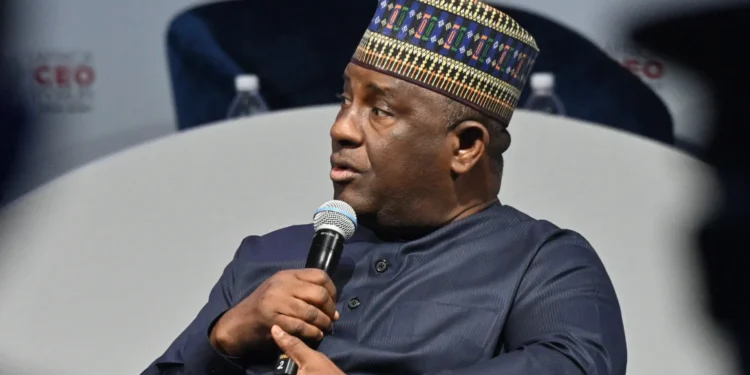

BUA Group Chairman Abdul Samad Rabiu has expressed optimism about Nigeria’s economic trajectory, projecting that the naira could strengthen to between N1,300 and N1,400 per US dollar by the end of 2025.

Speaking after a strategic meeting with President Bola Ahmed Tinubu at the Aso Villa on Wednesday, Rabiu attributed the anticipated currency gains to bold fiscal reforms, improved market confidence, and reduced reliance on Central Bank foreign exchange interventions.

“The exchange rate has continued to improve. Naira is trading below N1,500 today, and I’m confident it will strengthen even further. I expect that the rate should come down to maybe N1,300 to N1,400 before the end of the year. This is something we should all celebrate.”, Rabiu stated.

He commended the Central Bank of Nigeria (CBN) for its evolving role, noting that businesses now source foreign exchange independently through global banking channels, including ATM and credit card access abroad.

Food Prices Fall as Reforms Take Hold

Rabiu also highlighted the impact of government policies on food affordability, citing BUA’s efforts earlier in the year to slash the price of rice from over N100,000 per bag to N50,000.

“Since then, prices of several food items have followed that positive trend,” he said. “Products such as flour, pasta, macaroni, semolina, and others that we produce have seen significant price reductions from what they were last year.”

He credited President Tinubu’s administration for granting duty waivers on key food items, which helped ease import costs and stabilize domestic supply chains.

“We must acknowledge and appreciate His Excellency for these waivers. They have contributed greatly in making this possible,” Rabiu added.

Reforms Fuel Business Confidence

The BUA Chairman emphasized that Nigeria’s economic recovery is being driven by decisive policy actions that are laying the groundwork for long-term growth.

“There are bold reforms and decisive policies creating the foundation for a stronger economy, a more stable currency, and a better future for businesses and Nigerians alike,” he said.

Rabiu’s remarks reflect growing optimism among private sector leaders about Nigeria’s fiscal direction, particularly as the government continues to implement structural reforms aimed at boosting productivity, reducing inflation, and enhancing investor confidence.

What You Should Know

On Tuesday, the naira closed at N1,493.2 per dollar in the official market, following the conclusion of the 302nd Monetary Policy Committee (MPC) meeting of the Central Bank of Nigeria (CBN).

- According to data published on the CBN website on Tuesday, the latest figure represents a slight depreciation from N1,491.49/$1 on Monday and N1,488/$1 on Friday.

- In the parallel market, the naira also slipped, exchanging at N1,521.5/$1 on Tuesday, compared to N1,518/$1 on Monday, widening the gap between official and black-market rates.