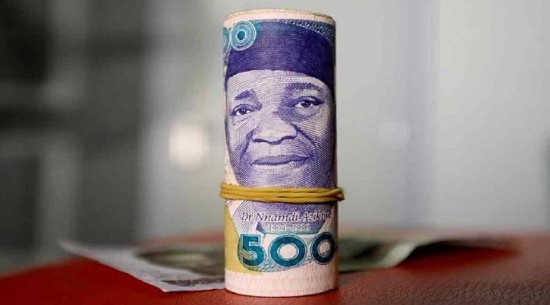

The Nigerian naira has traded for the third consecutive day against the dollar at the same exchange rate of N1,650/$ in the parallel segment of the forex market.

In the official market, data from NAFEM indicated that the local currency settled at N1,544 per dollar, reflecting a N5 increase from Wednesday’s settlement of N1,539 per dollar.

The naira has been identified as one of the top five worst-performing currencies globally, despite increased outflows from the country’s FX reserves.

Fundamentals suggest that, despite recent interest rate cuts by the U.S., the Nigerian naira continues to face challenges.

The country’s crude oil production, a major source of foreign exchange, remains at tepid levels, meaning the CBN’s recent interventions in the volatile market have not significantly reversed the naira’s declining value.

Price action indicates that naira short sellers are still dominant in the unofficial black market. The naira will likely face increased selling pressure as demand for foreign exchange rises, particularly for foreign tuition, vacations, and fuel imports.

Cordros Research predicts that the naira may trade between N1,400 and N1,500 per dollar by the end of the year, according to its H2 2024 forecast report titled “Bridging Reforms to Recovery.” This projection assumes that the CBN will continue to implement FX reforms and monetary tightening measures, maintain high interest rates, moderate the impact of ongoing geopolitical tensions in emerging markets, continue to intervene in the FX market, and sustain average domestic oil production while global interest rates decline in H2 2024.

The research also outlines a worst-case scenario in which unfavorable conditions might cause the naira to decline to between N1,500 and N1,600 per dollar.

Dollar Index Within Range in Global Market

After Fed Chairman Jerome Powell stated that a 50-basis point (bps) rate cut would not be the new normal, traders quickly recovered their initial losses on Wednesday but lost some ground yesterday. Moving forward, the extent of any decrease will depend on economic data released before each rate decision, which is viewed as somewhat hawkish by the markets.

Regarding economic data, traders are discussing the likelihood of a further 50 basis point rate cut, with stronger economic data points expected this Thursday. The weekly Jobless Claims report came in lower than the anticipated 230,000, at 219,000. The Philadelphia Manufacturing Index increased by 1.7 points, aligning with the expected -1 percent decrease.

Price action shows that the US Dollar Index (DXY) is back within its range after a brief dip below it. For the past few weeks, DXY’s fluctuations have been influenced by factors outside its typical bandwidth. Given the recent Fed rate reduction and the outlook for the year, a gradual depreciation of the currency is expected. Additional strain on the lower end of the spectrum is likely if economic data continues to deteriorate, putting pressure on the Fed to cut interest rates by an additional 50 basis points in November.

The upper bound of the recent range remains at 101.90. The 55-day Simple Moving Average (SMA), currently at 102.74, could lead the index to 103.18 in the future. The 200-day SMA and the 100-day SMA, at 103.79, make the next tranche quite uncertain.

The Dollar Index, which measures the value of the US dollar relative to a basket of six other currencies, increased by 0.2 percent to 100.48 index points in early trading on Friday, though it remained just above a 12-month low following the Federal Reserve’s significant 50 basis point reduction to a range of 4.75 percent to 5 percent.

Markets project a 40% probability that the Fed will reduce rates by an additional 50 basis points in November, with expectations of 73 basis points by year-end. By the end of 2025, rates are anticipated to be at 2.85 percent, which is currently viewed as the Fed’s estimate of neutral. Before the US Federal Reserve (Fed) meeting, the US Dollar (USD) was trading at similar levels and even moving higher in anticipation of the US trading session.