Shareholders of Afriland Properties Plc have endorsed the recommendation of the Board of Directors for a full-year dividend of N343.5 million for the financial year ending December 31, 2023.

The shareholders approved the company’s 11th Annual General Meeting (AGM) which was conducted virtually.

The dividend translates to 25 kobo per ordinary share and a 150% increase in payout as against 10 kobo per ordinary share declared in the previous year.

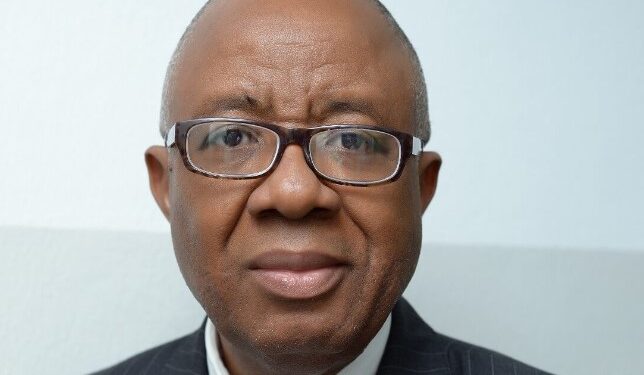

Addressing stakeholders during the meeting, the Chairman of Afriland Properties Plc, Emmanuel Nnorom, noted that the growth achieved in the financial year 2023 reflects the company’s commitment to creating value for all stakeholders.

According to him, it also shows the dedication of the management team and the unwavering support of shareholders.

Managing Director/CEO of Afriland Properties Plc, Uzo Oshogwe, highlighted the completion of the company’s proprietary projects as one of the drivers contributing to the firm’s robust financial performance while sharing plans on further diversification of its development portfolio in the current year.

- “In line with our growth strategy, Afriland Properties Plc plans to commence the construction and equally commission several landmark projects in the coming years in Lagos, Abuja, and Port Harcourt.

- Notable among these projects is Afriland Estate, a fully residential estate in Abuja, further solidifying our position as a market leader in the real estate sector. Afriland Properties remains dedicated to creating sustainable communities and enhancing shareholder value through its strategic investments and operational excellence,” Oshogwe remarked.

Financial Performance

Speaking on the financial performance, he said the company reported a 150% increase in total revenue, reaching a total of N4.72 billion, compared to N1.89 billion in the previous year.

The company’s Profit Before Tax (PBT) also witnessed a substantial surge, standing at N2.41 billion, reflecting a 34% increase from N1.80 billion in the preceding year.

Additionally, Afriland Properties Plc saw its total assets grow by an impressive 76%, reaching N34.07 billion when compared to N19.38 billion in 2022.

What shareholders said

Shareholders commended the company’s financial performance, reaffirming their confidence in its leadership and strategic direction.

National Coordinator, Independent Shareholders Association of Nigeria (ISAN), Moses Igbrude, urged Afriland’s Board and Management not to rest on their oars to ensure that the company continues to post good financial performances and reward shareholders with worthy dividends.