The President and Chairman of the Board of Directors of the African Export-Import Bank (Afreximbank), Prof. Benedict Oramah, has predicted that intra-African trade—which the bank’s 2025 report estimates at $220.3 billion for 2024—is expected to double within a decade as the African Continental Free Trade Agreement Area( ACFTA) is fully implemented by African countries.

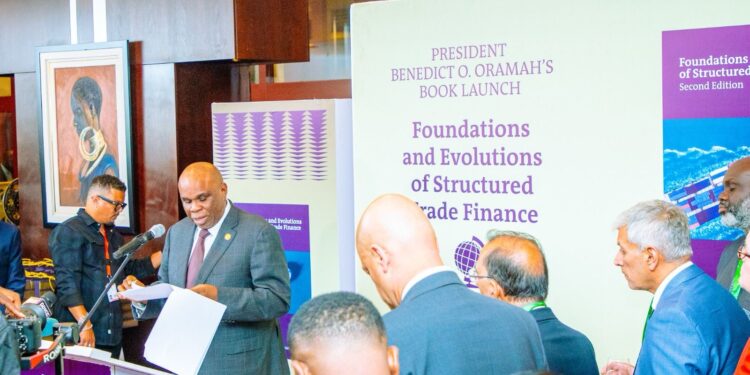

He disclosed this during his remarks on Wednesday at the exclusive launch and signing event of his book titled “Foundations and Evolutions of Structured Trade Finance (Second Volume),” held on the sidelines of the Afreximbank 32nd Annual Meetings attended by Nairametrics.

Oramah explained that over the past decade, global trade dynamics have rapidly evolved, with an increasing emphasis on South-South trade.

Growing African Trade

The Afreximbank chief said that trade between Africa and other developing countries has risen significantly, growing from approximately 23% of Africa’s total trade in 1995 to an estimated 68% in 2024.

“Meanwhile, the share of trade with advanced economies has fallen to below 50%,” he added.

He highlighted that another important aspect of these emerging dynamics is the increasing focus on intra-African trade, adding that “Currently averaging about 15-17%, this share is expected to double within a decade as the Free Trade Agreement is fully implemented”.

- He further explained that this shift raises important questions about the relevance of traditional structured trade finance models in financing South-South trade.

- He stressed that other significant developments on the African continent include the increasing discovery of oil, gas, and other natural resources across many countries, as well as the emergence of new producers, different from traditional producers with which banks used to be comfortable regarding their performance risks.

- Additionally, he stated that the continent is steadily reversing the “curse of de-industrialisation,” meaning that traditional trade finance structures, which are heavily focused on commodity finance, will require a rethink.

“With the rise of manufacturing giants in Africa, opportunities for the emergence of domestic and regional value chains, as well as the growth of small and medium-sized enterprises, are emerging,” he added.

- He said his new volume captures these developments and others, including changing regulatory environments and their influence on the conduct of trade finance in developing markets.

What You Should Know

In the bank’s flagship report, titled “2025 African Trade Report,” intra-African trade reached $220.3 billion in 2024, compared with $196.04 billion in 2023 and $208.3 billion in 2022.

The top five intra-African exporters in 2024, according to the report, are South Africa, Côte d’Ivoire, Egypt, Nigeria, and Zimbabwe.

These five countries are followed by Mali, Ghana, Zambia, the Democratic Republic of Congo, and Namibia.

- Intra-African trade in 2024 was said to have demonstrated a gradual yet consistent advancement toward deeper continental integration, even amid global economic uncertainties, reflected in the robust growth of intra-African trade during 2024 compared with a contraction in 2023.

- This upturn was largely driven by stronger performance in major economies such as Nigeria and Morocco, offsetting weaker performances in Ethiopia and Côte d’Ivoire.

According to the report, “In West Africa, Nigeria emerged as the region’s largest intra-African trading country as trade with the rest of Africa expanded to reach approximately US$18.4 billion in 2024, up from just US$8.1 billion in 2023.”

Crude oil remained Nigeria’s primary export to African markets during the period, but there was growing momentum toward refined product exports following the operational launch of the Dangote Refinery.