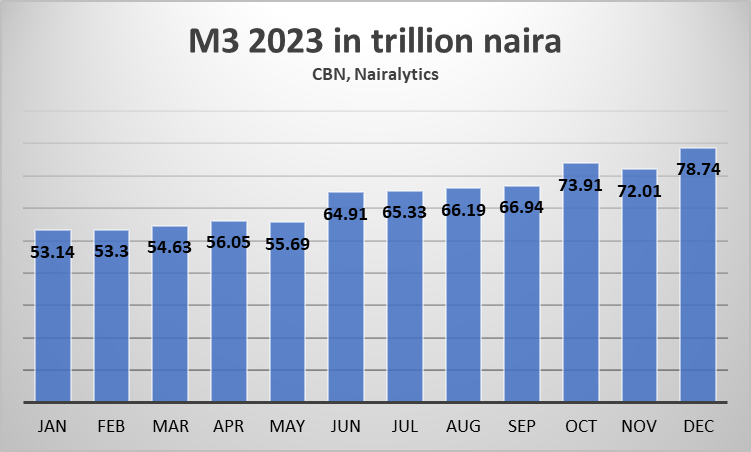

Nigeria’s broad money supply increased to N78.74 trillion as of December 2023, the highest ever recorded in the country.

This is an increase of N26.58 trillion or 51% year on year when compared to N52.16 trillion recorded in 2022. This is according to the latest data from the Central Bank of Nigeria (CBN) as contained in its money and credit statistics.

The broad money supply (M3), which is used to measure liquidity in the economy has been on an upward trajectory in recent years and at a rapid pace. It comprises net foreign assets and net domestic assets.

Why this matters?

In analysing Nigeria’s economic landscape, a critical lens must be cast upon the burgeoning money supply, a key barometer for gauging inflationary trends and interest rate movements. Recent times have seen a notable swell in Nigeria’s money supply, which aligns with various economic challenges. Prominent among these are the escalating inflation rates, mounting pressures on the naira’s exchange value, and a downtrend in interest rates.

This increase in the money supply signals a probable escalation in inflation, which could erode Nigerians’ purchasing power. Furthermore, an inflated money supply often correlates with diminished interest rates, especially in scenarios marked by a scarcity of viable investment opportunities. This dynamic could potentially render Nigerian investment instruments less appealing to international investors, which is a critical concern given Nigeria’s desire for dollar inflows, which has declined significantly.

As the CBN’s Monetary Policy Committee (MPC) gears up for its meeting, the implications of this expanded money supply on their deliberations, particularly regarding the Monetary Policy Rate (MPR), are poised to take centre stage. Such discussions are pivotal in charting the course for Nigeria’s economic stability and growth.

More Insights

- Economic theory shows a direct relationship between the money supply and inflation levels. It is a common stance among economists that managing the money base is crucial for controlling inflation. The money supply expansion should ideally align with output growth rates to maintain inflation at manageable levels.

- Despite this principle, Nigeria’s financial landscape presents a unique scenario. While there has been a significant surge in the money supply, the country’s economic growth has been tepid, with an annualised growth rate hovering around a modest 54% GDP. This disparity is stark – the money supply has expanded more than 17 times faster than the economy.

- Inflation has been a significant concern, with the headline inflation rate jumping from 21.5% to 92% over the past year, marking a 7.5%-point increase. Projections for this year suggest a possible easing of inflation. However, the exchange rate, a critical driver of inflation, remains a contentious issue. The Naira has been trading at approximately N1,348.63 against the dollar in the official market, closely mirroring the rates in the parallel market, which raises concerns about the inflation outlook in the near to medium term.

- Notably, this increase in the broad money supply comes despite the CBN’s efforts to tighten monetary policy and mop up excess liquidity. The CBN has incrementally raised the MPR from 11.5% in May 2022 to 18.75% as of July 2023. Despite these measures, the CBN’s inflation target for this year is 4%, indicating that its efforts to rein in inflation have not been entirely successful.

- The CBN is poised to hold its first MPC meeting of 2024 in less than a month, where current Governor Yemi Cardoso is expected to express his stance on the ongoing interest rate hikes and make a clear, bold move against rising inflation. However, his approach may conflict with President Bola Tinubu’s plans to reduce interest rates in Nigeria, potentially setting the stage for a clash between the government’s economic objectives and the CBN’s tight monetary policy.

thanks for all the chat gpt insight