The Naira was muted in the last trading session of the week, while the greenback reached a two-year high as currency traders braced for a strong nonfarm payroll reading on Friday afternoon.

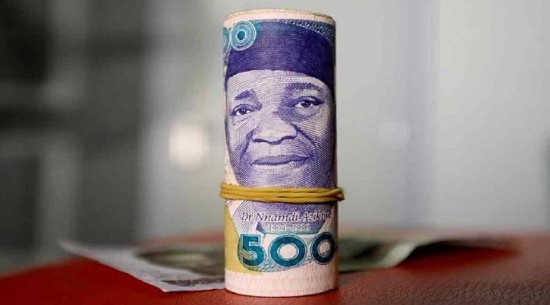

The naira traded at around N1660/$ in the black (unofficial) market.

Price action suggests that bulls haven’t shown the capacity this week to push the settlement price below the N1600/$ mark.

However, naira bulls might gain some momentum in the mid-term amid projected moderation in Nigeria’s inflation readings.

According to the most recent NESG-Stanbic IBTC Business Confidence Monitor report, Nigeria’s inflation rate is expected to drop to 27.1% by December 2025.

This prediction gives consumers and companies facing protracted economic hardships hope, as it indicates that structural reforms are starting to have a positive impact despite ongoing obstacles.

Inflation remains a major concern for the country’s FX market and larger economy, with growing fuel prices and currency depreciation driving up costs across all sectors.

The report pointed out that after fuel subsidies were eliminated and the foreign exchange market was liberalized, inflationary pressures were especially severe in 2024. Expectations regarding prices, demand, investment, and financial performance are still crucial to the cautiously optimistic outlook for business performance in the first quarter of 2025, according to the report.

U.S. Dollar Index Near Two-Year High

The greenback did not move much during overnight trading due to a market holiday in the world’s largest economy.

However, after the Federal Reserve issued hawkish signals earlier this week, the dollar remained positive. The dollar index saw a minor firming during London’s trading session, staying just below its highest points since November 2022.

- The focus was firmly on the December nonfarm payroll data for additional clues on the U.S. economy, which was due later today. The dollar index is hovering around 109, driven by strong demand and persistent signals of monetary policy tightening.

- Investors anticipate clarity on the labor market’s momentum and potential policy ramifications when the December NFP data is released on Friday. A projected decrease in the headline number from 227,000 to 160,000 is expected.

- Additionally, the Fed’s December meeting minutes, released on Wednesday, supported the dollar by restating the central bank’s caution that interest rates will decline more slowly this year.

- The minutes also revealed that policymakers were concerned about Trump’s expansionary and protectionist policies, which could eventually fuel inflation.

The U.S. Dollar Index held firm at its 20-day Simple Moving Average (SMA), retaining a positive bias amid elevated volatility.

Although there seems to be some exhaustion, technical indicators lean positive. If bearish momentum picks up, key support is around 108.5 index points.

The DXY may maintain its high position around 109 amid ongoing inflation worries and stable yields, even though its short-term trading ranges will likely be more constrained.