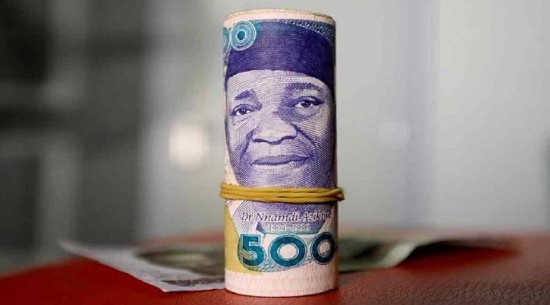

The naira suffered a significant depreciation on the Nigerian Autonomous Foreign Exchange Market (NAFEM) window, falling to N1,329.65/$1 on Wednesday, May 29, 2024.

This sharp decline follows a period of consecutive appreciation, despite the Central Bank of Nigeria’s (CBN) interventions aimed at stabilizing the currency.

According to data from the FMDQ Securities Exchange, the naira had appreciated by 26.32% between Friday, May 24, and Tuesday, May 28, 2024.

On Monday, the exchange rate between the naira and the dollar saw a significant appreciation of 10.71%, closing the day at N1,339.33/$1 on the Nigerian Autonomous Foreign Exchange Market (NAFEM) window.

By Tuesday, the naira also surged to N1,1173.88/$1 on the NAFEM window, marking an increase of 14.09% from the previous day’s rate. This is the highest one-day increase since January 2024.

However, the naira has snapped this significant appreciation, falling hard on Wednesday.

Marginal FX turnover increase: Despite the depreciation on Wednesday, the foreign exchange turnover slightly increased to $336.54 million, a 2.50% rise compared to Tuesday’s volume.

- This increase is very marginal compared to the 81.59% increase in FX turnover recorded the previous day.

- The drastic reversal in the naira’s value raises concerns about the effectiveness of the CBN’s measures to maintain currency stability.

What you should know

Sources who spoke with Nairametrics earlier said that the apex bank has been selling foreign exchange on the official market.

According to sources with knowledge of the matter who spoke with Nairametrics, the CBN has reverted to its previous strategy of selling foreign currency below the market rate, which led to the initial appreciation.

Providing further specifics on the interventions, a Private Wealth Advisor for a Lagos firm, Damilola Alonge, told Nairametrics: “The apex bank intervened at the NAFEM twice yesterday. The first round of intervention was about $3 million and the second round at $2 million.”

He added that successful bids were within N1260 and N1320 for the first intervention on Tuesday, while the second intervention was between N1160 and N1250.

- On Monday, he disclosed that CBN intervened in two tranches with $2 million sold. The interventions were around the rates of N1,380 and N1,400 while the second intervention was around N1,310 and N1,370.

- The total intervention size on Monday was estimated to be around $80 million on Monday and $97 million.

- The sources added that the CBN would likely “manage” the rate a lot lower today, Wednesday, May 29, as a way to celebrate the first anniversary of the president of Nigeria, Bola Tinubu.

- However, despite the interventions, the naira still fell hard on Wednesday.