusi and replaced him with the current CBN Governor, Godwin Emefiele.

Godwin Emefiele, (2014 – To Date) – By law, Emefiele’s appointment is meant to expire next month. However, the announcement of his reappointment makes it the first time a CBN Governor will be running two terms in office since the advent of Democracy in 1999. Earlier today, Nairametrics highlighted the positive and negative effects of Emefiele’s reappointment.

Below are the highlights of the performance of the Nigerian economy under Emefiele’s watch:

- The economy grew at a 4 year average of 0.95%

- Inflation was a 4 year average of 12.68%

- The exchange rate was a 4 years average of 264.66/$

- MPC was an average of 12.82%

- Highest MPC was 14%

- Savings rate was an average of 3.38%

- Lending rate in 4 years average 12.82%

In the meantime, reactions have continued to trail Emefiele’s reappointment. Whether this is a good or bad move by the Presidency, the Nigerian economy might just get what it has bargained for.

I was not surprised by his reappointment of mr Emefielie.there was no creditable candidate for the governor of cbn.most Nigerian central banker were professional central banker by profession.who will you put in his job,now the nation was facing the biggest challenge for 50 yrs.Mr emefiele have acquired the experience now and skill to chart the Nigeria banking industry.

some of the governor of cbn from north Nigeria were not professional banker, with the except of Sanusi,who was the managing director of first bank ,he was a retail banker by training, the other sanusi was a retail banker,Mr mai-bornu was a politician in the first republic,mallam ciroma was a journalist by training,mr ahmed was an accountant by training.Dr clement isong was an economist by training (a monetary economist)ola Vincent a hybid of economist and banking.professor soludu was an economist by training with inclination of applied economist