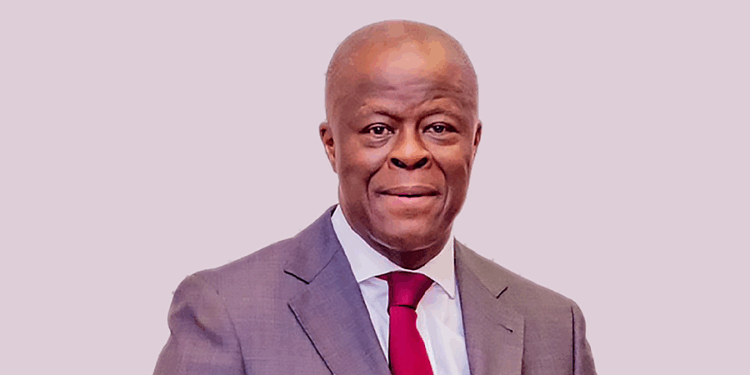

Minister of Finance and Coordinating Minister of the Economy, Wale Edun says interest rate cuts may come soon if inflation keeps easing, a move that could reduce debt-servicing costs and ease pressure on Nigeria’s strained public finances.

This is according to comments made by Edun during an interview on the sidelines of the Abu Dhabi Sustainability Week, and reported by Bloomberg.

The signal comes at a time when Nigeria’s budget is heavily burdened by debt servicing costs, volatile oil revenues, and a widening fiscal deficit, making any easing in borrowing costs materially important.

What they are saying

Edun, according to Bloomberg, commended the Central Bank of Nigeria (CBN) for what he described as “excellent” progress in curbing inflation, attributing recent improvements to aggressive monetary tightening implemented over the past two years.

The CBN had more than doubled its policy rate from 2022 levels in a bid to rein in inflationary pressures, before implementing a 50 basis-point cut in September that brought the monetary policy rate to 27%.

The move followed a sharp moderation in inflation from its late-2024 peak.

According to Edun, a sustained decline in inflation would create room for additional rate cuts, helping to reduce borrowing costs and easing the government’s debt servicing burden.

Lower inflation and borrowing costs would free up revenue currently spent on servicing debt and improve the fiscal balance, Edun said.

What the data is saying

Nigeria’s fiscal outlook remains under pressure. In the proposed 2026 budget, more than a quarter of the N58 trillion spending plan—estimated at about N40 billion—is allocated to interest payments.

Projected revenues stand at around N34 trillion, constrained largely by subdued oil receipts, leaving a budget deficit of roughly N24 trillion, or about 4.3% of GDP. This is wider than the estimated deficit recorded in the previous year.

Why this matter

Lower interest rates would not only support economic activity but also provide fiscal breathing room for the federal government by reducing the share of revenue devoted to debt servicing.

With oil revenues remaining volatile and deficits widening, Nigeria’s fiscal sustainability is increasingly sensitive to movements in inflation and borrowing costs.

Edun noted that the government’s borrowing strategy would remain flexible and market-driven, with decisions on domestic and external issuances guided by pricing, timing, investor appetite, and adherence to debt limits outlined in the medium-term expenditure framework.

Beyond monetary policy, the administration is intensifying efforts to boost revenue mobilisation and reduce reliance on borrowing, particularly through structural reforms and improved efficiency in revenue collection.

What you should know

The federal government is also counting on privatisation proceeds, divestments by the Nigerian National Petroleum Company (NNPC), and increased crude oil production to support budget funding.