Nigeria’s economy faces deep structural flaws that have hindered consistent growth and development, despite occasional spikes in gross domestic profit growth rates over the last few years.

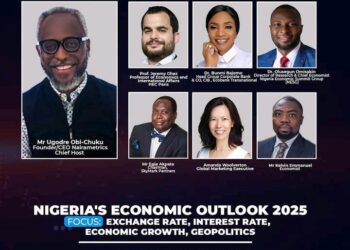

This is according to Dr. Olusegun Omisakin, Director of Research and Chief Economist at the Nigeria Economic Summit Group (NESG). during the Nairametrics Nigeria Economic Outlook 2025 Focus: Exchange Rate, Interest Rate, Economic Growth, Geopolitics, where he reviewed Nigeria’s economic trajectory and outlined the challenges facing the nation.

Speaking on the country’s historical growth trends, he noted that while Nigeria experienced a remarkable growth rate of 14.6% in 2002, subsequent years have been marked by a downward trend.

“From around 1999 to 2002, we had a fantastic series of growth rates, ending up with about 14.6%. That looks incredible because if you talk about that now, it seems impossible—but we did it,” he said.

- However, by 2005, growth had slowed to 7%, and between 2010 and 2016, GDP growth rates fluctuated between 2.7% and -1.6%, including a recession in 2016.

- Dr. Omisakin attributed this volatility to two fundamental issues: the economy’s flawed structure and the absence of a coherent economic philosophy.

“The structure of the economy has been fundamentally faulty for years. It doesn’t matter how long we follow the current structure; we will continue battling with growth rates below 5%,” he emphasized.

- He further criticized the lack of consistency in economic planning across political administrations. “We need a philosophy that transcends political transitions, so each administration doesn’t reverse or dilute the previous one’s efforts,” he explained.

More insights

Despite the bold reforms undertaken by the 2024 administration, including forex liberalization, fuel subsidy removal, and tax reforms, economic instability persists. Dr. Omisakin pointed out that the success of these reforms is constrained by systemic inefficiencies.

Highlighting whether the challenges stemmed from policy implementation or the policies themselves. Dr. Omisakin argued that even the best policies can deliver limited results within Nigeria’s flawed economic environment. “The results are determined by the efficiency of the economic system. Even with efficient reforms, people will still suffer because of the underlying issues,” he said.

- He explained the role of Nigeria’s informal economy and excluded population in limiting the effectiveness of policy changes. “Most economic activities remain below reasonable productivity levels, and that limits the effectiveness of any policy changes,” he said.

- Dr. Omisakin suggested that while some economic stability might be achieved in the short term, the costs to the population will remain high unless structural issues are addressed. “We need to focus on stability first before addressing the longer-term structural issues,” he concluded.

- The conversation shows that without addressing the foundational problems of Nigeria’s economic framework, the country risks perpetuating a cycle of short-lived growth and persistent poverty, unemployment, and inequality.