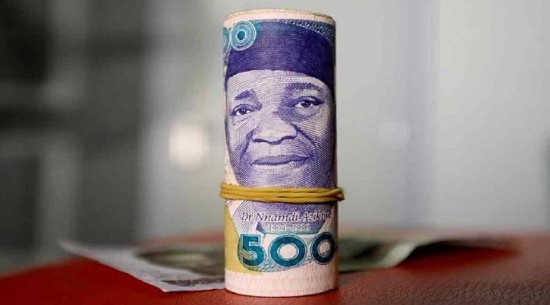

The Nigerian currency ended last month on a losing note, trading at N1,541.94/$1 on Monday, September 30, 2024, but showed strength throughout the month.

The naira started the first trading month at N1,585.77/$1 in the official market, posting a monthly gain of 2.85%, but plummeted significantly in the black market.

The naira, however, closed flat against the dollar in the parallel section of the forex market, trading at N1,700/$1, compared to the previous day’s rate of N1,705/$1.

Dealers in the parallel market highlighted shortfalls in the past two weeks, which may have sparked market depreciation.

President Bola Tinubu eliminated regulations last year that maintained the currency’s artificial overvaluation in an effort to attract foreign investment. The Nigerian currency has lost more than two-thirds of its value in contrast to the dollar.

Nigerian businesses predict that the naira will weaken further until December, but they expect it to strengthen the following year, according to a CBN survey. Furthermore, the current state of the naira contradicts predictions from Renaissance Capital, Goldman Sachs, and the Financial Derivatives Company, all of which stated that the value of the naira would stabilize at N1,000 or less.

Petroleum products consume about 40% of Nigerian foreign exchange. Dangote stated that the refinery would boost the naira. The largest refinery in Africa will start accepting naira for crude oil on October 1st. The Federal Inland Revenue Service (FIRS) Chairman Zacch Adedeji’s spokesman, Dare Adekanmbi, announced in a statement released on Sunday that the government had confirmed that the naira-for-deal agreement would begin on Tuesday.

The Technical Sub-Committee on Domestic Sales of Crude Oil in Local Currency, chaired by Adedeji, is working diligently to ensure that the agreement is executed as intended to benefit Nigerians. Adekanmbi stated, “I can confirm that the Chairman of the Sub-Technical Committee, Zacch Adedeji, is working day and night to ensure that everything goes according to plan. He is aware of how critical it is that the agreement be implemented exactly as intended to benefit Nigerians.”

In the meantime, the amount of money exchanged (turnover) in the NAFEM increased from $20.9 billion in the first nine months of 2023 to $33.7 billion in the first nine months of 2024 (YoY), marking a 61 percent increase.

U.S. Dollar Shows Upside Amid Strong U.S. Fundamentals

The dollar index maintained strength against its major competitors during the London trading session on Tuesday, following Federal Reserve Chair Jerome Powell’s retreat from expectations of further large-scale interest rate cuts.

The dollar index added 10 basis points on Tuesday, reaching 100.82, after pushing 30 basis points higher on Monday. In a speech at a Tennessee conference, Powell took a more assertive tone, stating that the central bank would probably continue reducing interest rates by a quarter percentage point in the future. He further disclosed, “It doesn’t seem like this committee is in a rush to lower rates.”

Traders reduced expectations for a 50 basis-point (bps) reduction to 35.4 percent from 53.3 percent a day earlier; however, they remain confident that the Fed will cut again at the next policy-setting meeting in November, according to CME Group’s FedWatch Tool.

The Federal Reserve began its easing cycle in August with a larger-than-expected half-point reduction. Powell’s address preceded a busy week for U.S. manufacturing indices, including the Institute for Supply Management report later on Tuesday, the non-manufacturing report on Thursday, and potentially significant monthly jobs numbers on Friday.