Nigeria’s total public debt could rise to N160.6 trillion by the end of 2025, raising new concerns about the country’s deepening fiscal vulnerabilities.

This projection is contained in the latest H2 2025 economic outlook report released by CSL Stockbrokers Limited, a subsidiary of FCMB Group Plc.

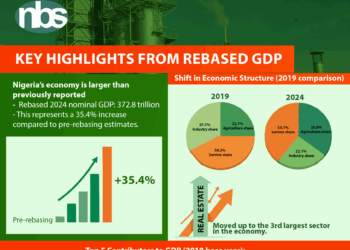

According to the report, the Federal Government may borrow an additional N9.3 trillion or more in the second half of the year to cover its widening fiscal deficit, potentially pushing the country’s public debt stock to around 50.2% of the pre-rebased Gross Domestic Product (GDP).

“We expect the government to ramp up its borrowing efforts in the second half of the year to bridge the widening fiscal gap,” the outlook stated. “We believe the government could come to the market to raise around N9.3 trillion or more in the second half of the year, which could see the total public debt rise to at least N160.6 trillion (c.50.2% of pre-rebased GDP) by the end of the year.”

Oil revenue shortfalls, stalled tax reforms fuel fiscal pressure

CSL’s forecast signals growing unease about Nigeria’s fiscal trajectory, as the government contends with weak oil revenue and delays in implementing key tax reforms. Although the 2025 budget had projected a fiscal deficit of 3.9% of GDP, CSL anticipates the gap could widen to 5.8% due to shortfalls in both oil and non-oil revenue sources.

On the oil front, Nigeria has struggled to meet its 2025 production target of 2.06 million barrels per day. Between January and May, actual production averaged just 1.67 million barrels per day. This underperformance has been compounded by lower-than-expected oil prices, which have averaged $70.82 per barrel, below the government’s benchmark of $75. These twin pressures have created a significant gap in projected earnings from oil, the country’s primary revenue source.

The non-oil segment has fared no better. A proposed increase in the Value Added Tax (VAT) rate from 7.5% to 10% has stalled, with lawmakers opposing the move. Additionally, the implementation of new tax legislation has been postponed until 2026, further constraining efforts to raise domestic revenue in the short term.

CSL also flagged concerns about the Nigerian National Petroleum Company Limited’s revenue remittance practices. According to the report, NNPC is currently remitting only about half of the savings from the removal of fuel subsidies to the Federation Account. This shortfall in expected inflows has further tightened fiscal space and complicated budgetary planning.

To plug the widening deficit, the Federal Government is expected to ramp up borrowing in both the domestic and external markets. CSL referenced a recently submitted $25 billion medium-term borrowing plan, which includes provisions for foreign-currency-denominated local debt instruments.

There is also speculation that Nigeria may return to the international capital market to refinance a maturing Eurobond in November.

Despite the growing debt stock, the country’s debt-to-GDP ratio may appear to decline slightly to 50.7% by year-end, thanks to the planned GDP rebasing. However, CSL warns that this cosmetic improvement does little to address the underlying issues of debt sustainability.

What you should know

Nigeria’s total public debt rose to N149.39 trillion as of March 31, 2025, reflecting a year-on-year increase of N27.72 trillion or 22.8% from N121.67 trillion recorded in the same period of 2024.

- According to a recent report by the Debt Management Office (DMO), the figure also represents a quarter-on-quarter increase of N4.72 trillion or 3.3% from N144.67 trillion as of December 31, 2024.

- The steady uptick in the nation’s debt stock is largely due to new borrowings undertaken by the Federal Government to finance budgetary gaps, as well as the continued depreciation of the naira, which has significantly raised the naira value of external debt obligations.

The rising debt profile comes amid sustained fiscal pressure, with the government increasingly reliant on both domestic and foreign borrowings to fund infrastructure, service existing debt, and support recurrent expenditure.