I looked up the trade numbers for Nigeria to understand where the forex needed to strengthen the naira would come from. I was not impressed.

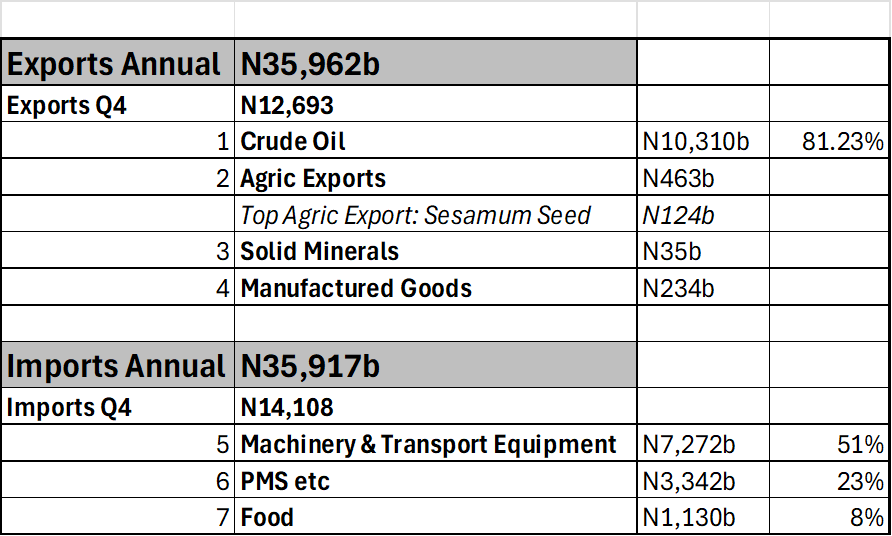

These are Quarterly trade numbers in my attached infographic from the Nigerian Bureau of Statistics Q4 2023, but the spirit of the numbers remains unchanged.

- Oil exports alone account for 81% of total exports. Put it this way: If you doubled Agricultural exports ten times, you would not get half of what Nigeria gets from crude oil and gas exports.

So, in the short term, we must stop the distracting talk of “let’s diversify exports,” etc.; that’s a long-term goal. Today’s goal must be to grow oil exports to generate FX for the economy.

- Solid Minerals exports are “audio”; I won’t waste time discussing them. The folks illegally mining gold and other precious minerals and exporting know what they are doing. Suffice it to say it is criminal negligence for a nation with lithium, uranium, gold, silver, etc. deposits to deliver N35b a quarter on solid minerals exports.

- The most significant immediate opportunities here are on the import side with PMS (Dangote Refinery) and Food. These, to my mind, are prime candidates for import substitution. The Nigerian government should offer a Three-year tax holiday to any firm that can substitute wheat imports for cassava or a locally grown crop. Maize is a forex drainer for Nigeria. I can only thank God for Aliko Dangote; even before his refinery, the Urea fertilizer company alone was Nigeria’s top non-oil exporter.

Folks, we have been playing since 1970 with “agriculture.” Nigerians have confused what we see villagers do with hoes and cutlaApologies to the hardworking farmers, but Nigeria needs to develop a cash crop export infrastructure. It’s surprising that the entire agriculture value chain in Nigeria delivers only N125b a quarter from the top earner in that quarter.

Thus, Nigeria has to get serious about diversifying its earning base. Nigeria carries a vast and critical risk in that it depends heavily on crude oil and gas to earn dollars. Nigeria is potentially one global crisis or recession away from being bankrupt if she does diversify away from a single main FX earning base.

Recommended reading: FG to raise $10 billion to boost FX liquidity -Tinubu

Next steps?

- Boost oil and gas exports immediately

- Medium to long term, diversify FX revenue sources away from crude oil and gas.