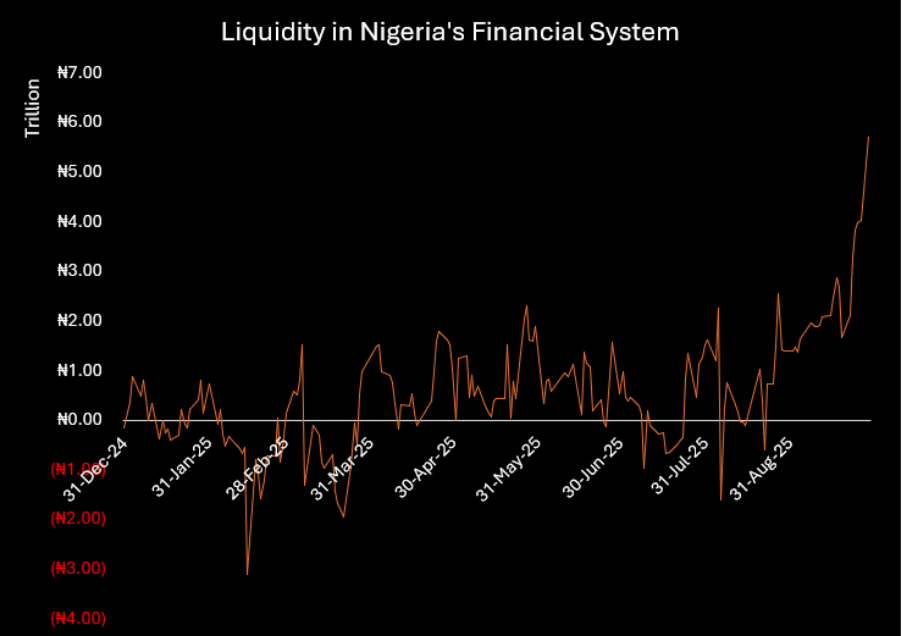

System liquidity in Nigeria’s financial market surged to a historic high of N5.73 trillion on Monday, up sharply from N4.02 trillion recorded last Friday, on the back of the recent policy adjustments by the Central Bank of Nigeria (CBN).

Recall that at the 302nd Monetary Policy Committee (MPC) meeting, the CBN cut the Monetary Policy Rate (MPR) by 50 basis points (bps) to 27%, the first adjustment since November 2024.

Alongside the rate cut, the apex bank also revised the Standing Facilities corridor to +250/-250bps around the MPR from +500/-100. This policy shift has spurred significant activity in the Standard Deposit Facility (SDF), with placements rising to N5.39 trillion on Monday alone.

The adjustment comes against the backdrop of moderating inflation. Nigeria’s headline inflation slowed for the fifth consecutive month in August 2025, easing to 20.12%, giving the MPC room to loosen policy slightly in order to support growth and liquidity conditions.

Since the MPC announcement, system liquidity has more than doubled from N2.12 trillion last Monday to N5.73 trillion this week, with much of the increase driven by flows into the SDF.

The SDF is a key liquidity management tool that allows commercial banks to park surplus funds with the CBN in exchange for interest. By providing this safe overnight option, the CBN absorbs excess liquidity, sets a floor for interbank lending rates, and maintains short-term market stability.

Its impact is twofold: it sterilizes idle funds, reducing inflationary pressures, while also shaping the availability of liquidity in the wider market. The latest corridor adjustment has made the SDF more attractive, prompting banks to lock up record volumes of cash with the CBN. This also helps banks to earn interest on their deposits, without exposure to possible non-performing loans, which rose to 6.03% in Q1 2025.

Although this has pushed system liquidity to record highs, much of it remains sterilized at the apex bank, preventing excessive liquidity from spilling into the economy and helping reinforce monetary policy objectives.

Money market drops on improved liquidity

Following the CBN’s policy shift, interbank lending rates dropped to their lowest levels in almost a year. On Wednesday, 24th September 2025, the Open Buy Back (OBB) rate declined sharply to 24.5%, while the overnight rate eased to 24.88%, reflecting the impact of improved system liquidity. These are the lowest levels recorded since early November 2024.

In a conversation with Abigael Kazeem-Adeshina, Research Analyst at Norrenberger Financial Group, she explained that the CBN’s latest policy shift reflects a delicate balancing act, easing interest rates in line with market expectations while still managing money supply through the corridor adjustment, despite the recent reduction in the Cash Reserve Ratio (CRR).

Looking ahead, Abigael suggested that another moderate rate cut could be on the table in November, contingent on inflation trends in September and October, which she expects may continue to ease.

Bottom Line

The CBN’s latest policy adjustments have injected fresh momentum into system liquidity, with record placements in the SDF highlighting banks’ preference for safe returns. While this strategy supports monetary stability and helps tame inflation, it also means that much of the liquidity buildup is effectively trapped within the CBN, limiting its immediate impact on credit creation and real sector growth.