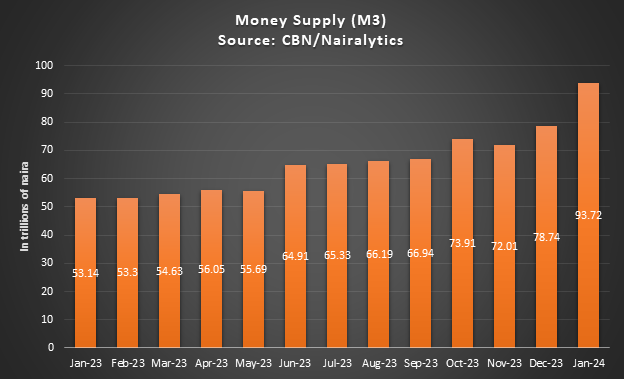

Nigeria’s broad money supply surged to a historic high of N93.72 trillion as of January 2024, marking a remarkable ascent.

This figure represents a staggering 76% surge from the N53.14 trillion recorded in January 2023, showcasing a substantial year-on-year growth of N40.48 trillion.

Moreover, compared to the preceding month of December 2023, which stood at N78.74 trillion, this represents a robust 19% increase, equivalent to N14.98 trillion.

The latest insights from the Central Bank of Nigeria (CBN) unveil these profound shifts in the nation’s monetary landscape, as detailed in its comprehensive money and credit statistics.

The trajectory of Nigeria’s broad money supply (M3), a pivotal gauge of economic liquidity, has been on an undeniable upward trajectory, surging at an accelerated pace in recent years. M3 encompasses both net foreign assets and net domestic assets, painting a holistic picture of the nation’s monetary dynamics.

Why does this matter?

Recent trends underscore a pronounced expansion in Nigeria’s money stock, a trend that intersects with an array of economic challenges. Foremost among these challenges are the surging inflation rates, mounting pressures on the naira’s exchange rate, and a downward trajectory in interest rates.

The uptick in the money supply portends a potential surge in inflation, posing a significant threat to the purchasing power of Nigerians. Moreover, an inflated money stock typically correlates with a decline in interest rates, particularly in environments characterised by a dearth of viable investment prospects.

This dynamic may render Nigerian investment vehicles less attractive to global investors, a matter of grave concern considering Nigeria’s imperative for sustained dollar inflows.

More Insights

While there has been a significant surge in the money supply, the country’s economic growth has been tepid, with Nigeria’s economic growth rate for 2024 projected to be around 2.9% and 3.1%, having one of the slowest growth rates in West Africa.

This disparity is stark – the money supply is growing much faster than the economy.

Inflation has been a significant concern, with the headline inflation rate jumping 29.9% in January 2024. Although the rate is projected to drop to 21.5% this year, it may end up peaking at 44% if adverse economic conditions persist.

As the CBN’s Monetary Policy Committee (MPC) gears up for its meeting, the implications of this expanded money supply on their deliberations, particularly regarding the Monetary Policy Rate (MPR), are poised to take centre stage. Such discussions are pivotal in charting the course for Nigeria’s economic stability and growth.

Notably, this increase in the broad money supply comes despite the CBN’s efforts to tighten monetary policy and mop up excess liquidity.

The CBN has incrementally raised the MPR from 11.5% in May 2022 to 18.75% as of July 2023, an increase of 725 basis points in slightly over one year.

In less than a week, the current Governor Yemi Cardoso is expected to express his stance on the ongoing interest rate hikes and make a clear, bold move against rising inflation.

However, his approach may conflict with President Bola Tinubu’s plans to reduce interest rates in Nigeria, potentially setting the stage for a clash between the government’s economic objectives and the CBN’s tightening monetary policy.

This is what I think President Bola Tinubu should do as a matter of urgency if he has the gut, if he has the political will and really want to redeem himself and save this country from total collapse.

1. He should immediately backtrack from the subsidy removal policy he enacted about 8 months ago as a matter of fact he confessed that it wasn’t in the script they gave him on that inauguration day, because that singular speech he made has thrown the country economy into the worst economic woes Nigeria has ever experienced since we became an independent country and when I say policies i mean the fuel subsidy and the floating of the naira. there is no shame in saying what i thought it was going to work but unfortunately it didn’t work as planned so i am taking a step back to the drawing board to re-strategies

2. He should ask the CBN Governor Yemi Cardoso to revoke all the BDC license and refund their =N=30,000,000 (Thirty Million Naira deposit) and then make it ilegal for any individual or company to trade FX other the Banks. The Banks should be the only legal organisation to trade FX in the country going forward. I definitely know if he uses the instrumentality of the National Assembly they will frustrate it because many of them are stakeholders in the BDC business. He has executive powers he should use executive orders to do this. I don’t see any reason why some association who called themselves BDC operators should be dictating our FX rate damn free market operation, we are all suffering right now!

3. With number two in place, the CBN should move to enable the naira master, visa and even verve naira cards so as to enable payments to be made in naira with automatic official CBN rate conversion done limits should be placed on usage, Minimum PTA should be pegged at $1,000 and it should solely be accessible through the ATM debit cards and not cash. other sectors that needs FX should be reviewed as well. Embassies like Egypt embassy, and Turkish embassy that receive their visa fees in dollars should be immediately asked to stop that nonsense and start receiving their visa fees in naira which is our currency, even the United States that own dollars don’t receive their visa and consular fees in dollars but naira so i don’t see any reason why other countries whose currency is not US dollars should force Nigerians to pay them in dollars for a service they rendered to them on Nigeria soil.

4. Still with the CBN, they should immediately begin the removal of 1000 naira notes from circulation and subsequently be followed by 500 naira notes only 200 naira notes should be more in circulation for cash transaction. Banks should enable the contactless payment on PoS machines with a limit of 10,000 for a start without a pin and gradually increase the limit and any transaction more than that should be require pin. we need to expand our payment system to accommodate more of online and cashless payment system to that our dependency on cash for transaction will reduce, this will strengthen our currency and eliminate to the barest minimum corruption and open for more transparency and accountability and just for the records help us in a great deal in the fight against insecurity from kidnapping to armed robbery where ransoms are requested from victims.

5. The Government through the ministry of foreign affairs, ministry of interior, the CBN and FAAN should research with empirical data destinations Nigerians travels to more and see how we can transact directly with those countries in their currencies from our currency such that we don’t need to depend more on the dollars for settlement.

6. Our refineries should be brought to full capacity to mitigate the fuel consumption we have in the country

This are just a few things i believe if we do can go a long way to help cushion the pressure on the economy as we speak.

Long Live the Federal Republic of Nigeria. Okiroro OGHENE-Othuke

The fuel subsidy is not coming back. The country simply cannot afford it anymore. Let it go.

Yea, fuel subsidy is gone…..

Nigerians should reduce dependency on imported product and eat ofada or drive Innosun motors for example. Moreover thr federal agencies should ascertain which players in the system is hoarding the US dollar after purchase from nafem or parallel markets, it appears some elements are bent on sucking any available dollar out of the system, this has to be reduced. Interest rates should ( unfortunately) keep climbing, enough to encourage monetary instruments like bonds and treasury sales to mop up the excess naira. Eventually, we have to wait for these interventions to work.

Yea, fuel subsidy is gone…..

Nigerians should reduce dependency on imported product and eat ofada or drive Innosun motors for example. Moreover thr federal agencies should ascertain which players in the system is hoarding the US dollar after purchase from nafem or parallel markets, it appears some elements are bent on sucking any available dollar out of the system, this has to be reduced. Interest rates should ( unfortunately) keep climbing, enough to encourage monetary instruments like bonds and treasury sales to mop up the excess naira. Eventually, we have to wait for these interventions to work.