For the first time ever, the combined wealth of Africa’s billionaires has crossed the $100 billion mark, driven largely by the surging fortunes of Nigerian business moguls.

According to the latest Forbes Billionaire List released this March, the continent now boasts 22 billionaires with a combined net worth of $105 billion—up from $82.4 billion and 20 billionaires in the previous year.

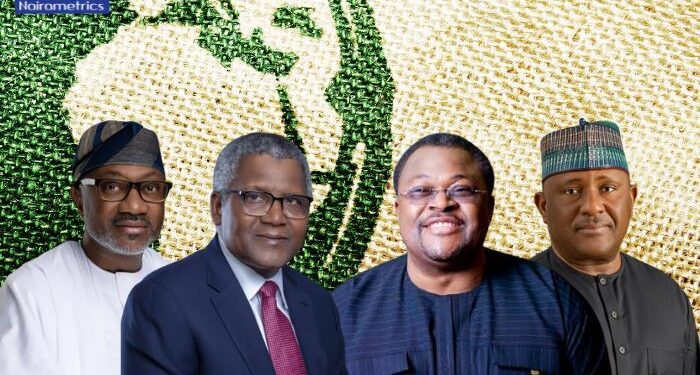

Nigeria had only 4 billionaires on the list.

This growth comes despite the persistent challenges across Africa, including currency devaluations, political instability, and fragile consumer markets.

Dangote’s refinery fuels massive wealth jump

Africa’s richest man, Aliko Dangote, has once again topped the list, for the 14th consecutive year. His net worth surged from $13.9 billion last year to $23.9 billion in 2025, largely due to the inclusion of the Dangote Refinery’s valuation in Forbes’ calculations.

- The $19 billion refinery, which began limited operations in early 2024 after years of delays, is now expected to reach full refining capacity this month.

- Located on the outskirts of Lagos, the refinery is a game-changer for Nigeria’s downstream sector, allowing the country to export refined petroleum products for the first time in decades.

“This is a very, very big relief,” Dangote told Forbes in February. He added that the refinery was a “pivotal step in ensuring that Africa has the capacity to refine its own crude oil, thereby creating wealth and prosperity for its vast population.”

Dangote also becomes one of the 100 richest people in the world, a milestone no other African billionaire has reached this year.

Other Nigerian billionaires hold firm

For the second year running, Nigerian businessman Femi Otedola, chairman of Geregu Power Plc, made it to the billionaire rankings with a net worth of $1.5 billion.

- Otedola’s resurgence was driven by a sharp rally in Geregu’s share price, which jumped nearly 40% in the past year following improved revenues and strong earnings performance.

- The power company, which is listed on the Nigerian Exchange (NGX), has become one of the more prominent listed players in Nigeria’s evolving energy sector.

- Otedola, a former oil magnate, has shifted focus in recent years to power generation and financial services, with investments in First HoldCo Plc, the parent company of FirstBank.

The list also features two other Nigerian billionaires: Abdulsamad Rabiu, founder of BUA Group, with an estimated net worth of $8.1 billion; and Mike Adenuga, owner of Globacom and Conoil, with a fortune valued at $6.1 billion.

Mike Adenuga ranked 5th on the list of top African Billionaires, while Abdulsamad Rabiu came 6th. Both men ranked 2nd and 3rd, respectively, on the top Nigerian list. Otedola ranked 16th on the list and 4th from Nigeria.

Rabiu’s wealth stems from his extensive holdings in cement, sugar, and real estate, while Adenuga’s telecom and oil assets continue to deliver strong returns despite Nigeria’s macroeconomic headwinds.

South Africa dominates in numbers

While Nigerian billionaires made headlines with their wealth increases, South Africa retained the highest number of entries on the list with seven billionaires.

- The country’s richest man, Johann Rupert, saw his fortune rise 39% to $14 billion, making him the second-richest African.

- Rupert chairs Richemont, the Swiss-based luxury goods giant behind brands like Cartier and Montblanc. He has held the No. 2 spot in Africa’s billionaire rankings since 2022.

Other South African billionaires on the list include Nicky Oppenheimer ($9.4 billion), Patrice Motsepe ($3.2 billion), Koos Bekker ($2.7 billion), and Michiel Le Roux ($1.7 billion).

Notable African names: Egyptians, Moroccans, and a Tanzanian

Egypt has four billionaires on the list, led by construction and engineering magnate Nassef Sawiris, whose net worth increased to $8.7 billion following a rise in Adidas shares, where he owns a significant stake.

- Morocco contributed three billionaires, including the return of real estate mogul Anas Sefrioui, who re-entered the list after a rally in the share price of his firm Douja Promotion Groupe Addoha.

- Tanzania’s lone billionaire, Mohammed Dewiji, remains on the list, as does Zimbabwe’s Strive Masiyiwa, although the latter’s fortune declined sharply following Zimbabwe’s currency reforms.

Masiyiwa’s net worth dropped by 33% to $1.2 billion after the government scrapped the Zimbabwe dollar in favor of a new gold-backed currency, the ZiG.

Africa’s billionaire geography

Here’s a breakdown of the number of billionaires by country:

- South Africa: 7

- Nigeria: 4

- Egypt: 4

- Morocco: 3

- Algeria: 1 (Issad Rebrab)

- Tanzania: 1 (Mohammed Dewiji)

- Zimbabwe: 1 (Strive Masiyiwa)

Behind the numbers

Forbes compiled the rankings using stock prices and exchange rates as of March 7, 2025.

- Only billionaires with primary business operations or residence in Africa were considered—meaning names like Mo Ibrahim (U.K.-based) and Nathan Kirsh (U.S./U.K.-based) were excluded.

The rise in African billionaire wealth also mirrors a broader surge in global equity markets, which gained 22% in the 12 months ending February 2025, according to the MSCI World Index.

Bottom line for Nigeria

Nigeria’s presence on the list is not only about the number of billionaires, but also the scale of wealth they command.

- Dangote alone accounts for nearly a quarter of the total $105 billion wealth among African billionaires.

- Combined, Nigeria’s four billionaires hold close to $40 billion in assets—solidifying the country’s dominance in African private wealth creation.

As the Dangote Refinery scales up, Geregu Power continues to perform, and firms like BUA and Globacom sustain market relevance, Nigerian billionaires are once again playing a central role in shaping the continent’s economic future.