Welcome once again to daily performance of major economic indicators and highlights from trading sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

This report is dated May 8th, 2019.

***AfDB, Fidelity Bank to fund MSMEs with $50m***

Bonds: The Bond market traded on a relatively calm note, with fewer volumes traded on the day. We however witnessed some renewed interest on the short end of the curve (21s – 23s), which compressed yields marginally by c.2bps on the day.

We expect yields to remain relatively stable around the 14.50% mark in the near term. A further moderation in short term rates by the CBN would also be supportive of a decline in bond yields, barring significant shocks to Oil prices and general EM sentiments from the ongoing China-US trade spat.

Treasury Bills: The T-bills market traded on a bullish note, with yields declining by c.10bps as the significantly robust system liquidity levels spurred some renewed demand interests mostly on the mid to long end of the curve, in absence of an OMO auction by the CBN.

We expect that the CBN conduct an OMO auction tomorrow, given expected inflows from OMO T-bill maturities (N152bn) and retail FX refunds. In the absence of this however, the market would remain slightly bullish.

Money Market: The OBB and OVN rates declined further by c.4pct as system liquidity remained significantly robust at c.N310bn in absence of a CBN OMO auction. The OBB and OVN rates consequently ended the session at 6.00% and 6.64%.

Rates are expected to decline further tomorrow, barring a significant OMO sale by the CBN.

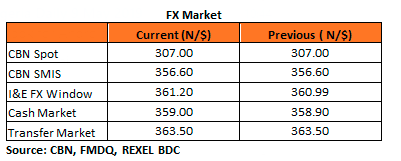

FX Market: At the Interbank, the Naira/USD rate remained unchanged at N307.00/$ (spot) and N356.60/$ (SMIS) respectively. The NAFEX closing rate in the I&E window however rose by 0.06% to N361.20/$, as market turnover declined by 23% to $121m. At the parallel market, the cash rate rose by 0.03% to N359.00/$, while the transfer rate remained unchanged at N363.50/$.

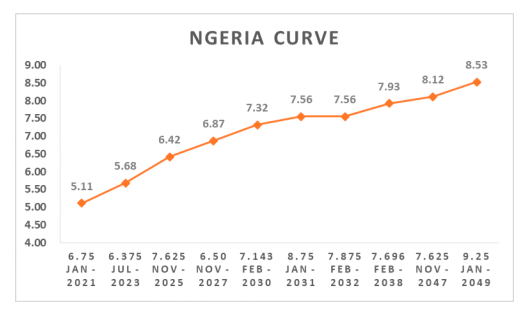

Eurobonds: The NIGERIA Sovereigns turned weaker with yields rising higher by c.12bps on the day, on the back of a further weakness in EM interest ahead of the US-China trade negotiations.

In the NGERIA Corps we witnessed some profit taking on the FIDBAN 22s and ETINL 24s, with slight demand seen on the Access 21s Sub.

________________________________________________________________________

Contact us:

Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

No one ever comments on these daily updates. ?

Yet it tells significant stories (if you know how to interpret them).