Information from DAAR Communications Ltd, owners of AIT, reveals the company is owing its employees about N1.1 billion in accrued (unpaid) salaries. The company has been hemorrhaging cash for the last three years as its business model struggles to contain incessant drop in revenues.

DAAR reported that its employees are owed about N1.1 billion as at June 2017 an increase of about N130 million from the N1.06 billion owed as at December 2016. The company’s unpaid salaries has been increasing from 2014 when it was N583 million. It rose to about N774 million as at the end of 2015 and now N1.1 billion.

A further look at the company’s books reveal its staff cost has averaged about N1.4 billion annually, despite it multi-year drop in revenues.

Downsizing

In 2016, AIT reportedly laid off about 32% of its workforce, reducing headcount to about 814 from 1,211 the year before. Staff downsizing was also at all cadres with Management staff shedding about 74 employees to close at 36. About 24 senior staff members were let go, leaving just 149 on its payroll. About 299 Junior Staff members were relieved of their jobs leaving just 629 as at December 2016.

Struggle with television

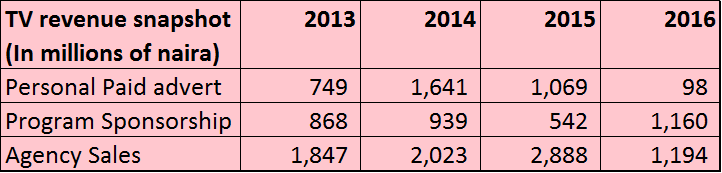

DAAR Communications problems started in 2014 after it reported a revenue of about N6.9 billion in 2016 compared to N5.3 billion in 2015. A major factor for the strong revenues back then was its Television segment which reported about N6.2 billion alone in revenues. Since then, its television revenue has dropped to under N3 billion as it struggles to bring back lost business in its personal paid adverts and agency sales.

AIT has posted losses for over 5 years now, however it appeared to be turning the corner in 2014 and 2015, at the height of campaign for the 2015 Presidential elections. The company was perceived to be in support of the then ruling PDP, airing programs that berated the current ruling party, the AIT. Business seems to have gone south for them since President Buhari took over, allowing TV stations like Channels, Silver Bird, TVC dominate the airwaves.

It is also interesting to note that despite booking over N6 billion in revenues, DAAR Communications has struggled to convert the amount into cash. Out of its N6.4 billion in trade receivables, it wrote off about N3.2 billion.

Other obligations

DAAR Communications sold the property of its parent company in 2016 for about N950 million and used to proceeds to repay loans owed to Fidelity Bank Plc. The company’s only major loan of N1.48 billion is owed to its Parent company.

How it dovetails

DAAR Comms inability to pay its salaries boils down to a business model that is structurally flawed. The company spends between N95 to N105 in cost of sale for every N100 of revenue generated. It also carried huge operating cost, most of which are salaries, explaining why it chooses not to pay salaries. To make it worse, it finds it hard to get paid for some of the ads paid on its platform, resulting in the N3.2 billion write down mentioned above. Had it collected this cash, it may have had enough money to pay salaries.

By downsizing and cutting cost, the company seems to be adjusting to the realities of its situation, a move that might please shareholders.

Silver lining

Despite the company’s dire situation, it could still turn things around if the current management and owners will allow it to. The company has over N31 billion in Fixed Assets, stated at cost. This can be significant source of cash if it decides to unlock some value from its properties. It is still a recognized brand name in Nigeria and could attract significant business as the 2019 election draws nearer. Nigerians disgruntled with the current administration may find a television station critical of the government in power as a solace thus boosting the company’s ratings. This of course depends on the running battle between its chairman, Raymond Dokpesi and the EFCC.

The share price remains stuck at 50 kobo.

raymound dokpesi a serial and versertile Nigerian businessman,he did set up an ocean transportation vessel with the late abiola,he have to ante his game.he must ask himself.why his previous business failed.this article showed the company made revenue over a billion with assets over 31 billion,the business.SOMETHING IS MISSING AND IT’S NOT BEING DONE PROPERLY, THIS COMPANY AS a successful business on-going concern, HAVE GOOD FIRBES and virbration,BUT A BUSINESS WAS SET UP TO MAKES PROFIT.is he pumping his business with his friend,cronies or relative,i said so because the profit margin is thin,due to overhead expenses.can information technology helps in reducing cost.or are they ignoring the views of their customers, IN their television and radio programmes.are they boring and irrelevant,the choice is your.over to you to the board and management

WHAT THE GOOD PEOPLE AT NAIRAMETRICS DO NOT REALIZE FROM THEIR ANALYSIS OF THE DAARCOM BOOKS ARE THE DISTURBINGLY BAD BUSSINESS DECISIONS MADE BY MR. DOKPESI AND HIS BOARD OF DIRECTORS. THE MONEY THAT HAS BEEN WASTED IS MORE THAN ENOUGH TO PAY EVERYONE + GIVE THEM A RAISE IN SALARY. THEY ALSO ARE NOT ABLE TO TAKE INTO ACCOUNT THE HUGE AMOUNT OF CASH THAT THE BOOKS NEVER SEE.

the problems at Daar started a long time ago. one major factor is the GMD. here is a partial look at the destruction of DAAR. visit me on FB to see more information, : “Mr. Akiotu, it is becoming painfully clear that you have no concept of the principal Fiduciary duties of A Board of Directors. Even though you have been the General Managing Director of DAAR Communications since May of 2009. Please look it up.

I have been doing some calculations of the losses you have caused the shareholders and owners of DAAR based on you’re so called projects that we have talked about. This does not include you over seeing the 95.3% drop in share prices or your own salary and benefits.

Total loss: N4,977,500,000.00 Naira

Average per year: N633,187,500.00 Naira

This is an incredible amount of money. God has no idea how you can throw money away like this and at the same time hold an expatriate who served DAAR well for 10 years hostage in Nigeria by not paying him the 19 million that has been due to him for the last 14 months. I am of course speaking of Engineer Dean Gay.