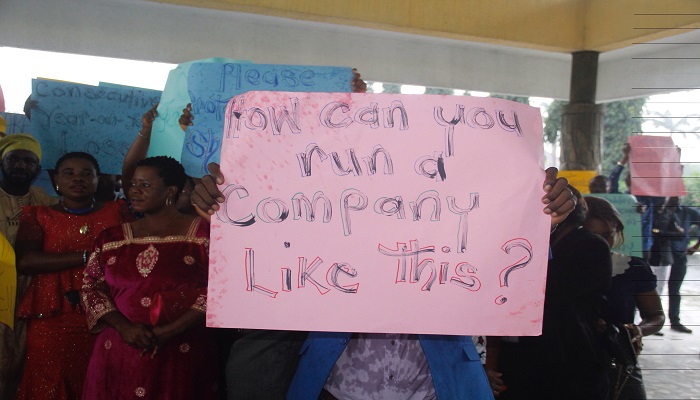

As 7UP Nigeria Plc, continues with its delisting process, several shareholder groups have raised objections to it. While some of the shareholders called for a forensic audit of the company’s affairs, others tasked the regulators to ensure the minority shareholders were fairly treated.

A timeline of events leading to the delisting

7UP Nigeria Plc had in November 2017, sent a notice to the Nigerian Stock Exchange. Affelka SA, the majority shareholder in the company offered to buy up the 26.78% of 7Up’s share capital that it did not own. Affelka is owned by the El Khalil family which founded the company.

Affelka, then increased its tender price from ₦112.70 to ₦125 per share. The NSE then placed the company’s shares on suspension subsequent to a motion passed by minority shareholders approving the takeover bid.

The protests are late

Shareholders in the country often wait until the last minute, before expressing concern about the state of finance of a company. In the ongoing Oando Plc Saga, the shareholders waited till two significant investors Alhaji Dahiru Mangal and Gabriel Volpi to send a petition to the Securities and Exchange Commission(SEC). Mangal has since withdrawn his petition, following a peace accord brokered by Emir of Kano, Sanusi Lamido Sanusi.

Rather than agitate for bonuses and dividends, shareholders should put management to task concerning strategies to remain afloat in a tough economy. They also need to invest more in financial literacy.

7-UP Plc was incorporated as a private limited liability company on 25th June 1959 under the name Seven‐Up Limited by Mohammed El-Khalil. On 16th May 1960, the name was changed to Seven‐Up Bottling Company Limited and in 1978 it became a public company. 7-UP Plc was listed on the NSE on June 1st, 1986.

The name “Seven‐Up Bottling Company PLC” was adopted on 26th November 1991 in compliance with the provisions of the Companies and Allied Matters Act 1990.

![[Results] Higher Costs Chops off 7up Margins](https://nairametrics.com/wp-content/uploads/2015/07/7up-Neymar.jpg)

.gif)