The Central Bank of Nigeria (CBN) has confirmed the approval of final operating licences for 82 Bureaux De Change under its updated regulatory framework, cautioning Nigerians to avoid patronising unlicensed foreign exchange dealers.

The approval is based on the 2024 Regulatory and Supervisory Guidelines for BDC Operations and took effect from November 27, 2025.

The announcement was contained in a statement issued on Monday and signed by the Acting Director, Corporate Communications, Hakama Sidi Ali.

The bank stated that only operators listed on its website are recognised to conduct business. According to the statement, “only Bureaux De Change listed on the Bank’s website are authorised to operate from the effective date.”

The apex bank emphasised that more names would be added as their approvals are finalised, noting that the public can verify all valid licences online. “The CBN will continue to update the list of Bureaux De Change with valid operating licences for public verification on our website,” the statement added. It also advised the public to “avoid dealing with unlicensed Foreign Exchange Operators.”

Legal consequences for unlicensed BDC operations

The CBN reiterated that operating a bureau de change without the required approval is an offence under the Banks and Other Financial Institutions Act. It warned that offenders would be sanctioned. “Operating a Bureau De Change business without a valid licence is a punishable offence under Section 57(1) of BOFIA 2020,” the statement read.

The bank urged the public to be cautious when conducting forex transactions, saying the clarification was necessary to prevent members of the public from falling victim to illegal operators. The statement concluded that members of the public “are hereby advised to note and be guided accordingly.”

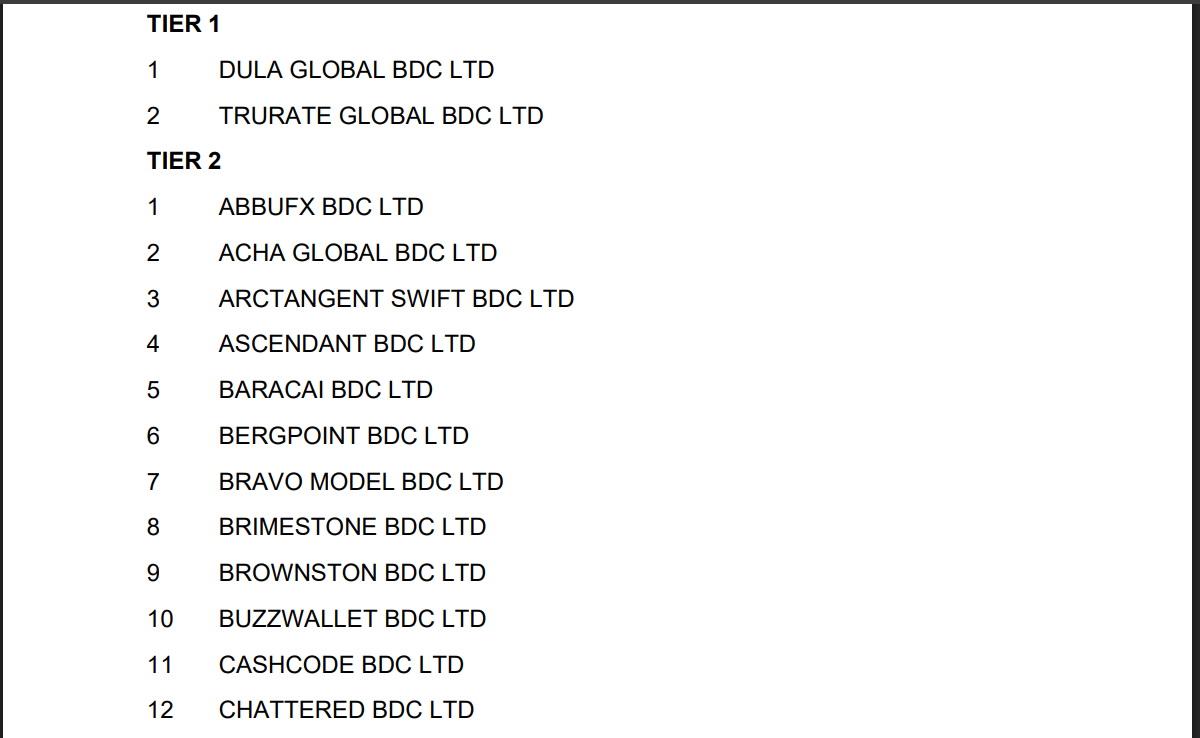

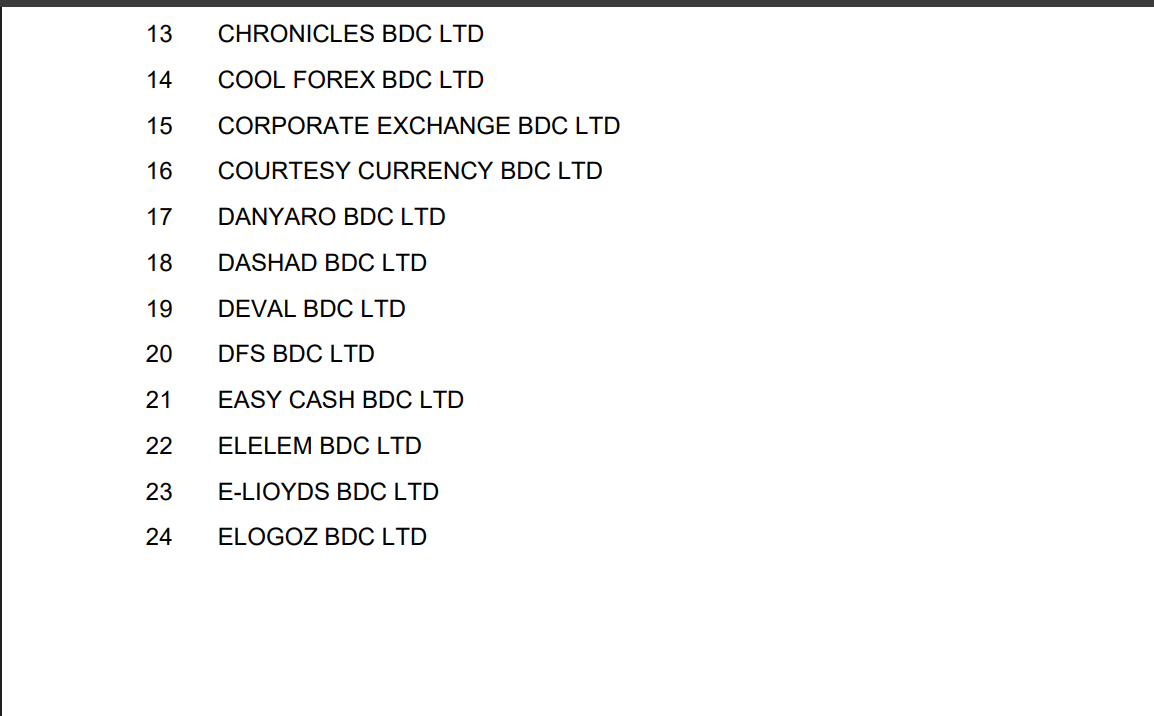

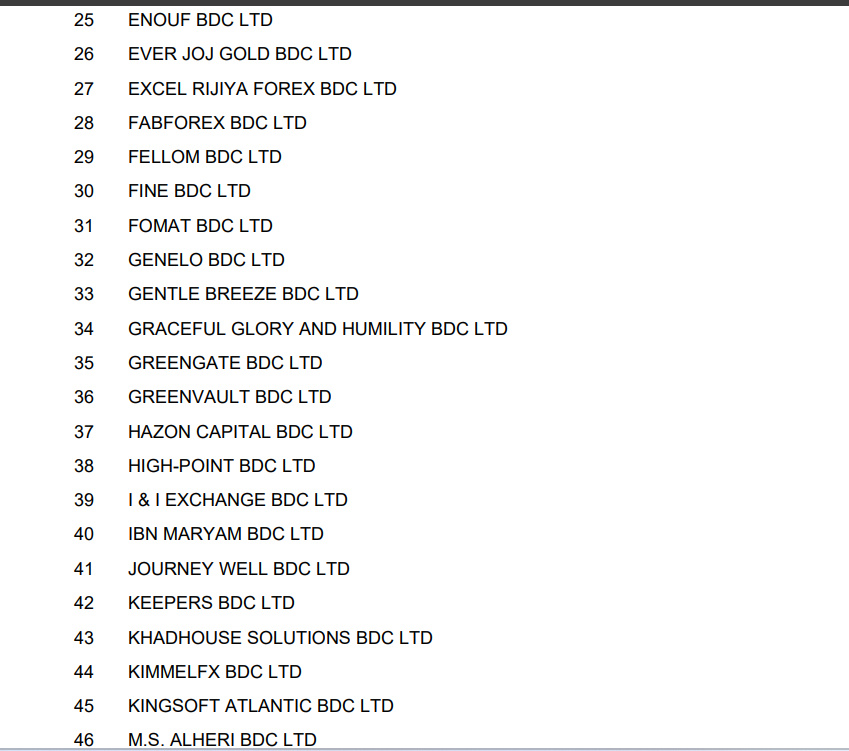

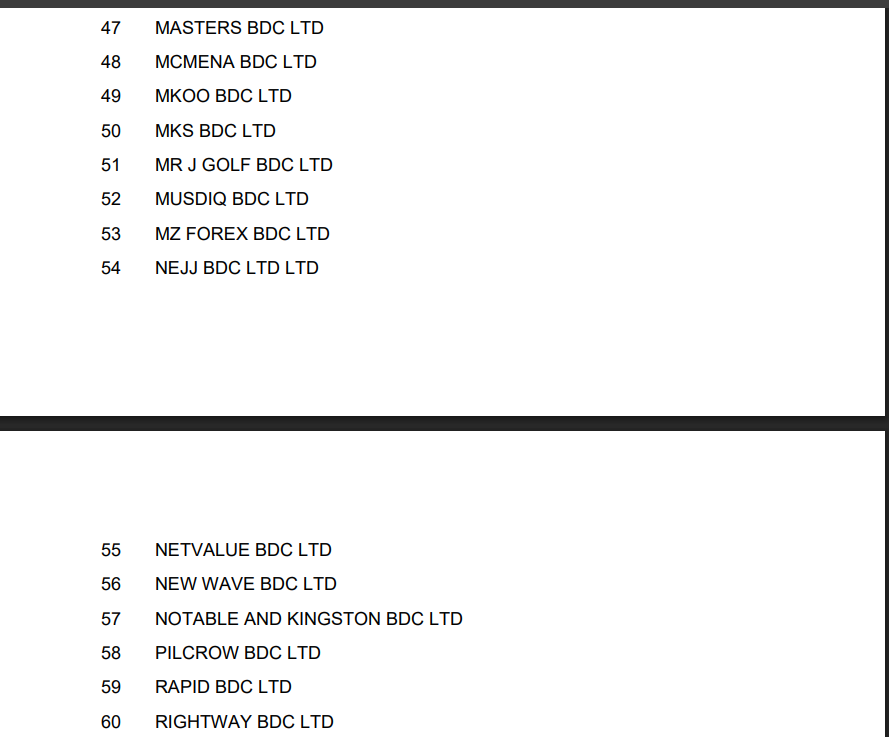

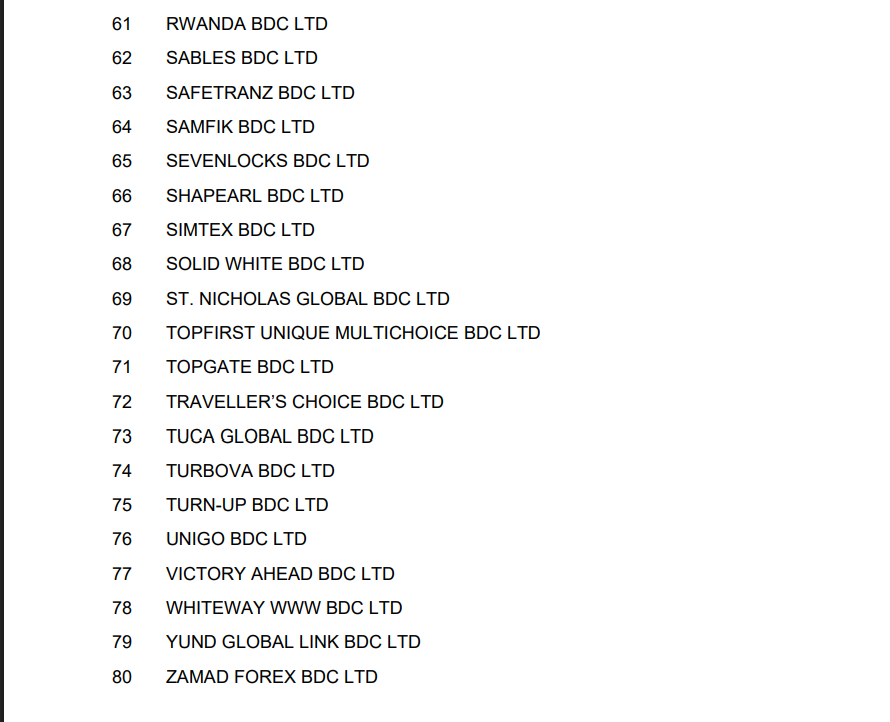

See full list below:

What you should know

What you should know

The confirmation of 82 licences comes as the CBN intensifies its efforts to bring greater transparency and structure to the forex market, following several policy reforms over the past months.

In May 2024, the CBN released the approved guidelines for operations of Bureau De Change (BDCs) across the country while asking BDCs to reapply for licensing online with the new regulatory requirements in the next six months.

According to the new regulatory requirements, Tier-1 BDCs are mandated to have a minimum capital base of N2 billion while that of Tier-1 was set at N500 million.

Furthermore, the bank set the application fee for a Tier-1 license at N1 million and that of Tier-2 at N250,000. The licensing fees for Tier-1 and Tier-2 BDCs were set at N5 million and N2 million, respectively.

The bank also asked BDCS to meet the requirements of the Tier of license they are applying for within the next six months.

The new guidelines approved for Tier-1 BDCs allowed them to operate across the 36 states of the country and the FCT and open franchises all over the country, subject to the approval of the CBN.

Some of the guidelines for BDCs included banning BDCs from futures, options and derivative trading, carrying out outward international transfers, receiving international inward transfers, dealing on crypto assets or entities that deal with crypto assets and others.