Nigeria, a dominant player and economy in Sub-Saharan Africa (SSA), fell behind eight other SSA countries in attracting private infrastructure investment commitments in 2023.

The 2023 Annual Report on Private Participation in Infrastructure (PPI) by the World Bank disclosed this while noting a 5% year-on-year decline in private infrastructure investment in low- and middle-income countries in 2023.

This development raises significant concerns about Nigeria’s current investment climate and its ability to draw private participation in infrastructure (PPI).

Dwindling investments in SSA

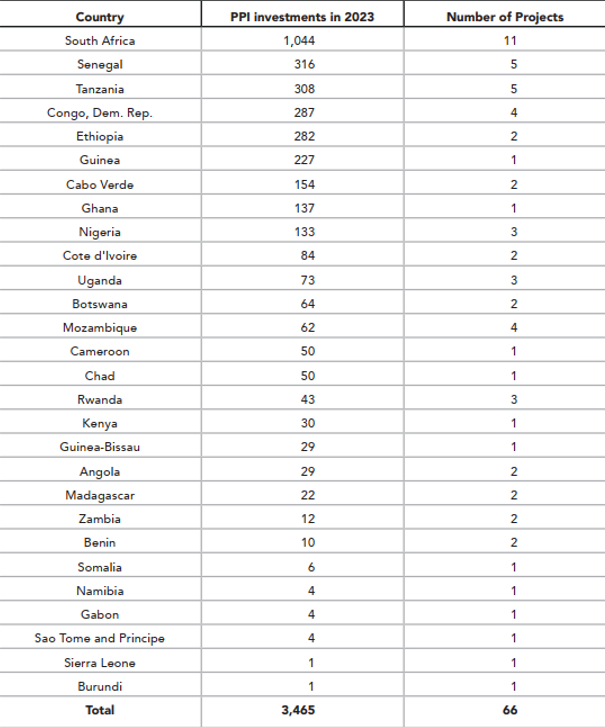

The SSA secured a total of $3.5 billion in infrastructure investments for the year, a decrease of 24% from the previous year. Leading the region was South Africa, which garnered $1.04 billion across 11 projects, accounting for about 30% of the region’s total PPI. Senegal and Tanzania also surpassed Nigeria, each securing investment well over $300 million.

The World Bank report read: “In 2023, SSA saw investments in 66 projects totalling $3.5 billion. This marked a 24 per cent decrease from the investment levels of the previous year and a 46 per cent decrease from the past five-year average. The largest contributor to the region’s PPI was South Africa, responsible for 30 per cent of the regional PPI, followed by Senegal and Tanzania. The sector receiving the largest share of PPI was energy, followed by the ICT sector.”

Nigeria gets 3.84% of SSA’s PPI commitments in 2023

Nigeria attracted $133 million, with private investment recorded in only three projects in 2023. Out of the $3.5 billion commitments made to SSA countries, Nigeria got only about 3.84%.

This figure is far less than the $15 billion Foreign Direct Investment (FDI) commitments claimed by the Federal Minister of Information and National Orientation, Mohammed Idris. However, it is important to note that the commitments noted by the minister may be majorly from the public sector of foreign countries and may not be focused on infrastructure development.

Investment Commitments and Number of Infrastructure Projects with Private Participation in SSA, 2023

Various factors including economic uncertainties and a less favourable investment climate in specific countries might explain the overall decrease across the region.

The significant reduction in Nigeria’s investment, however, is particularly notable given its previously strong performance in attracting PPI. This year’s lower investments could reflect more profound economic challenges, regulatory uncertainties, or potentially more competitive offerings from its African peers.

In 2023, Nigeria saw a shift in foreign investment trends amid economic challenges, with a total capital importation of $3.9 billion, a noticeable decrease from the $5.3 billion recorded in the previous year. This was also the lowest capital importation for Nigeria dating as far back as 2013 when the National Bureau of Statistics (NBS) started publishing data. For context, Nigeria attracted over $23 billion in capital importation in 2019.

Implications for Nigeria’s Economic Development

- This shift in investment patterns poses serious implications for Nigeria’s economic development. Already, it has been reported that given the current rate of capital expenditure, it would take approximately 300 years to bridge Nigeria’s infrastructure gap. The country’s ability to attract and secure international finance is crucial for its ongoing and future infrastructure projects, which are essential for sustained economic growth.

- While Nigeria grapples with these challenges, other nations in the region are capitalizing on their opportunities. South Africa, for instance, showcases a diversified approach to infrastructure development with significant commitments in both the energy and ICT sectors.

- Similarly, Senegal and Tanzania are becoming increasingly attractive to investors with their focus on energy and transport infrastructure.

- It is expected that investors and stakeholders in the infrastructure sector will closely monitor Nigeria’s ongoing reforms. There is anticipation to see whether it can reform its investment climate to become a top destination for infrastructure finance in Sub-Saharan Africa.