- FirstBank will host an SMEConnect Webinar on 26 November 2025 themed “Strategies for SMEs: Securing Your Business Under the New Tax Law,” featuring industry experts like Taiwo Oyedele and Yemi Adesanya.

- The event aims to equip SMEs with insights on tax compliance, business formalisation, and access to financial solutions, including FirstSME accounts.

- FirstBank, established in 1894, is a leading financial inclusion provider with over 43 million customer accounts, international presence across three continents, and numerous global awards for excellence and innovation.

FirstBank, West Africa’s premier financial institution and financial inclusion services provider, is pleased to announce its upcoming SMEConnect Webinar scheduled to hold on Wednesday, 26 November 2025.

The SMEConnect Webinar is one of the ways FirstBank delivers its capacity building of its value propositions to small and medium-sized enterprises (SMEs). It is designed to empower SMEs with the knowledge, tools, and resources needed to thrive in today’s competitive business landscape.

The upcoming webinar themed “Strategies for SMEs: Securing Your Business Under the New Tax Law” will guide participants through the upcoming changes in tax regulations, ensuring they are well-equipped to comply with the new requirements. Industry experts and thought leaders, including Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms (Keynote Speaker), Yemi Adesanya, the Financial Controller, FirstBank (Guest Speaker) and Dr. Abiodun Famuyiwa, Head of SME Banking at FirstBank (Host) will share insights on overcoming challenges, leveraging digital tools, and accessing financial opportunities designed to support SME growth.

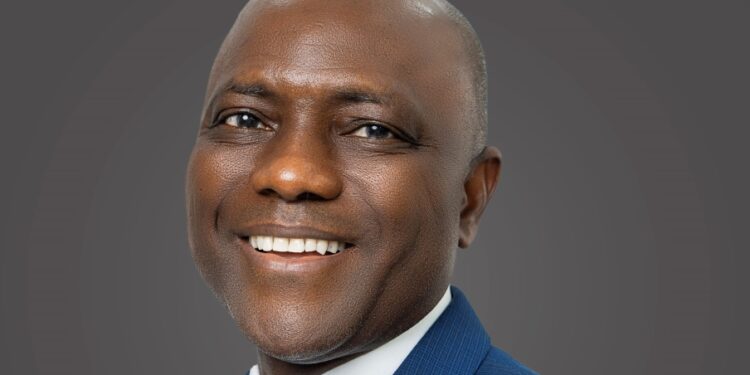

Speaking ahead of the event, Chuma Ezirim, Group Executive, e-Business and Retail Products at FirstBank, said, “SMEConnect Webinar is an initiative to ensure that SMEs are not only equipped to survive but positioned to scale sustainably in the competitive marketplace. The implementation of the new tax policy is fast approaching; hence we want to provide all businesses with adequate information and insights on the new requirements, to help them navigate the regulations.”

The webinar will also focus on the benefits of formalisation and the suite of banking solutions available to registered and unregistered businesses, especially the FirstSME accounts for businesses.

To register for the webinar, interested participants are encouraged to visit https://firstbanknigeria.zoom.us/webinar/register/WN_QyFwBS9LRuOu6NGTaujb0A

About FirstBank

First Bank of Nigeria Limited “FirstBank”, established in 1894, is the premier bank in West Africa, a leading financial inclusion services provider in Africa, and a digital banking giant.

FirstBank’s international footprints cut across three continents ─ Africa, Europe and Asia, with FirstBank UK Limited in London and Paris; FirstBank in The Democratic Republic of Congo, Ghana, The Gambia, Guinea and Sierra Leone; FBNBank in Senegal; and a FirstBank Representative Office in Beijing, China. All the subsidiary banks are fully registered by their respective Central Banks to provide full banking services.

Besides providing domestic banking services, the subsidiaries also engage in international cross-border transactions with FirstBank’s non-Nigerian subsidiaries, and the representative offices in Paris and China facilitate trade flows from Asia and Europe into Nigeria and other African countries.

For over 13 decades, FirstBank has built an outstanding reputation for solid relationships, good corporate governance, and a strong liquidity position, and has been at the forefront of promoting digital payment in the country with over 13 million cards issued to customers (the first bank to achieve such a milestone in Nigeria).

FirstBank has continued to make significant investments in technology, innovation and transformation, and its cashless transaction drive has been steadily accentuated with virtually over 25 million active FirstBank customers signed up on digital channels, including the USSD Quick Banking service through the nationally renowned *894# Banking code.

With over 43 million customer accounts (including digital wallets) spread across Nigeria, the UK and sub-Saharan Africa, the Bank provides a comprehensive range of retail and wholesale financial services through more than 820 business offices and over 280,000 agent locations spread across 772 out of the 774 Local Government Areas in Nigeria.

In addition to banking solutions and services, FirstBank provides pension fund custody services in Nigeria through First Pension Custodian Nigeria Limited and nominee and associated services through First Nominees Nigeria Limited.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives, such as its employees’ ratio of female to male (about 41%:59%; and 37% women in management roles) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organisation. In addition, the Bank’s membership in the UN Women is an affirmation of a deliberate policy that is consistent with UN Women’s Women Empowerment Principles (WEPs) ─ Equal Opportunity, Inclusion, and Nondiscrimination.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 – 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

Significantly, FirstBank’s Global Credit Rating was A+ with a positive outlook while ratings by Fitch and Standard & Poor’s were A (nga) and ngBBB+ respectively both with Stable outlooks as at September 2023. FirstBank maintained the same level of international credit ratings as the sovereign; a milestone that was achieved in 2022 for the first time since 2015.

In 2024, FirstBank received notable international awards and accolades. Some of these include Nigeria’s Best Bank for ESG 2024 and Nigeria’s Best Bank for Corporates 2024 both awarded by Euromoney Awards for Excellence; Best SME Bank in Africa and in Nigeria by The Asian Banker Global Awards; Best Private Bank in Nigeria and Best Private Bank for Sustainable Investing in Africa by Global Finance Awards; Best Corporate Bank in Nigeria 2024, Best CSR Bank in Nigeria 2024, Best Retail Bank in Nigeria 2024, Best SME Bank in Nigeria 2024 and Best Private Bank in Nigeria 2024 all awarded by the Global Banking and Finance Awards.

FirstBank has continued to gain wide acclaim on the global stage with several international awards and recognitions received so far in 2025 which includes Best SME Bank in Nigeria 2025 and Best SME Bank in Africa 2025 by The Asian Banker; Best Private Bank in Nigeria 2025 and Best Private Bank for Sustainable Investing in Africa 2025 by Global Finance Awards; SME Financier of the Year in Nigeria 2025 by The Digital Banker Global SME Banking Innovation Awards; Best Retail Bank in Nigeria 2025 and Best Bank for Empowering Women Entrepreneurs in Nigeria 2025 all by The Annual Global Economics Awards.

Our vision is “To be Africa’s Bank of first choice” and our mission is “To remain true to our name by providing the best financial services possible”. This commitment is anchored on our core values of EPIC – Entrepreneurship, Professionalism, Innovation and Customer-Centricity. Our strategic ambition is “To deliver accelerated growth in profitability through customer-led innovation and disciplined execution.”