Nigeria’s leading financial advocacy platform, Nairametrics will hold its monthly industry outlook on the current spate of public offers by Nigerian banks as they hope the meet the capital requirement by the Central Bank of Nigeria (CBN).

The virtual event is billed to hold on the 24th of August 2024 between 10 am and 11:30 am via Zoom.

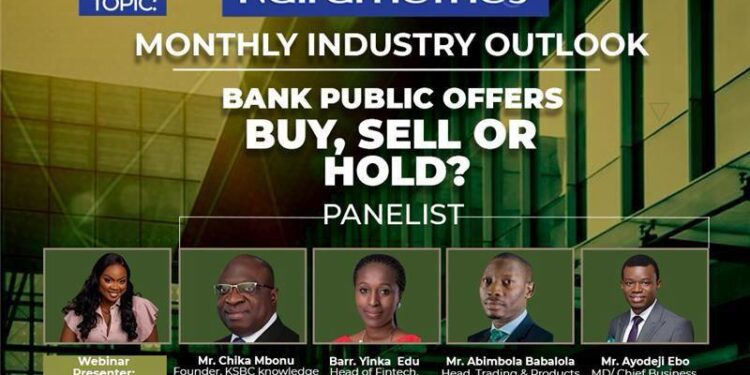

The theme for this August monthly industrial outlook webinar is- Bank Public Offers- Buy, Sell or Hold?

The theme of the webinar stems from the ongoing public offers and right issue by Nigerian banks in a bid to meet the new capital requirement set by the Central Bank of Nigeria (CBN).

Panellists during the webinar will discuss the prospects of Nigerian banks in light of the current economic challenges across the country and recent government policies affecting Nigerian banks.

Furthermore, discussions during the webinar will centre on the in-depth review of the financial positions of Nigerian banks looking at their financial result in 2023 and the first half of 2024 and using that historical data to evaluate whether investors should buy, hold or sell.

Also, the webinar will also analyse the facts behind the offer of Nigerian banks which have ongoing public offers on the NGX and the prospects of Nigerian banks meeting the set capital requirements for their banking license.

To register and be a part of the webinar, click here.

Profile of Panellists

The webinar will be moderated by Joanna Mustafa, a seasoned broadcaster and host of the Market Pulse program which airs on News Central TV every weekday.

- Mr. Chikatara Mbonu– A chartered accountant, banker, and consultant. Chika Mbonu started his career at Arthur Andersen now KPMG before venturing into banking where he rose to the peak of the industry as M.D/CEO of two Nigerian banks.

He is an alumnus of the University of Ife, now Obafemi Awolowo University, Lagos Business School and IESE Business School, Barcelona, Spain and a fellow of the Institute of Chartered Accountants of Nigeria.

Chika Mbonu combines over 36 years of experience in banking, consulting and accounting and has delved into the training and development of professionals in the banking industry.

- Barr. Yinka Edu– Yinka Edu is a Partner at Udo Udoma & Belo-Osagie, leading the firm’s Banking and Finance, Capital Markets, and Fintech practices. She is a seasoned expert in financial law, with significant contributions to landmark transactions like Nigeria’s first global depositary receipts program, the initial Eurobond issuance by a Nigerian corporation, and the establishment of the country’s first ETF. Yinka has also played a key role in major capital-raising transactions and complex corporate finance deals, including Seplat’s dual listing and BUA Foods’ consolidation and listing.

- Ayodeji Ebo– Ayodeji Ebo is the Managing Director/Chief Business Officer of Optimus by Afrinvest, a digital platform powered by Afrinvest (West Africa) Limited, and also serves as the Chief Group Business Development Officer for Afrinvest.

With over 18 years of experience in business and investment strategy, as well as economic and investment research, Ayodeji has held key roles in several prestigious organizations, including Chapel Hill Denham and Greenwich Merchant Bank.

He previously served as the Managing Director of Afrinvest Securities Limited, where he led the firm’s investment research team and worked in investment banking.

He holds a Bachelors’ and Master’s degree in Economics from the Universities of Jos and Lagos respectively. He is also a Fellow of the Chartered Institute of Stockbrokers (CIS) and the Association of Chartered Certified Accountants, UK (ACCA).

- Abimbola Babalola– Abimbola Babalola is a Fellow of ICAN, CIS, and CIBN. He holds a Higher National Diploma in Computer Science from Yaba College of Technology, along with a Bachelor’s degree in Accounting and a master’s in computer science from the University of Lagos.

Abimbola began his career at the Nigerian Stock Exchange in 1997, where he pioneered the establishment of Market Data sales under the CAPNET project. Currently, he is the Head of Trading and Products at the Nigerian Exchange Limited.

In addition to his professional achievements, Abimbola is deeply committed to education, leadership, and public speaking. He regularly facilitates professional development programs for ICAN, CIBN, and CIS, contributing to the growth and development of future leaders in the financial sector.