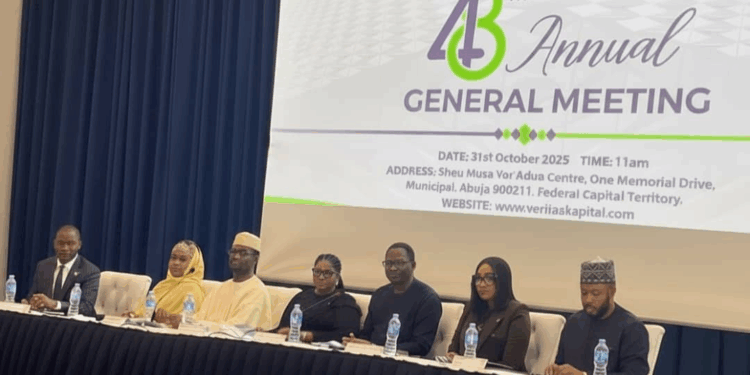

Veritas Kapital Assurance Plc has elected Mr. Babatunde Ayokunle Irukera, former Executive Vice Chairman of the Federal Competition and Consumer Protection Commission (FCCPC), as Chairman of the Board of Directors, following a unanimous vote by shareholders at the company’s 48th Annual General Meeting (AGM) held in Abuja on Friday, October 31, 2025.

Irukera’s emergence was by unanimous shareholder approval, reflecting broad confidence in his leadership and governance pedigree.

Addressing the shareholders, Irukera pledged a renewed era of accountability, fairness, and inclusiveness, assuring them that under his leadership, all shareholders will be treated equally and fairly.

He also reaffirmed the company’s commitment to the ongoing recapitalization exercise in Nigeria’s insurance industry, emphasizing that the process would be managed prudently to ensure shareholders’ interests are fully protected.

On dividend payments, Irukera noted that the company was on course to resume distributions soon.

“Even prior to recapitalization, we have been on a high-speed train towards paying dividends. We are working up to the point that you will receive your dividends,” Irukera stated.

Shareholders’ reactions and expectations

At the AGM, shareholders expressed satisfaction with the company’s increased female representation on its board and commended the prompt payment of insurance claims.

However, they urged the new board to restore the company’s culture of consistent dividend payments, a practice they said had stalled in recent years.

Chief Essien Peters, one of the shareholders, praised Veritas Kapital’s earnings potential but appealed to management to revive dividend disbursements to sustain investor confidence.

Another shareholder, Mr. Patrick Ajudua, lauded the company’s claim-settlement record and expressed optimism that Veritas Kapital would emerge among Nigeria’s top five insurers post-recapitalization.

Capital raise and governance

The AGM also authorized the board to raise up to N15 billion via private placement to strengthen the company’s capital base and meet recapitalization requirements.

The resolution empowers the board to determine the offer terms, appoint advisers, and amend the company’s Memorandum and Articles of Association accordingly.

On financial performance, the Managing Director of Veritas Kapital Assurance Plc, Dr. Adaobi Nwakuche, reported that the company’s revenue grew by 228% to N23.3 billion for the 2024 financial year, compared to N7.1 billion recorded in 2023.

She added that total assets rose by 60% to N33 billion, up from N20.66 billion in the same period, while gross premium income increased by 225% to N23.69 billion, from N7.3 billion in 2023.

However, the company recorded a 161% decline in profit before tax (PBT) and a 170% decline in profit after tax (PAT), attributed to significant claims from its special risk portfolio.

Despite these challenges, Dr. Nwakuche expressed confidence in the company’s growth trajectory and long-term profitability.

“As a going concern, Veritas Kapital Assurance Plc remains dedicated and steadfast in achieving its goal of being the underwriter of choice in the Nigerian insurance market,” she said.

What you should know

Veritas Kapital has released its unaudited results for the nine months ended September 2025, reporting profit before tax of N4.88 billion, representing a 64% YoY increase from N2.98 billion, and a profit after tax of N4.12 billion, up 44% from N2.87 billion in 2024.

- Gross premium rose slightly to N18.68 billion, while insurance service expenses fell by 62%, bolstering profitability.

- Shareholders’ equity also strengthened by 27% to N19.47 billion.

For Q4 2025, the company forecasts a profit after tax of N478 million and expects its cash balance to rise to N7.08 billion.

Veritas Kapital Assurance Plc, formerly known as UnityKapital Assurance Plc, provides non-life insurance products and services to individuals and institutions nationwide.

The company remains one of Nigeria’s notable players in general insurance underwriting.

Veritas Kapital began the year trading at N1.36 per share and has since gained 47.8%, ranking 82nd on the NGX in terms of year-to-date performance.