Barrister Yinka Edu, partner and Head of Fintech, Banking & Finance, and Capital Markets at Udo Udoma & Belo-Osagie, has asserted that the new regulations introduced after the 2005 bank recapitalization exercise, including stricter margin lending rules and increased Central Bank of Nigeria oversight, have significantly strengthened Nigeria’s banking system.

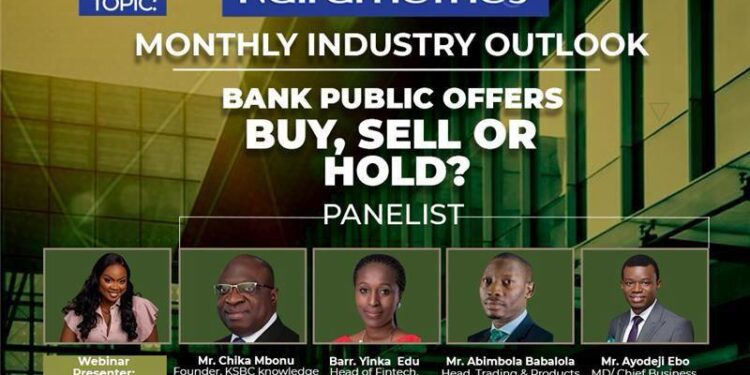

She made this remark while speaking as a panelist during the Nairametrics Industry Outlook webinar with the theme, “Banking Public Offers: Buy, Sell or Hold?” held on Saturday.

Barr. Edu highlighted that the 2005 Nigerian bank recapitalization was plagued by significant issues, including alleged margin lending and insider lending, where banks were reportedly lending funds for the purchase of their own shares, resulting in no actual capital inflow.

She further explained that this, along with poor governance, inadequate risk management, and several unsuccessful bank mergers, compromised the effectiveness of the recapitalization effort, leading to the implementation of stronger regulatory frameworks that have been a focus of post-2005 reforms.

Barr. Edu explained that new regulations have been introduced to address the issues from the 2005 recapitalization. Margin lending rules are now strictly enforced, preventing banks from lending funds for their own shares, ensuring that genuine capital enters the system. She also noted that the Central Bank of Nigeria (CBN) now rigorously scrutinizes fund sources, requiring real new money for significant bank investments.

“There have been many new regulations introduced. Margin lending regulations are now strictly enforced, and banks are required to comply with them. Disclosure requirements have also evolved significantly, particularly regarding prospectuses and the information that banks must disclose.

“Today, the Central Bank of Nigeria (CBN) scrutinizes the source of funds very carefully. Generally, if you are making a significant investment in a bank, the CBN wants to ensure that the funds have not been borrowed from the banking system and that it is truly new money coming in. Additionally, corporate governance has improved substantially,” Barr. Edu stated.

Additionally, she noted that the establishment of the Financial Reporting Council of Nigeria (FRCN) has greatly improved corporate governance by enforcing stringent reporting standards, positioning the banking sector on a more stable and transparent footing.

Barr. Edu stressed that these reforms have been crucial in stabilizing and enhancing the integrity of Nigeria’s financial system. She noted that the bank recapitalization is vital if Nigeria is to achieve the $1 trillion economy that the current administration aims for, as stronger banks will be more resilient and better equipped to provide the necessary support to drive economic growth.

Barrister Yinka Edu’s investment advice for bank offers

Barr. Edu advised potential investors in the ongoing public banking offers to approach their decisions with caution and informed judgment. She stressed the need to thoroughly evaluate the management of the banks they are considering and to carefully review the prospectuses, particularly the Risk Factors and forward-looking statements.

Also, she recommended seeking advice from financial experts and emphasized the importance of understanding how the banking sector operates, with a long-term perspective.

Speaking further in the webinar session, Barrister Edu urged investors to carefully consider their approach to diversification. She advised them to think critically about whether to spread their investments across multiple bank stocks, focus on a single bank, or even assess if investing in bank stocks aligns with their overall financial goals. This, she emphasized, is crucial for managing risk effectively.

Finally, she cautioned against investing more than one can afford, ensuring that financial stability remains a priority.

What you should know

- In March 2024, the Central Bank of Nigeria (CBN) introduced a recapitalization program aimed at increasing banks’ capital requirements and strengthening their asset base, enhancing their ability to take on greater risks, improve liquidity, and bolster their loss-bearing capacities, with broader implications for the Nigerian economy and financial sector.

- Under this program, banks are required to increase their minimum paid-in common equity capital, comply with the Capital Adequacy Ratio (CAR) specific to their license category, and collectively raise approximately $4 billion by 2024.

- Additionally, the program allows banks to upgrade or downgrade their license authorization, merge, or acquire other banks, with a 24-month window to raise the necessary funds, effective from April 1, 2026.

- This initiative demands coordinated efforts from regulators, non-bank financial service providers, and the government, while also addressing structural challenges such as poor market information, weak loan recovery frameworks, and limited credit access for SMEs.

- To meet these requirements, several banks, including Fidelity Bank, GTCO, and Zenith Bank, have launched public offers to raise the necessary funds.