Oil Prices At 4-year High after OPEC Rebuffs Trump

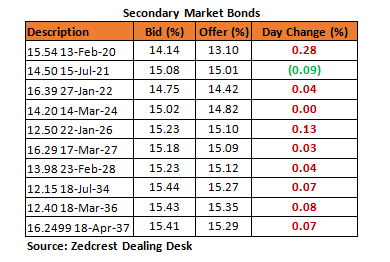

Bonds

The Bond market opened the week on a relatively quiet note, with some interests on the higher yielding 2021 bond, offset by some selloff on the 2036s which pushed yields higher by c.7bps across the curve. We observed a slowdown in client demand unlike sentiments witnessed for the most part of the previous week. This could be largely attributed to expectations for renewed supply at the forthcoming bond auction (Wednesday), where the DMO intends to raise a total of N90bn from the 2023, 2025 and 2028 maturities.

We consequently expect the market to remain slightly bearish, in anticipation of renewed supply of bonds at the auction.

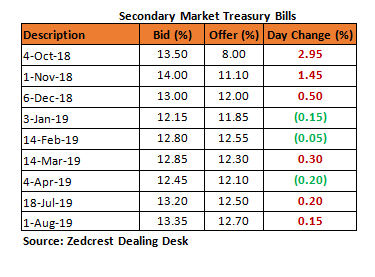

Treasury Bills

The T-bills market traded on a relatively flat note, with mixed trading sentiments witnessed over the course of the day. The short-tenured maturities (Oct-Dec) were the most actively traded, with yields closing slightly higher by c.10bps due to funding needs by some market players for the Wholesale FX auction by the CBN.

We expect the market to remain stable in the near term, due to the relatively buoyant level of liqudity in the system. We however note a slow down in demand from clients as they anticipate a renewed supply of the long tenured bills (Aug/Sep – which offer the highest yield in the market) at the next CBN OMO auction expected Thursday.

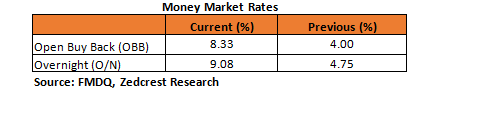

Money Market

The OBB and OVN rates inched higher, closing today at 8.33% and 9.08% respectively. This came on the back of funding for a wholesale FX auction (c.N75bn est.) by the CBN. System liquidity which opened the day at c.N478bn is consequently estimated to close at c.400bn positive.

We expect rates to remain stable, as there are no significant outflows expected tomorrow.

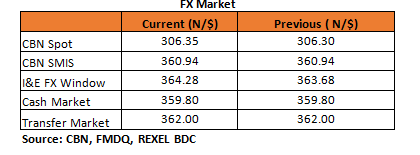

FX Market

At the Interbank, the CBN spot rate depreciated by 0.02% to N306.35/$, while the SMIS rate remained unchanged at N360.94/$. At the I&E FX window the NAFEX closing rate depreciated by c.0.16% to its highest level in more than a year at N364.28/$ from N363.68/$ previously. At the parallel market, the cash and transfer rates remained unchanged at N359.80/$ and N362.00/$ respectively.

Eurobonds

The NGERIA Sovereigns traded flat on the day, with only slight interests seen on the 2030 and 2032 bonds. A bank holiday in South Africa resulted in a relatively slower trading session.

The NGERIA Corps were slightly bearish, with some selloff seen on the GRTBNL 18s, Zenith 19s and FBNNL 21s.