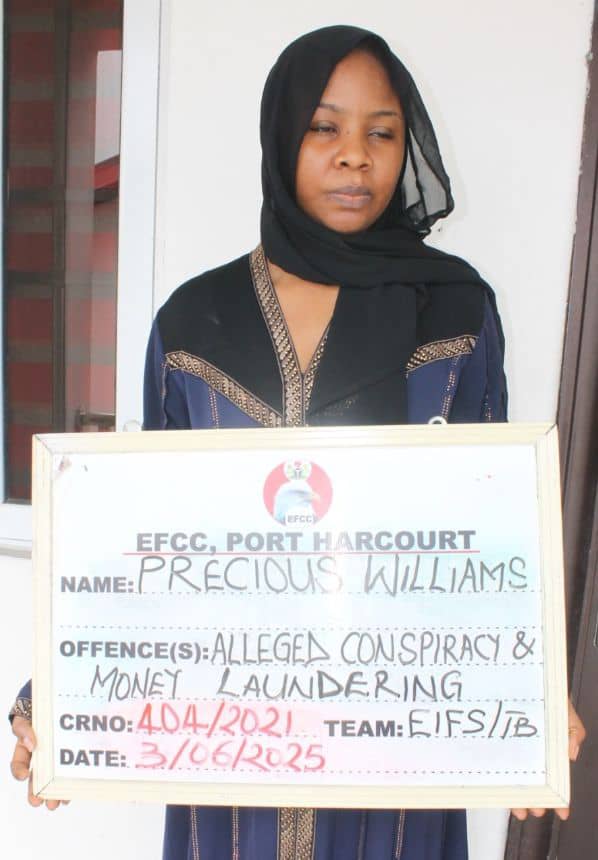

The Economic and Financial Crimes Commission (EFCC), Port Harcourt Zonal Directorate, has arraigned Precious Williams, a director of Glossolalia Nigeria Ltd and Pelegend Nigeria Ltd, over an alleged N13.8 billion Ponzi scheme fraud.

The arraignment took place before Justice S.I. Mark of the Federal High Court in Port Harcourt, Rivers State.

Williams is facing a 14-count charge bordering on conspiracy, obtaining money under false pretence, advance fee fraud, and money laundering.

According to the EFCC, she allegedly received funds traced to Maxwell Chizi Odum, founder of the MBA Trading and Capital Investment Limited, who is still at large and laundered them through company accounts.

Charges

One of the charges reads: “That you, Precious Williams of Glossolalia Nigeria Limited; Pelegend Nigeria Limited, Phenom 413 Events Limited (company representative at large) and Doxasterz Oil and Gas Limited, sometime between the 24th day of August, 2019 and 15th day of February, 2020, at Port Harcourt, within the jurisdiction of this Honourable Court, directly took possession of the sum of Ten Billion Naira (N10,000,000,000.00) only from Maxwell Chizi Odum (still at large) and MBA Trading and Capital Investment Limited (at large) through your Sterling Bank PLC Account No. 0064260799, when you reasonably ought to have known that the said funds formed part of the proceeds of the unlawful activities, of Maxwell Chizi Odum (still at large) and MBA Trading and Capital Investment Limited (at large) of obtaining money under false pretence from one Christian I. Agadaga and over three thousand (3000) other unsuspecting members of the Nigerian public, under the pretext that it was for investment purposes that will yield for them 10% to 15% interest per month, and you, thereby committed an offence contrary to Section 15 (2)(b) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.”

Another reads: “That you, Precious Williams, and Pelegend Nigeria Limited, sometime between the 17th day of December, 2019 and 13th November, 2020, at Port Harcourt, within the jurisdiction of this Honourable Court, directlytook possession of the sum of One Billion, Five Million, Nine Hundred and Four Thousand Naira (N1,005,904,000.00) only from MBA Trading and Capital Investment Limited (at large) through Pelegend Nigeria Limited’s Polaris Bank PLC Account No. 0139723989, when you reasonably ought to have known that the said funds formed part of the proceeds of the unlawful activities of Maxwell Chizi Odum (still at large), and MBA Trading and Capital Investment Limited (at large) of obtaining money under false pretence from one Christian I. Agadaga and over three thousand (3000) other unsuspecting members of the Nigerian public, under the pretext that it was for investment purposes that will yield for them 10% to 15% interest per month, and you, therebycommitted an offence contrary to Section 15 (2)(b) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.”

Court proceedings

Williams pleaded not guilty to all charges. The EFCC counsel, E.K. Bakam, requested a trial date and moved for her remand in a correctional facility.

However, her lawyer, Tochukwu Maduka, SAN, urged the court to consider her bail application, insisting she needed time to prepare for trial. But the EFCC opposed the application, describing it as premature and improperly filed, since it was submitted before the amended charges and formal arraignment.

Bakam opposed the bail plea, arguing that it was filed prematurely before the amended charge and arraignment, and suggested that the defence should file a fresh application.

Justice Mark ruled that the defendant be remanded at the Port Harcourt Correctional Center and adjourned the case to June 17, 2025, for the hearing of the bail application.

More insights

The EFCC declared Maxwell Chizi Odum, whom Williams allegedly received funds traced to, wanted in December 2021 after thousands of Nigerians accused his company, MBA Trading and Capital Investment Limited, of defrauding them through an elaborate Ponzi scheme. The firm promised investors unusually high returns of 15% interest monthly.

Williams is the latest associate of Odum to face prosecution, as the anti-graft agency continues efforts to recover stolen funds and bring suspects to justice.

Williams was arrested following petitions from multiple victims who alleged that she received money from over 3000 victims by false pretence and laundering the money for personal use sometime in April 2021.

This arraignment adds to a long trail of legal action against associates of the firm.