December 2025 has delivered a familiar but striking story for Lagos households; the festive season demand has collided with tightening supply, pushing prices of most food items sharply higher across major markets.

Compared to November, price movements in December were overwhelmingly upward, reflecting increased household consumption, higher logistics costs, and trader speculation typical of the end-of-year period.

Based on the latest Lagos market survey, out of the 70 tracked food items, 49 increased, 18 declined, and 3 were flat in December against November 2025, meaning 69.0% of items rose, 25.4% fell, and 5.6% were unchanged.

The breadth of price increases suggests that the modest relief seen in November has largely evaporated, reinforcing how fragile food affordability remains for urban consumers.

The December market survey, conducted across four major markets—Mushin, Mile 2, Daleko, and Oyingbo market confirm that seasonality remains a powerful inflation driver in Lagos, often overriding broader macro improvements such as harvest inflows or temporary fuel price relief.

According to the Nigeria Bureau of Statistics (NBS), Nigeria’s headline and food inflation moderated to 14.45% year-onyear (YoY) and 11.08% (YoY) in November 2025, respectively, while Lagos food inflation eased to 13.6% (YoY) from 14.76% (YoY), reflecting broad market moderation.

However, this ease may not reflect in December as prices of items as observed in the December survey are driven by renewed increases in fresh food, tubers, and protein items.

Items that increased in price

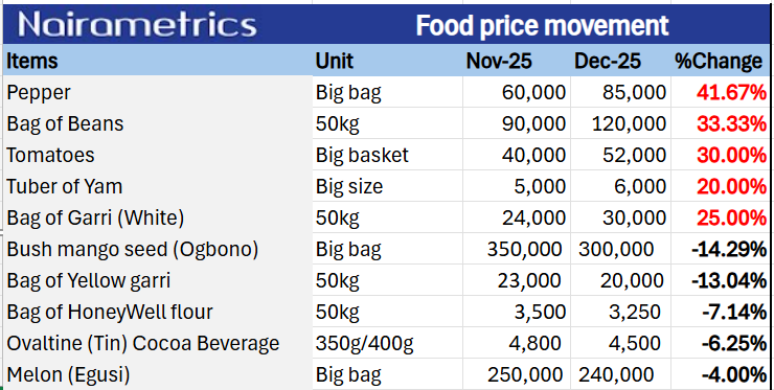

Price increases in December were broad-based, cutting across fresh produce, staples, proteins, oils, and processed foods, such as:

- A big bag of Pepper jumped from N60,000 to N85,000, reflecting a massive increase of 41.67% which a medium bag rose by 38.89% to N50,000 from N36,000 in the month of December.

- A 50kg bag of brown beans reversed the 14.81% decline in the previous month, to now sell at an average of N120,000 from N90,000, reflecting a 33.33% increase.

- Likewise, a basket of round-shaped tomatoes climbed from N40,000 to N52,000, a 30.00% surge in price.

- A 50kg bag of white garri is sold for N30,000 in December, from N24,000 it sold for in November, reflecting a 25.00% increase.

- Similarly, the price of a big-size Abuja yam rose by 20%, averaging N6,000, though the big sizes differ in length and weight, while a medium-size Abuja yam rose from M3,500 to N4,500 (+28.60%).

- Carton of turkey and chicken lap rose by 16.44% and 14.58%, selling at N85,000 and N55,000 respectively from the previous prices of N73,000 and N48,000.

- A kilo of Titus (mackerel) fish further increased by 14.29% from N7,000 to N8,000.

Other notable increases:

- Ayoola Poundo yam flour: up 13.33%, from N3,750 to N4,250

- Local vegetable oil (25litres): up 13.04%, from N57,500 to N65,000

- A crate of egg: up 1.82%, from N5,500 to N5,600

- Dry onions (big bag): up 11.11% from N90,000 to N100,000

- Honeywell wheat (1kg): up 11.11% from N1,350 to N1,500

Traders attribute the surge to reduced inflows from the North, spoilage risks during transportation, and heavy festive buying by households and food vendors.

Fish sellers report that cold-chain costs and weaker supply from coastal hubs compounded festive demand.

The increases in oils, flours and processed staples point to continued input cost pass-through, including packaging, transportation, and financing costs.

Items that reduced in price

Despite the festive inflation wave, according to our survey, 18 items recorded price declines, mostly among processed goods and selected staples:

- Bush mango seed (ogbono) recorded a sharp decline of 14.29% from N350,000 to N300,000.

- Unlike the white garri, the 50kg bag of yellow garri fell by 13.04% from N23,000 to N20,000.

- Cocoa beverages such as Ovaltine, Milo, Bournvita recorded mild declines between 7.14% to 2.91%

- Likewise, major flour brands (Honeywell, Dangote, Golden Penny) recorded declines between 6.25% to 2.74%.

- Furthermore, a big bag of Egusi (melon) eased by 4% from N250,000 to N240,000.

Notably, prices of noodles and tea also recorded marginal price reductions

However, a small group of items (about 4 in total) showed minimal or no movement, mainly niche processed products where pricing is tightly controlled by manufacturers and demand elasticity is limited, such as a basket of potatoes, a bag of white and oloyin beans, etc.

Market reactions: how buyers and sellers are coping

For many Lagos residents, December shopping has become an exercise in prioritization rather than abundance.

- Mrs. Zainab – pepper seller, Mile 12

“Once December starts, pepper becomes gold,” “Northern trucks are fewer, and drivers are charging more for fuel and trips. Pepper jumped to N85,000 per big bag; if supply improves after Christmas, it should calm down.”

- Mrs. Emmanuel OnaAra – frozen food retailer, Daleko

“Chicken lap and turkey cartons moved fast. Feed is still expensive, diesel for cold rooms too.”

- Mrs. Kemi Adebayo – provisions retailer in Mushin

“Some companies reduced prices to attract Christmas buyers,”“But foodstuffs that people cook fresh are the ones expensive now.”

- Alhaji Musa Abdullahi – tuber wholesaler in Mile 2 market

“People who postponed buying yam in November rushed back in December,” “That sudden demand pushed prices up quickly.”

- ThankGod – grain seller in Oyingbo

“There are varieties of ogbono in the market ranging from Nsukka to Cameroun and Benue ogbono, which is reflected in their price difference. For instance, a big bag of Nsukka ogbono costs N330,000 because of its nutritional value, while the regular Cameroun is selling for N300,000.” “It is best to know what you are buying to avoid buying the wrong one for a high cost.”

- Some sellers also admit to price hoarding, holding back stock in anticipation of further increases closer to Christmas and New Year.

About the Nairametrics Food Price Survey

The Nairametrics Food Price Watch is a monthly market survey tracking the prices of major food items across Nigeria.

This report specifically covers four key markets in Lagos State: Mushin Market, Daleko Market, Oyingbo Market, and Mile 12 Market.

The survey provides up-to-date insights into food price trends, helping businesses, policymakers, and consumers make informed decisions.