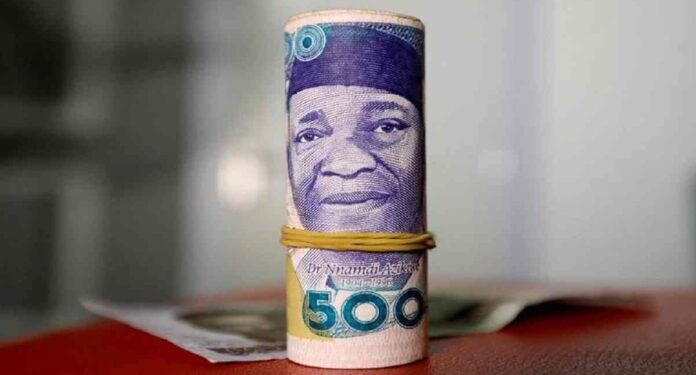

The Naira closed the week on a high note in the parallel market, reaching N1,520/$1, making it the strongest performance for the currency throughout the week.

This rate is N14 stronger than the official rate posted by the Central Bank of Nigeria (CBN), which stood at N1,534/$1 as of market close on Thursday.

This development marks a continued appreciation trend in the unofficial market, where the naira climbed steadily from N1,550/$1 on Tuesday to N1,530/$1 on Wednesday, further improving to N1,535/$1 on Thursday, before settling at N1,520/$1 on Friday.

In contrast, the official exchange market remained relatively stable but less competitive. The naira closed at N1,534/$1 on Thursday, a modest gain from N1,537/$1 on Wednesday, and slightly below N1,536/$1 on Tuesday.

Last week’s performance

Last week, the naira the gap between the official and parallel exchange markets when the currency traded at N1,535 to the dollar in the parallel (black) market, just N1 less than the N1,536/$1 rate recorded at the official market.

Data on the CBN website, last week, shows the naira closed at N1,536/$1 on Thursday, a depreciation from N1,531/$1 on Wednesday.

Intra-day trading on Thursday shows that the naira traded highest at N1,538/$1 and lowest at N1,520/$1, according to data on CBN website on Friday.

Foreign reserves hit $38.45 billion

Nigeria’s foreign exchange reserves have climbed to $38.45 billion from last week’s $37.78 billion. This represents a 1.77% increase week-on-week.

The development comes as part of ongoing efforts to stabilise the naira and attract foreign investment.

Analysts say the slight increase in reserves bodes well for the economy, as it strengthens the Central Bank’s ability to defend the naira, finance imports, and meet external obligations.

Speaking at a press briefing in Abuja on Tuesday, July 22, 2025, following the conclusion of the 301st Monetary Policy Committee (MPC) meeting, CBN Governor Olayemi Cardoso stated “The MPC also notes the sustained stability in the foreign exchange market, accentuated by improved capital flows, earnings from increased crude oil production, rising non-oil exports, and significant investments.

“And very importantly, Nigerians are having greater confidence in their own currency”, he added.

He noted further, “The foreign exchange market is working a lot better and more smoothly – the result of which has encouraged inflows into that market”

“Of course, reference is always being made to the fact that Nigeria has moved away from the very difficult situation where there were subsidies,” he added.

He said further, “These measures, painful though they may be, have resulted in stability in the foreign exchange market. There is positivity in our trade surplus, and it has restored investor confidence.”

What you should know

CBN announced the retention of the Monetary Policy Rate (MPR) at 27.5% at its 301st MPC meeting.

All 12 members of the MPC voted unanimously to maintain the MPR at 27.5%, signaling a unified stance among policymakers amid lingering inflationary pressures and exchange rate volatility.

Other key decisions taken by the MPC include:

- Maintaining the asymmetric corridor around the MPR at +500/-100 basis points

- Keeping the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks (DMBs) and 16% for Merchant Banks

- Leaving the Liquidity Ratio unchanged at 30%