Nigeria is on the verge of a new payment revolution, which experts are hopeful will bring more than 28 million Nigerians into the digital payment system with the imminent rollout of a new multipurpose card by the National Identity Management Commission (NIMC).

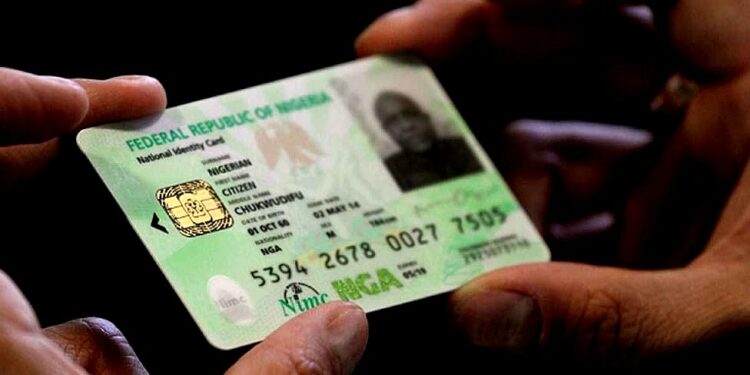

This new card scheme, which automatically gives every Nigerian with the National Identification Number (NIN) automatic access to digital payment is expected to be the game changer in the country’s payment landscape.

For the first time, the scheme combines the two key digital public infrastructures, the digital identity system managed by NIMC and the digital payment infrastructure managed by the Nigeria Inter-Bank Settlement System (NIBSS) to facilitate inclusive access.

Current realities

According to data from the EFiNA Access to Finance (A2F) 2023 report, 48% of adult Nigerians lack a transactional or financial account and are being excluded from the modern digital financial system.

“The ownership and use of banking services skews heavily towards the top of the wealth distribution; in the more developed districts and urban areas; as well as towards males, those with better educational achievements and the middle-aged contributing further to inequalities across and within these categories,” EFiNA stated in the report.

- The report also noted that there are over 28 million Nigerians who have NIN but do not have financial accounts.

- However, with a robust digital identity system, industry analysts say Nigeria has an easy solution to bridge the digital payment gap, which is why NIMC and NIBSS– through its subsidiary, AfriGo—coming together to launch the multipurpose card is seen as the game changer.

- According to NIMC, over 115 million NIN had been issued as of October 2024 and the database is still growing.

The card and its features

Sharing details about the new card program during a press conference last week, the Director-General and Chief Executive Officer of the Commission, Dr. Abisoye Coker-Odusote said the card aims to address multiple use cases of federal government and private sector interventions.

It is also targeted at addressing social and economic issues in the country, with payment functionalities and identity as a foundation.

- According to her, the key features of this card include the biometric, which is unique to the owner.

- The card has a long validity period because it’s also fully KYC enabled and it has an offline and online capability, which means the card can be used for financial transactions even in areas where there is limited or no access to the internet.

- On the back, the card provides additional functionalities that enable Nigerians and those who are going to have access to it to be able to prove their identity at any point in time they are called to do that.

- The NIMC CEO further explained that the new multi-purpose card also facilitates the inclusion of citizens in the social and economic activities in the country.

“The biometric NIN-Enabled card facilitates social, economic, and financial inclusion in line with President, Bola Ahmed Tunibu’s Renewed Hope Agenda,” she said.

Deepening financial inclusion with NIN

For the Managing Director of AfriGo, Ebehijie Momoh, the new card scheme is a huge opportunity for Nigeria to deepen financial inclusion.

She noted that the ability to link government disbursements to the cards would streamline processes and ensure transparency, ultimately helping to close the financial inclusion gap in the country.

“We have over 100 million people with National Identification Number (NIN), what that means is that automatically, we can bring 30 million additional people into the financial ecosystem by issuing the card to every Nigerian,” she said.

“This is a huge opportunity to bring people into financial services. This is why we are collaborating with NIMC to create multipurpose cards linked to NINs,” she said.

What it means for Nigerians

Speaking with Nairametrics, a former President and CEO of OPay Nigeria, Mr. Olu Akanmu said the NIMC-AfriGO partnership will ensure the integration of citizens’ digital identity with digital payments and mimic elements of the desired integrated national digital public infrastructure between identity and payments.

He said the biggest impact would be to connect the over 28 million Nigerians who have NIN into the financial system through the card.

“The scheme could move the number of adults who can receive digital payments from 52% to more than 80% over the next two years with potential large spiral effects in access to credit and other financial services.”

He noted that the card scheme must, however, stay mission and impact-focused.

“It will achieve its greatest social and commercial impact not by competing with the existing card schemes but by going to where those private card schemes have not reached which is still close to half of our population,” he added.

- He said the card scheme could also solve the problem of the government’s inability to do an auditable and creditable cash transfer program if it is mission-focused.

- According to him, this would bring the large mass of economically disadvantaged most hit by the pains of economic reforms into the formal digital financial rail for easy, effective, and credible cash transfer programs, moderate their economic reform pains, and widen support for the economic reform program.

Corroborating Akanmu’s position, a public affairs analyst and CEO of SalesUltimo, Mr. Muritala Bello, said with financial accounts linked to unique digital identities, it will become easier for Nigerians to have access to credits from financial institutions.

He added that this transparency would encourage lenders to offer more affordable interest rates, as they can accurately assess a borrower’s risk profile, unlike the current system where lenders assume the worst and charge high rates.

What you should know

Although the government is hoping to issue the cards to as many Nigerians as requested, NIMC has said that Nigerians who want the card would have to pay for it.

According to the Head of Card Management Services at NIMC, Dr. Peter Iwegbu, aside from the government’s limited resources to fund free cards, NIMC also wants to avoid repeating the mistake of the past efforts to issue physical cards to Nigerians for free, which many Nigerians did not collect.

- He said that over two million cards were produced in the previous attempt to issue free National ID cards by the NIMC, but many of them were uncollected to date.

- Iwegbu, however, noted that the government has different programs to make the card available to less-privileged Nigerians who may not be able to pay for the card but need it to access government support.

- He said NIMC is working with banks across the country, which will make it possible for people to walk into any bank closest to them and request the card.

This report is produced under the DPI Africa Journalism Fellowship Programme of the Media Foundation for West Africa and Co-Develop.