Nigerian commercial banks are scrambling to meet the Central Bank of Nigeria’s (CBN) July 14 deadline for submission of Capital Restoration Plans, as the apex bank moves to phase out the regulatory forbearance regime introduced during the COVID-19 pandemic.

The CBN’s directive, issued in June, is part of a broader strategy to reinforce capital buffers, enhance balance sheet resilience, and ensure prudent capital retention across the banking sector.

The regulatory forbearance, which allowed banks temporary relief from certain prudential requirements, is now being wound down in a structured and supervised manner.

“To complement the above measures and ensure forward-looking capital planning, all affected banks are required to prepare and submit a comprehensive Capital Restoration Plan to the CBN on or before the 10th working day following the end of the quarter, with effect from June 30, 2025,” the CBN stated in a circular.

The 10th working day falls on Monday, July 14, 2025.

What the CBN Requires

The directive applies specifically to banks benefitting from regulatory forbearance related to credit exposures and breaches of the Single Obligor Limit (SOL)—conditions that indicate potential financial stress.

The Capital Restoration Plan must outline detailed strategies for restoring full regulatory compliance, including:

- Cost optimisation initiatives

- Risk asset reduction

- Significant risk transfers

- Business model adjustments

- Provisioning status and reconciliation of affected credit exposures

- Capital Adequacy Ratio (CAR) calculations with and without transitional reliefs

- Classification migration data for restructured or impacted loan facilities

- Full disclosure of Additional Tier 1 (AT1) instruments, including issuance terms and usage

The CBN emphasized that all submitted plans will undergo regulatory review and approval and will form the basis for continuous supervisory monitoring throughout the transition period.

“These measures represent a firm but supportive framework for the final phase of exiting the regulatory forbearance regime and reflect the CBN’s focus on macro-financial stability, responsible banking practices, and regulatory standards,” the bank said.

Banks Respond to the Pressure

Several banks have acknowledged the urgency of the deadline. A senior staff member at a Tier II bank, who spoke on condition of anonymity, confirmed that preparations are underway.

“We are aware of the deadline, and we will submit before the date,” the official told Nairametrics.

Another bank representative confirmed that their institution’s plan would be submitted within the week.

Many banks had earlier issued statements pledging to exit the forbearance regime by June 30, 2025. With that date now past, the CBN is requiring formal documentation of how each institution intends to restore its capital position and return to full compliance.

Exposure Levels Across the Sector

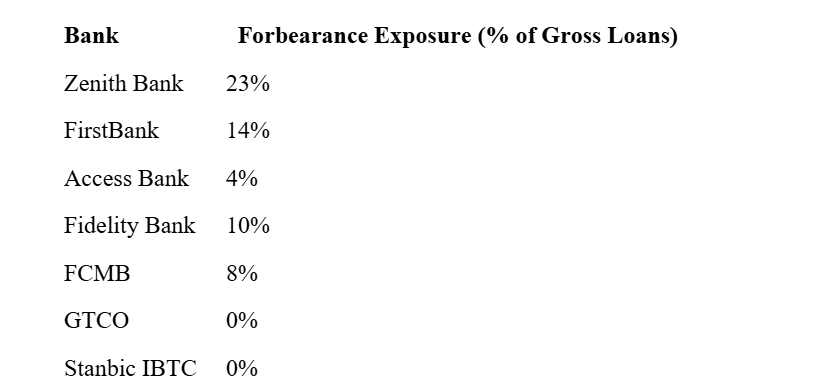

According to a research by Renaissance Capital, several top-tier banks have significant exposure to forbearance loans:

GTCO and Stanbic IBTC have already exited the forbearance regime, having proactively provisioned for and written off affected exposures as of December 2024.

“GTCO, in particular, had proactively cleaned up its books,” the report noted.

The estimates for GTCO, UBA, Fidelity, and FCMB were based on recent management engagements, while the forecast for Zenith Bank was drawn from a December 2024 interaction.

With the regulatory window closing, the banking sector is now under close scrutiny as the CBN seeks to ensure a smooth and orderly transition back to full prudential compliance.