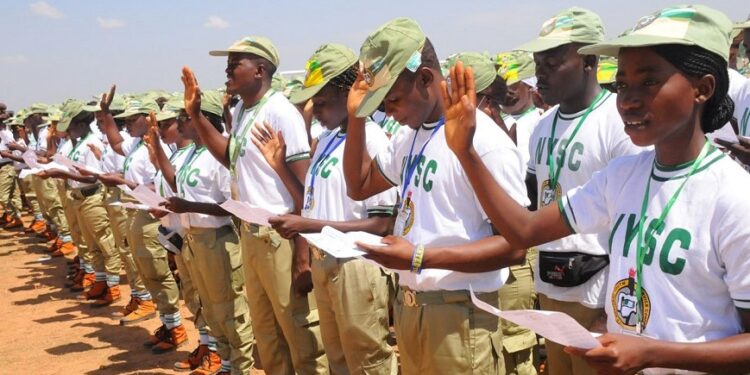

The Federal Government has announced that the repayment process for the Nigeria Education Loan Scheme (NELFund) will begin two years following the completion of the National Youth Service Scheme (NYSC) by beneficiaries.

Dr. Akintunde Sawyer, the Executive Secretary of NELFund, disclosed this information in an interview with the News Agency of Nigeria (NAN) on Thursday in Abuja.

Sawyer mentioned that the two-year grace period following the NYSC is designed to give participants sufficient time to find employment and achieve financial stability before starting their repayments.

- “The law provides that for students who go into paid- employment, repayment will be two years after NYSC, but, that does not mean that they cannot pay back before that time.

- “However, if they don’t have a job two years after NYSC, we cannot compel them to pay. Where are they going to get the money from? So, we will help them and wait for them to be able to pay.

- “There will be a register of those who have taken the loan and employers will have access to that register and see who has a loan.

- “Once they see who has a loan, when they are employing the individual, they will be obliged through the payroll system to refund 10 per cent of the earnings of that individual back to the fund,’’ he said.

Sawyer said that the modalities of how the money would be rooted were still being worked out, but the employer would be obliged to make those deductions for as long as that person is at work.

- “If they are yet to secure employment or if they lose their jobs they are not obliged to pay.

- “We are not trying to turn applicants into criminals, we are trying to help Nigerians who need better education to get it so that they can improve their lives and the country as a whole can see improvement in its social-economic development,’’ he added.

Recommended reading: FG to launch Student Loan Fund scheme with an Application

What you should know

- The federal government dedicated N50 billion to the student loan scheme in the 2024 budget, as per the budget’s detailed appropriation.

- President Bola Tinubu also ordered the Nigeria Education Loan Fund (NELFUND) management to broaden its scope by providing interest-free loans to Nigerian students seeking skill-development programmes.

- Enacted in June under the name “Access to Higher Education Act, 2023,” or the Students Loan Act, this initiative established an Education Loan Fund.

- The Education Loan Fund, backed by the Student Loan Act, aims to provide interest-free loans to Nigerians pursuing tertiary education and skill development programmes.

Recommended reading: ‘Student loan scheme likely to be launched in three weeks’- Gbajabiamila