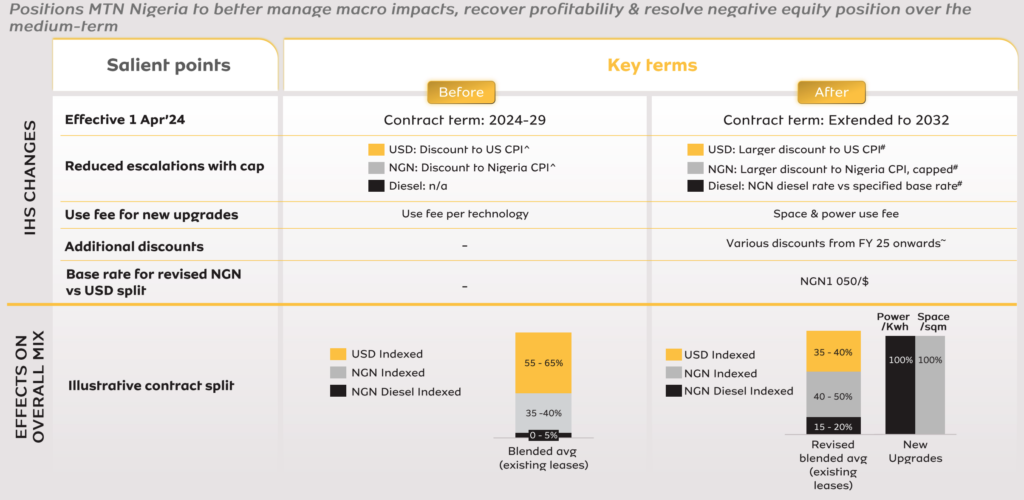

MTN Nigeria has renegotiated its tower lease agreements with IHS Towers, a strategic move that is expected to save the telecoms giant approximately N100 billion annually.

This renegotiation is part of the company’s ongoing efforts to enhance its financial performance amidst the challenging business environment in Nigeria.

The telecoms giant stated that the revised terms will significantly reduce its exposure to currency fluctuations and lower overall costs, providing a substantial boost to its earnings before interest, taxes, depreciation, and amortization (EBITDA) margin.

Recall Nairametrics earlier reported that the company said it has renegotiated the binding commercial terms of the existing infrastructure sharing and master lease agreements with IHS and ATC Nigeria. However, details of the cost savings were just released in the financial report of MTN Group

Key Highlights of the Renegotiation

The revised agreements between MTN Nigeria and IHS Towers have introduced several significant changes aimed at reducing operational costs and mitigating the impact of currency fluctuations.

- The most notable change is the reduction of the US dollar-indexed component of the leases, which has now been linked to a discounted U.S. consumer price index (CPI).

- This shift is crucial in lowering MTN Nigeria’s exposure to the volatile naira, providing the company with more predictable and stable cost structures.

- Additionally, the renegotiated terms have removed technology-based pricing, a move that simplifies MTN Nigeria’s cost framework.

- Under the new terms, payments for upgrades will now be based on tower space and power consumption, rather than the technology deployed on the towers.

- This change is expected to bring more clarity and control over the company’s expenditure on infrastructure.

Another critical aspect of the renegotiation is the introduction of an energy cost component indexed to the cost of providing diesel power.

Given Nigeria’s unreliable power supply, telecom companies like MTN Nigeria rely heavily on diesel generators to power their infrastructure.

By indexing energy costs to diesel prices, MTN Nigeria can better manage these expenses, which have been a significant burden on its operations.

Moreover, the revised agreements include provisions for discounts and incentives over the life of the contracts, further enhancing the financial benefits for MTN Nigeria.

Financial Impact and Outlook

MTN Nigeria expects the renegotiated terms to significantly boost its EBITDA margin by 3-4 percentage points for the full year 2024, with an estimated annualized benefit of N100-110 billion.

- For FY 2024, the financial uplift is projected to be between N75-85 billion. These savings come at a critical time for MTN Nigeria, as the company continues to navigate the complexities of the Nigerian market, including high operational costs, currency volatility, and regulatory pressures.

- The telecoms giant has been grappling with a negative equity position and is actively working to restore its balance sheet to health.

- The renegotiated tower leases are a key part of this strategy, as they provide substantial cost savings that can be redirected towards other critical areas of the business, such as network expansion and service improvements.

Strategic Initiatives and Industry Recovery

The renegotiation of tower leases is not an isolated effort but part of a broader strategy by MTN Nigeria to restore profitability and ensure long-term sustainability.

- The company has emphasized the importance of tariff increases in achieving these goals, citing the need for a more sustainable pricing structure in the telecoms industry.

- MTN Nigeria is currently in discussions with regulatory authorities to address this issue, with the aim of reaching a consensus that balances the interests of consumers and the need for continued investment in infrastructure.

- As MTN Nigeria continues to implement its strategic initiatives, the savings from the renegotiated tower leases will play a crucial role in supporting the company’s financial recovery.

- The expected annual savings of N100 billion will not only bolster MTN Nigeria’s EBITDA margin but also free up resources for further investments that are essential to maintaining its leadership position in the Nigerian telecoms market.

MTN Nigeria share price closed at N199.8 per share.