In October 2025, a couple of African currencies demonstrated resilience against the US dollar, defying the broader trend of depreciation observed across much of the continent.

The month saw a mix of steady and strengthening performances across African currencies, led by stable regimes like Eritrea’s and recovering units such as Liberia’s and Uganda’s.

The data sourced from Investing.com and Trading Economics was compiled and analyzed by the Nairametrics Research team.

Despite global currency pressures, several African currencies, including the Liberian dollar, Ugandan shilling and Zambian Kwacha, posted slight appreciation in October 2025.

The best-performing African currencies in October 2025 were those backed by disciplined monetary policy, limited external exposure, and steady foreign exchange reserves, the key indicators of resilience in a period marked by global economic uncertainty.

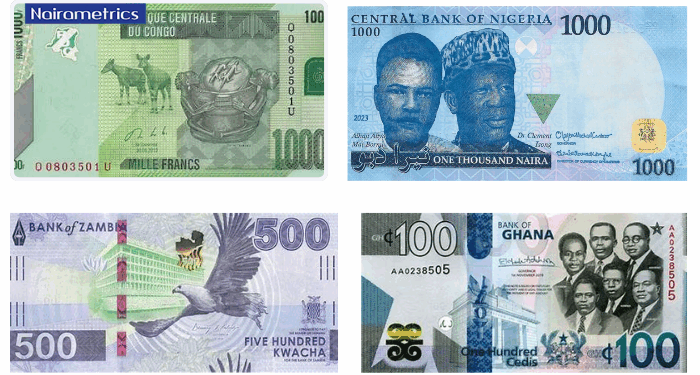

Best performing African currency in October against the US dollars.

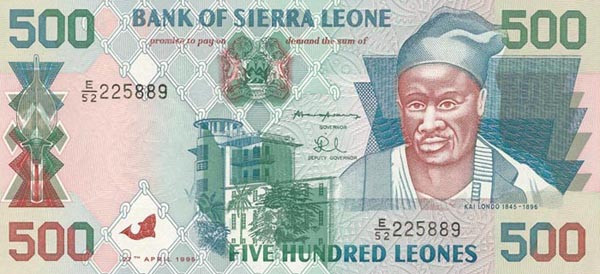

The Sierra Leonean Leone (SLL) appreciated by 0.7% against the US dollar in October, strengthening from 23,311 SLL/$ opening price to about 23,152 SLL/$ at the end of the month. This modest gain reflects the central bank’s ongoing efforts to stabilize the currency amid persistent inflationary and fiscal pressures.

In 2025, Sierra Leone’s economy continues to face challenges from high import dependency, limited export diversification, and fiscal constraints. The Bank of Sierra Leone (BSL) has maintained tight monetary policies to control inflation and reduce exchange rate volatility. Improved inflows from donor support and steady export performance in minerals and agriculture have provided some relief to the foreign exchange market.

The Leone’s marginal appreciation in October suggests tentative stabilization supported by monetary tightening and donor inflows.