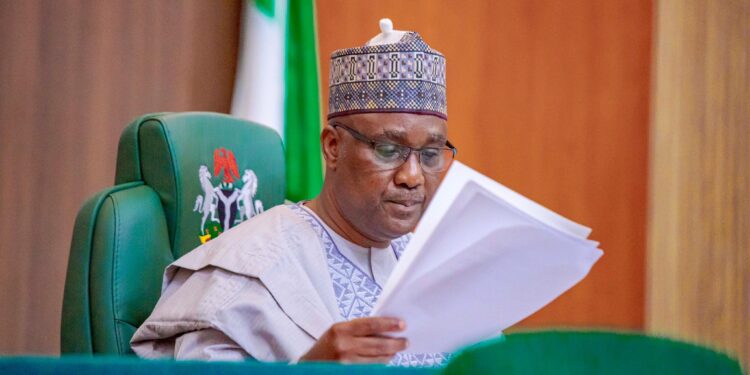

The Speaker of the House of Representatives, Rep. Tajudeen Abbas, has set a three-week deadline for the Committees on Finance and the Federal Inland Revenue Service (FIRS) to identify and eliminate double taxation on low-income Nigerian earners.

Abbas made the ruling on Thursday, October 10, 2024, after lawmakers adopted a motion regarding revenue generation and tax obligations amid rising inflation during plenary.

The motion was moved by Rep. Peter Aniekwe (LP-Anambra) and five other lawmakers.

Tax Obligations

Moving the motion, Aniekwe told lawmakers that Nigeria’s economic situation is currently plagued by inflation, unemployment, and the increasing cost of living, resulting in widespread hardship among Nigerians.

He highlighted that the imposition of multiple taxes, levies, and charges at various levels of government places further financial strain on citizens, especially low-income earners.

The lawmaker stated that while the government’s primary responsibility is to meet the basic needs of the masses, it is expected to achieve this through policies that promote economic development, social welfare, and prosperity for citizens.

“Concerned that the introduction of additional and sometimes unnecessary taxes, including consumption taxes, service taxes, and levies on essential goods and services, places an undue burden on the masses, further widening the inequality gap.

“Mindful that while taxation is necessary for government revenue, a balance must be struck between revenue generation and the economic well-being of citizens, particularly at a time when many families and businesses are still recovering from the economic impact of global and local challenges.

“Alternative measures can be taken to increase government revenue without overburdening the masses, such as expanding the tax base, improving tax administration, reducing government waste, and curbing corruption,” he said, as reported by the News Agency of Nigeria.

Subsequently, the House of Representatives urged the federal government to consider alternative revenue generation strategies instead of increasing taxes in the country.

The House further suggested widening the tax net to capture more high-income earners and strengthening the enforcement of existing tax laws.

The House agreed that the government should explore increasing the export of cash crops and agricultural produce.

In his ruling, Speaker Rep. Tajudeen Abbas mandated the Committees on Finance and FIRS to conduct a thorough review of existing tax laws and policies within three weeks to streamline tax collection processes.

Part of their responsibilities includes identifying and eliminating overlapping taxes and areas of double taxation to provide relief to citizens without jeopardizing government revenue targets.

The House further urged the National Orientation Agency (NOA) and other relevant agencies to educate the public on their tax rights and responsibilities and to report any cases of exploitation or unjust taxation to the ombudsman.

The House Committee on Legislative Compliance will oversee the implementation of these resolutions.

What You Should Know

- Nairametrics reports that Nigerians pay over 60 official and 200 unofficial taxes, with small businesses across Nigeria struggling with multiple taxation from different federal government agencies or similar taxes from various levels of government (federal, state, and local).

- The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr. Taiwo Oyedele, recently stated that there are even more unauthorized taxes, all disproportionately affecting small businesses, including petty traders, hawkers, artisans, truckers, cart pushers, okada riders, and other transporters.

- The Manufacturers Association of Nigeria (MAN) has asked both federal and state authorities to unify the various taxes imposed on its members, citing these levies as detrimental to business expansion.