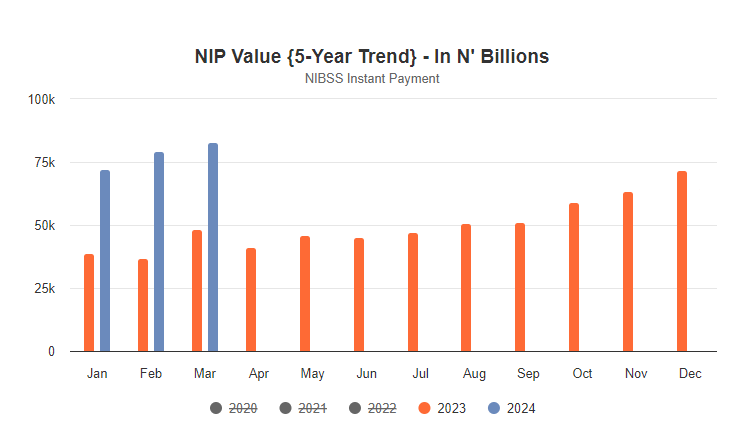

Electronic payment transactions in Nigeria rose to N234.4 trillion in the first quarter (Q1) of 2024 as more Nigerians went cashless over the period.

According to data released by the Nigeria Inter-Bank Settlement System (NIBSS), the value recorded on the Instant Payment (NIP) represents an 89% increase over the N123.9 trillion recorded in Q1 2023.

From January to March, there was a steady rise in the amount of payment transactions carried out via various banks and fintechs electronic channels in the country.

While the NIP transaction value rose to N72.1 trillion in January from N71.9 trillion recorded in December 2023, the value of electronic payments increased further to N79.3 million in February.

Recommended reading: E-payment transactions in Nigeria hit N600 trillion in 2023-NIBSS

By March, the value of electronic transactions in the country had surged to an all-time high of N83 trillion.

The NIBSS data show that e-payment volume also maintained a steady rise in the first quarter. An analysis of the monthly data reveals that transaction volume stood at 887.58 million in January.

In February, the volume of transactions jumped to 905 million, while a total of 986.6 million transactions were recorded in March.

Effects of CBN cashless policy

Industry analysts believe that the surge in e-payment transactions can be linked to the recent cash crunch experience and the cashless policy of the Central Bank of Nigeria (CBN) which has limited the amount of cash that can be withdrawn daily.

According to the revised cashless policy, which came into effect on January 9, 2023, cash withdrawal by an individual is limited to N500,000 a week, while corporate organizations have N5 million withdrawal limit in a week.

A Lagos-based financial analyst, Mr. Adewale Adeoye, said the surge is expected given the experience many Nigerians had in March last year, which exposed them to cashless transactions for the first time.

- “After what many Nigerians witnessed during the cash crunch period early last year, it was obvious that there was no going back on the embrace of electronic payment.

- Many of those who were forced to use either PoS or bank transfers during those periods now know that there’s a faster way to make payments without having to first withdraw cash from the automated teller machine (ATM). So, the increase in electronic transactions is expected,” he said.

NIBSS’ NIP

The NIBSS NIP is an account-number-based, online real-time inter-bank payment solution developed in the year 2011 by NIBSS. It is the Nigerian financial industry’s preferred funds transfer platform that guarantees instant value to the beneficiary.

According to NIBSS, over the years, Nigerian banks have exposed the NIP through their various channels, that is, internet banking, bank branch, kiosks, mobile apps, Unstructured Supplementary Service Data (USSD), POS, ATM, etc. to their customers.

Aside the cash scarcity experienced in March 2023, the revised cashless policy implemented by the CBN, which further limits the amount of cash that can be withdrawn from banks daily, has also been pushing e-payment growth. Many Nigerians are now getting used to mobile transfers, paying with PoS, USSD, among others.