The Securities and Exchange Commission (SEC) has reacted to the operations of CBEX, a digital asset trading platform in Nigeria, saying any of such platform not registered with the SEC is illegal.

This comes amidst the rumors of closure of the platforms over the inability of users to withdraw their funds over the weekend.

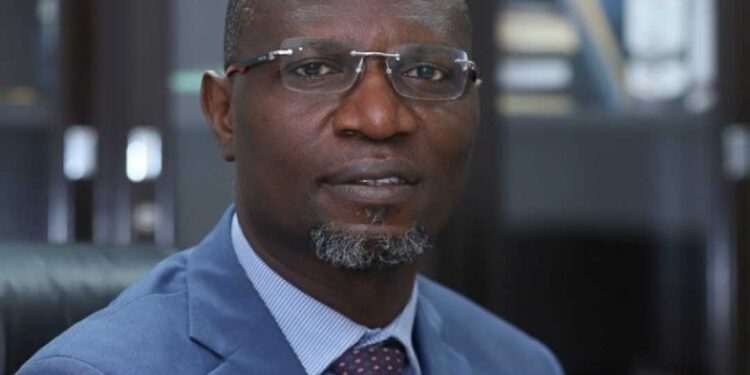

Speaking during a virtual engagement with fintech stakeholders on the Investment and Securities Act (ISA 2025) on Monday, the Director General of the SEC, Emomotimi Agama, warned Nigerians against patronizing unregistered platforms.

“Very recently, there has been a post that has gone viral around a particular platform and the activities of such platforms. And of course, the aftermath of it is further news of their closure and all of that.

“In fact, I was tagged in one of those messages. I want to state it very clearly. If it is not registered, it is illegal,” Agama stated without directly mentioning the platform.

Concerns over CBEX

Social media was abuzz on Friday following concerns about the operations of CBEX with several users warning that it shows signs of being a Ponzi scheme.

- The concerns stem from the inability of some users to withdraw, sparking fears that the scheme might have crashed.

- However, some users insist that the platform was still functioning, although withdrawals were currently not possible due to the platform’s rules and regulations.

- CBEX prides itself as an investment platform that gives users 100% return on investment in one month, and “investments” are only in USD. Users also get bonus for referral.

- Meanwhile, checks by Nairametrics on the SEC database confirm that CBEX is not currently registered with the Commission.

Crackdown on illicit activities

Speaking on the provisions of the Investment and Securities Act (ISA 2025) recently signed by President Bola Tinubu, the SEC DG said the Act has established clear rules and regulations for digital asset platforms, including registration requirements to promote transparency and trust.

This, it said, allows the SEC to crack down on illicit activities, such as Ponzi scheme, pump and dump tokens, and unregistered exchanges, creating a safer environment for investors.

“It is important that even for celebrities, we must be cautious around what we do. Becoming influencers or introducing meme coins, that does not mean well for the generality of Nigerians, are not going to be tolerated,” he warned.

What you should know

Nairametrics earlier reported that the SEC is now empowered through the ISA 2025 to prosecute promoters of Ponzi schemes in the country.

Speaking during a TV interview recently, the SEC DG noted that before the new law came into force, the Commission had no legal backing to prosecute Ponzi scheme operators, adding that this had made it difficult to bring them to justice.

- With this, Agama said operators of Ponzi schemes in Nigeria now face 10 years jail term and N40 million penalty if caught.

- He noted that with the new law the Commission now has all it needs to come against bad operators and bring succor to Nigerians.

- He said this would also allow the Commission to get the “bad guys” out of the way and making sure that people are more confident and happier to invest in the Nigerian market “knowing fully well that the investor protection responsibility of the SEC has now been enhanced.”