In a bold move to establish itself as the largest African-owned commodity trader of non-ferrous metals, Zéro Ferro and House of Commodity (HOC) have embarked on an ambitious journey to conquer the global commodities market.

Zéro Ferro aims to be Africa’s leading base metals company, ethically sourcing commodities that drive the progress of humanity. In Zambia, Bissados Limited is a subsidiary.

With a strong presence in Nigeria, Zambia and the Democratic Republic of Congo, the companies have already begun exporting copper concentrates to China, with a projected annual export value of $504 million.

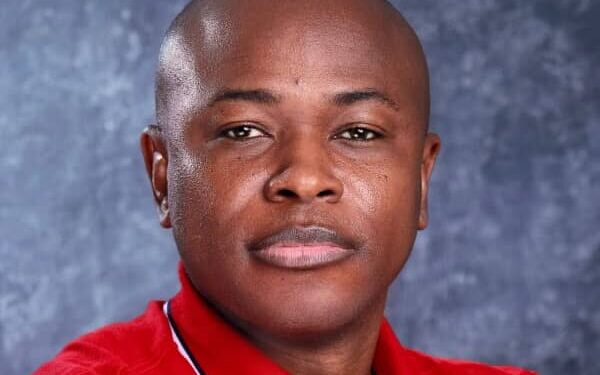

At the helm of this African commodities giant is Mr Olajide Abiola, the CEO with over 20 years of experience in multi-sector business leadership and in particular- sourcing non-ferrous metals.

With a proven track record in the industry and other sectors, the CEO and his team have successfully navigated the complexities of global commodity trading, establishing HOC and Zéro Ferro as a formidable player in the market.

Zéro Ferro’s business model is built on a simple yet effective strategy: sourcing high-quality non-ferrous metals from African mines- and exporting them to global markets. With a focus on copper, the company has established a strong presence in Zambia and the DRC, two of the world’s leading copper-producing countries. Working with Bonded warehouses like Zamfast/Costco Shipping to drive the logistics in a safe and timely manner.

At the moment, the company’s metals exports are destined for China, the world’s largest consumer of copper. With a projected annual export volume of 180,000 metric tons, Zéro Ferro is poised to become a significant player in the global copper market.

Based on current London Metal Exchange (LME) prices, the company’s annual export value is estimated to be in excess of $500 million.

Zéro Ferro and HOC’s success is built on a foundation of expertise, experience, and strategic partnerships. The companies’ CEO has established a network of contacts and partners throughout the African commodities industry, enabling Zero Ferro to source high-quality metals at competitive prices.

In addition to its copper exports, Zéro Ferro is also exploring opportunities in other non-ferrous metals, including zinc, lead, nickel, tin, columbite, tantalite, and tungsten ore. With a strong focus on sustainability and social responsibility, the company is committed to ensuring that its operations have a positive impact on local communities and the environment.

Both companies continue to expand their operations and establish themselves as major players in the global commodities market, their success is a testament to the growing importance of African-owned businesses in the global economy. With its focus on non-ferrous metals, Zéro Ferro and HOC are well-positioned to capitalize on the growing demand for these critical commodities.

As the world’s economies continue to evolve and grow, the demand for non-ferrous metals is expected to increase, driven by the growth of industries such as renewable energy, electric vehicles, and construction. With its strong presence in Africa and its focus on sustainability and social responsibility, Zéro Ferro is poised to play a major role in meeting this growing demand.

Beyond its success in commodity trading, HOC has also made a significant impact in the manufacturing sector back home. At the forefront of this endeavor is Jendo Oil, a nationally acclaimed premium cooking oil that has become a staple in many kitchens.

What sets Jendo Oil apart from its competitors is its unique composition, made from groundnuts. This distinction not only makes Jendo Oil a healthier option but also underscores HOC’s commitment to providing high-quality products that cater to the needs of its customers.

As a leader in its subsector, Jendo Oil has established itself as a trusted brand, renowned for its exceptional quality and nutritional value. By leveraging its expertise in manufacturing and distribution, HOC has successfully positioned Jendo Oil as a household name, synonymous with excellence and reliability.

The company’s foray into manufacturing, led by Jendo Oil, demonstrates the company’s dedication to diversifying its portfolio and exploring new avenues for growth.

As HOC continues to expand its reach, it remains focused on delivering innovative products and services that meet the evolving needs of its customers.

Meanwhile, Zéro Ferro and House of Commodity’s emergence as a major player in the global commodities market is a significant development for African-owned businesses.

With its focus on non-ferrous metals, commitment to sustainability and social responsibility, and strong presence in Africa, HOC and Zéro Ferro are well-positioned to capitalize on the growing demand for these critical commodities and establish themselves as a leader in the global commodities market.