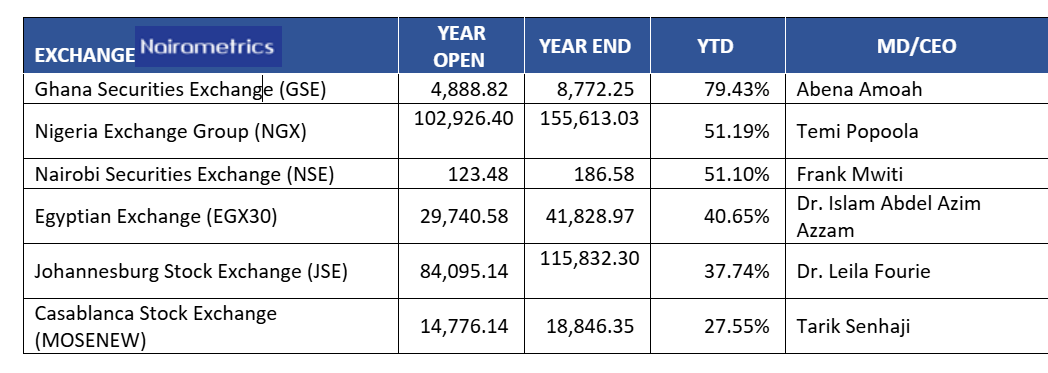

The Ghana Securities Exchange (GSE) composite index emerged as the top-performing equity market among selected African exchanges in 2025, outperforming Nigeria’s NGX All-Share Index (ASI) and several continental peers.

The GSE Composite Index returned 79.43% for the year, significantly ahead of the NGX ASI’s 51.19% gain, underscoring stronger equity momentum and sustained investor confidence in Ghana’s market.

According to year-end exchange data, the GSE Composite Index rose from 4,888.82 points at the start of the year to 8,772.25 points at year-end, reflecting steady capital inflows amid improving macroeconomic stability, currency reforms, and a gradual restoration of confidence in domestic assets.

What the data is saying

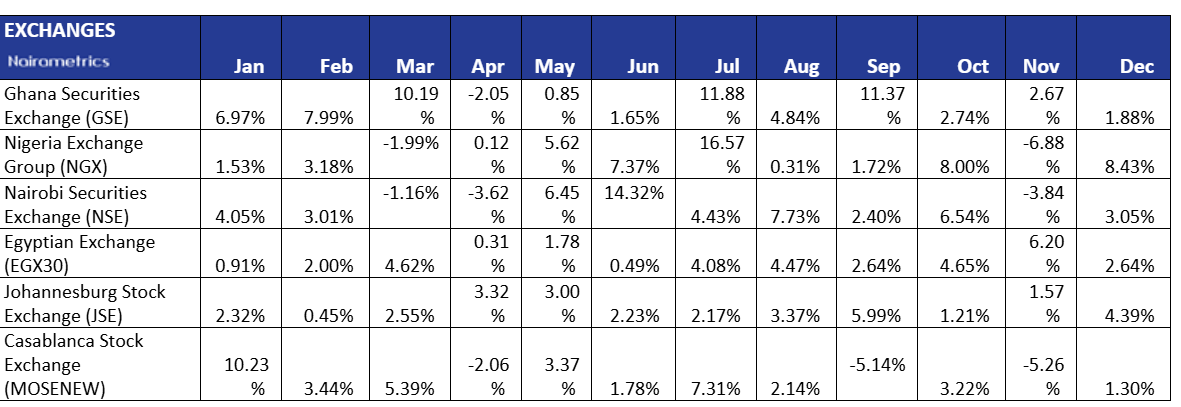

Monthly performance data shows that Ghana’s equity market leadership in 2025 was built on consistency rather than isolated spikes. The GSE Composite Index recorded gains in nine out of twelve months, with standout rallies in March (+10.19%), July (+11.88%), and September (+11.37%), which collectively anchored its outperformance.

While the market experienced a mild correction in April (-2.05%), the pullback proved short-lived. Positive momentum resumed immediately in May and strengthened into the second half of the year. This pattern reflects declining inflation expectations, improving macro visibility, and sustained risk appetite, allowing equities to re-rate steadily rather than episodically.

Across selected African markets, performance leadership in 2025 clearly favoured exchanges with durable monthly momentum, reinforcing Ghana’s position at the top of the performance table.

How Ghana pulled ahead of Nigeria

While Nigeria’s equity market delivered its strongest annual performance in nearly two decades, Ghana still outperformed on a relative basis. The nearly 28-percentage-point return gap highlights Ghana’s sharper equity repricing, driven by a smaller market base, thinner liquidity, and outsized rallies in select large-cap and mid-cap stocks.

By contrast, Nigeria’s NGX rally was broader and more liquid but relatively restrained by the weight of large-cap stocks and intermittent profit-taking across key sectors toward year-end. As a result, Nigeria’s gains were high impact but uneven, while Ghana’s advance was more methodical and persistent.

How other African exchanges performed in 2025

The MASI Index started 2025 strongly, posting a double-digit gain in January (+10.23%) and maintaining momentum through the first quarter. However, performance deteriorated in the second half, with sharp corrections in September (-5.14%) and November (-5.26%) erasing earlier gains.

Although intermittent rebounds occurred, including July (+7.31%), the market struggled to sustain upward momentum, reflecting heightened sensitivity to earnings expectations and liquidity shifts.

Why this matters

The 2025 performance of African equity markets highlights a clear distinction between consistency-driven leadership and volatility-driven returns. Ghana’s market benefited from sustained accumulation and improving macro confidence, while Nigeria and Kenya relied more heavily on episodic rallies.

This divergence underscores how market structure, liquidity depth, and investor behaviour shaped equity outcomes across the continent.