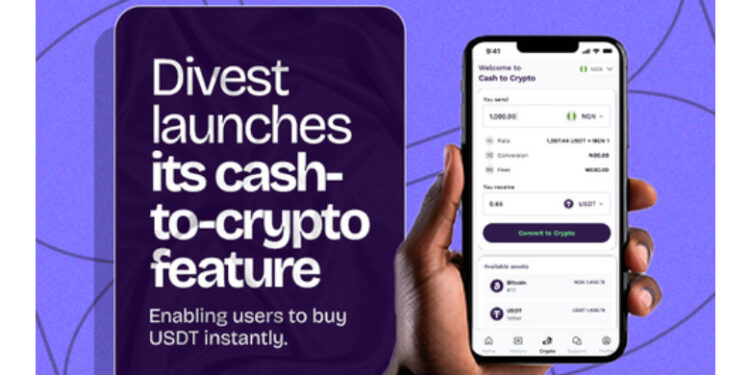

Divest App, Nigeria’s leading crypto-to-cash platform, is excited to announce the launch of its newest feature: Cash-to-Crypto, empowering users to buy USDT using their local currency directly within the Divest app.

Until now, users could only convert crypto to cash on the platform. This enhancement now allows end-to-end crypto access—from buying to cashing out—without ever leaving the Divest ecosystem.

With the launch of this feature, Divest is eliminating the need for third-party platforms, offering users a more seamless, secure, and profitable crypto experience.

“Divest is built for the modern African who needs fast, safe, and flexible access to crypto. This new Cash-to-Crypto feature is more than just a product update—it’s a leap forward in giving our users full control over their money, on their terms.”

— Kelechi Idoko, CEO of Divest App.

Why This Matters:

Previously, Divest users could seamlessly convert their crypto assets to Naira in under 30 seconds. Now, with the launch of the new Cash-to-Crypto feature, Divest takes it a step further — becoming a true one-stop shop for all your crypto needs. You can now convert your cash directly into crypto, starting with USDT, quickly and securely in the Divest App.

Key Features of Cash-to-Crypto

- Instant Crypto Purchase: Users can now buy USDT directly with their Naira.

- Flexible Limits:

- Minimum: $10

- Tier 1 Max: N1,000,000/day

- Tier 2 Max: N4,000,000/day

Currently, the feature supports USDT purchases, with more cryptocurrencies to be added in future updates.

About Divest:

Divest is a financial technology platform that serves as a cash-out solution for individuals who receive value through cryptocurrency. Our core offering enables users to seamlessly convert digital assets into local fiat currency, which is then instantly deposited into their bank accounts.

It offers the fastest and easiest way to convert crypto assets into cash without the hassle of intermediaries.

With commitment to continue empowering its users with full control of their digital assets, they have introduced the Cash-To-Crypto feature, enabling users to seamlessly buy Crypto instantly with naira.

The feature is live and fully integrated into the Divest app. You can download the Divest App Here or visit their website.