Market breadth closes at 1.18x

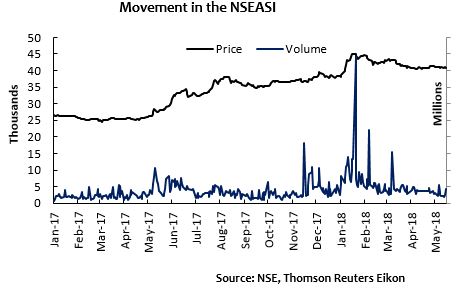

- The NSE All-Share index shed 12bps at the close of trades, settling the YtD return at +5.71%. A total of 271.27 million (-22.61%) shares worth NGN2.303 billion (-54.64%), were exchanged in 4,052 (+1.99%) deals.

- Bargain hunting activities were observed on some banking stocks, causing counters like UNITYBNK+8.51% and UBN+4.92% to feature on the top 10 advancers’ chart.

- In contrast, the strongest selling pressures were witnessed in the insurance space, as NEM-4.91% and CUSTODIAN-4.76% closed as top losers in the session.

- Trading activities resumed on IKEJAHOTEL+4.49%, following the decision by the NSE to lift the suspension placed on the counter since November 2016. Consequently, the stock gained 449bps at the end of the session.

- Data released by the National Bureau of Statistics (NBS) shows that Nigeria’s real GDP advanced by 1.95% year-on-year in Q12018 (versus -0.91% in Q12017).

- However, a slowdown in growth was witnessed from the previous quarter (+2.1% in Q42017), as a result of the moderation in growth witnessed in the non-oil sector.

- The Monetary Policy Committee (MPC) began its second session for the year today.

- We expect the committee to maintain all policy parameters, given the urgent need to preserve capital flows, amongst other key mandates such as inflation and exchange rate stability.

Silver lining

- Despite the extension of losses on the NSEASI from the previous week, there was an increase in positive momentum in the bourse, as indicated by the positive market breadth of 1.18x.

- We note that the price shedding witnessed on some large cap stocks in the financial services space (NSEBNK10-0.21, NSEINS-0.86%), left the market in the red.

Contact Morgan Capital for more information. Email: info@morgancapitalgroup.com

www.morgancapitalgroup.com