In October 2025, a couple of African currencies demonstrated resilience against the US dollar, defying the broader trend of depreciation observed across much of the continent.

The month saw a mix of steady and strengthening performances across African currencies, led by stable regimes like Eritrea’s and recovering units such as Liberia’s and Uganda’s.

The data sourced from Investing.com and Trading Economics was compiled and analyzed by the Nairametrics Research team.

Despite global currency pressures, several African currencies, including the Liberian dollar, Ugandan shilling and Zambian Kwacha, posted slight appreciation in October 2025.

The best-performing African currencies in October 2025 were those backed by disciplined monetary policy, limited external exposure, and steady foreign exchange reserves, the key indicators of resilience in a period marked by global economic uncertainty.

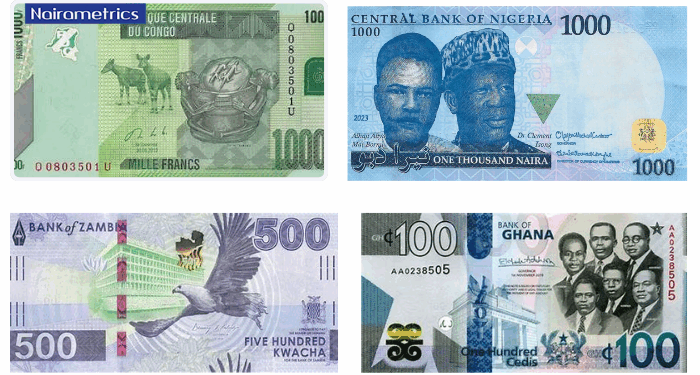

Best performing African currency in October against the US dollars.

The Nigerian Naira (NGN) appreciated by 3.4% against the US dollar in October, strengthening from around 1,478 NGN/$ to 1,427.50 NGN/$ at month-end. This modest recovery came amid tighter monetary measures, improved foreign exchange liquidity, and market interventions by the Central Bank of Nigeria (CBN).

In 2025, Naira’s performance has been shaped by the CBN’s foreign exchange reforms, higher oil prices, and stronger remittance inflows. The increase in global crude oil prices and efforts to boost domestic production have enhanced foreign exchange earnings, providing short-term relief to the naira.

However, structural challenges persist including weak non-oil exports, fiscal imbalances, and speculative demand for dollars.

In summary, the naira’s October appreciation reflects short-term FX liquidity improvements and monetary tightening.