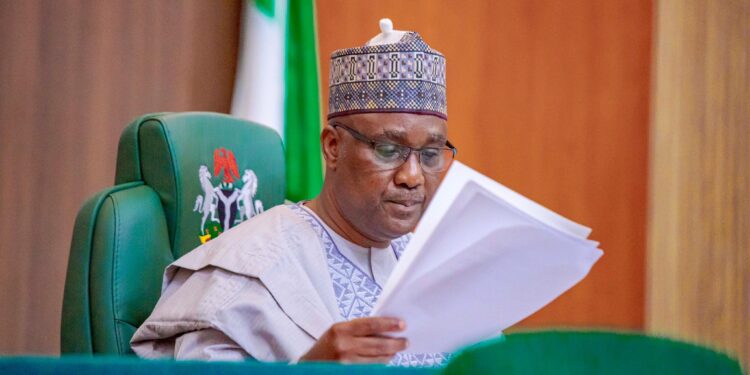

The Speaker of the House of Representatives, Abbas Tajudeen, has inaugurated an ad hoc committee tasked with reviewing the economic, regulatory, and security implications of cryptocurrency adoption and Point-of-Sale (POS) operations in Nigeria.

Speaking at the inauguration ceremony on Monday in Abuja, Tajudeen said the committee was formed in response to growing concerns over fraud, cybercrime, and consumer exploitation in the digital finance space.

“The Nigerian economy has shown remarkable resilience over the years, bouncing back from recessions and recording impressive growth in non-oil sectors,” Tajudeen noted. “It is safe to conclude that the cryptocurrency trade will thrive in such a robust economic environment.”

Risks Associated with Digital Currencies

However, the Speaker cautioned against overlooking the risks associated with digital currencies.

“There are real concerns about cryptocurrency’s susceptibility to terrorism financing and money laundering, given its opaque nature, dubious regulatory framework, unclear governance structure, and lack of accountability,” he said.

Tajudeen emphasized the need for clear rules and consumer protection measures to regulate Virtual Asset Service Providers (VASPs), including cryptocurrencies and crypto assets.

“This Ad-Hoc Committee is absolutely necessary,” he said. “Its main job is to undertake public hearings to collate relevant information from stakeholders that will guide the House in developing legislation for a regulatory framework for the adoption of the currency in our economy. Its work will also guide the House in its oversight functions as they concern the use of digital currency in Nigeria.”

He reaffirmed the commitment of the 10th House to safeguarding the country and its citizens from any negative developments that could undermine the economic reforms being championed by President Bola Tinubu’s administration.

Tajudeen urged committee members to approach their duties with patriotism and integrity, stating, “Let the best intentions for the good of the country continue to guide the work as always.”

Committee to Balance Innovation and Security

In his remarks, the committee’s chairman, Rep. Olufemi Bamisile (APC-Ekiti), described the assignment as one of national significance.

“We have been entrusted with a task of national importance: to review the economic, regulatory, and security implications of cryptocurrency adoption and Point-of-Sale operations in Nigeria,” Bamisile said.

He acknowledged the rapid growth of digital financial systems globally and the opportunities they present for commerce, financial inclusion, and innovation in Nigeria.

Focus of the Committee

However, he warned of the accompanying risks, including cybercrime, fraud, money laundering, terrorism financing, and regulatory uncertainty.

“Our focus will be on developing a legislative and regulatory framework that encourages innovation while protecting citizens and the integrity of the nation’s financial system,” he added.

Bamisile said the committee will work closely with key regulatory and security agencies, including the Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC), Nigeria Deposit Insurance Corporation (NDIC), Nigerian Financial Intelligence Unit (NFIU), Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Nigeria Police Force.

He assured that the committee will adopt a consultative and evidence-based approach, engaging stakeholders such as regulators, banks, fintech operators, civil society groups, and the security community during public hearings to gather diverse perspectives.

What You Should Know

- This is coming barely three days after the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, called for a pragmatic and collaborative approach to regulating cryptocurrency in Nigeria, acknowledging its rapid growth and the need for a structured framework to manage its impact on the financial system.

- Speaking at the inaugural CBN Governor’s Lecture Series held at the Lagos Business School (LBS) on Friday, Cardoso reflected on the evolution of digital currencies and the regulatory gaps that allowed crypto trading to flourish unchecked.

In response to the growing influence of digital assets, Cardoso said the CBN is working closely with the Securities and Exchange Commission and other regulatory bodies to develop a sustainable framework.